Using Hedera’s DLT network and cross-border payment solutions, Philippine banks are working to introduce PHPX stablecoin for real-time remittances.

Several Philippine banks are collaborating to develop PHPX, a peso-backed stablecoin, to enhance cross-border payments and financial inclusion. The introduction of the PHPX token is planned for May through July.

Just Finance, a Singaporean firm, is creating the PHPX stablecoin, which will be introduced on the Hedera decentralized ledger technology (DLT) network.

According to a Ledger Insights article, participating Philippine banks include Union Bank of the Philippines, Rizal Commercial Banking, Cantilan Bank, and Rural Bank of Guinobatan. Every participant will have a big say in how the PHPX stablecoin is run.

Philippine banks want to use the PHPX stablecoin to modernize cross-border remittances.

UnionBank previously oversaw PHX, a quasi-stablecoin used in a closed-loop payment system, through its fintech subsidiary UBX. The necessity of developing a coin that is “publicly exchangeable to support use cases outside our ecosystem” was emphasized by UBX CEO John Januszczak.

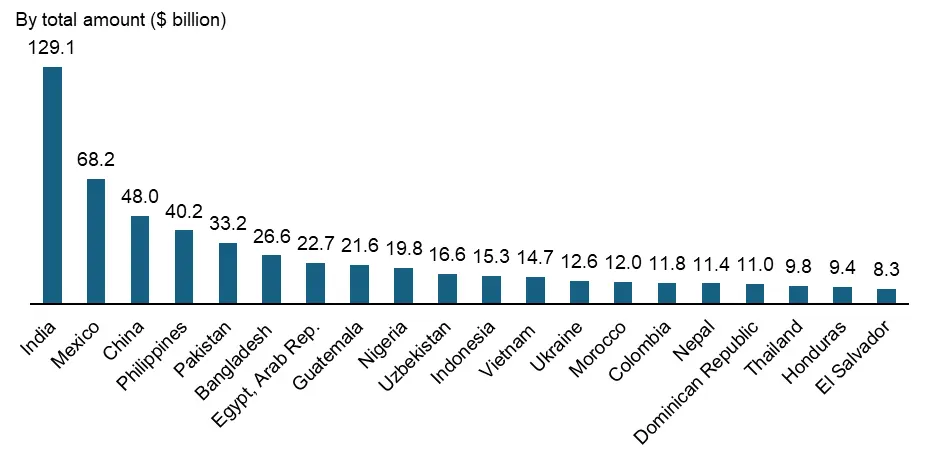

According to World Bank data, $40 billion was sent by foreign workers in 2024, making up a significant portion of the Philippine economy.

By providing real-time payment solutions and broadening its use cases beyond simple remittances, PHPX seeks to transcend domestic transactions and expedite cross-border transfers.

Our goal is for Filipinos who are employed in the United States or another country to be able to pay their children’s tuition directly from the US and for that payment to be processed instantly,” Januszczak stated.

Facilitating remittances via worldwide compliance

The proposal includes ideas for a multicurrency stablecoin exchange requiring liquidity providers for swaps between PHPX and stablecoins in US dollars, Singapore dollars, and Japanese yen to facilitate cross-border transactions.

Eligible investors may be added to the banking partners depending on future market demand to manage the PHPX stablecoin’s liquidity. The token might be used in point-of-sale and domestic retail transactions.

PHPX’s interactions will comply with the EU’s Markets in Crypto-Assets Regulation standards or comparable regional frameworks. Hedera’s permissioned network guarantees adherence to the Basel Committee’s low-risk crypto-asset criteria.