Dual exit mechanisms are introduced by Usual’s USD0++ staked stablecoin, causing market volatility and intense community discussion.

On January 9, Usual, a decentralized finance (DeFi) stablecoin issuer, announced a significant update to its USD0++ protocol, adding two exit options to increase the token’s long-term viability.

The modifications are part of a larger plan to bring the staked stablecoin into line with its goal of turning USD0++ into a financial instrument that resembles bonds and is supported by actual revenue sources.

The revelation immediately disrupted the market, though, and USD0++ fell as low as $0.89 before levelling at about $0.92, or 8% below its $1 peg.

Users now have to quickly adjust to the new redemption possibilities due to the dual exit system, which includes both conditional and unconditional exits, as well as sudden modifications to the official documentation about the floor price of the staked stablecoin.

In an X post, Aave founder Stani Kulechov discussed the development and said it is just another instance of “how things can go wrong with fully hardcoded and immutable price feeds.”

Two ways out: a harsh place and a rock

As per normal, the dual exit mechanism was launched on January 9. It offers users a “conditional exit,” which penalizes early withdrawals by requiring users to forfeit a portion of their collected points but permits 1:1 redemption at the $1 peg.

The alternative is the “unconditional exit,” which provides an instant cash-out at a floor price of $0.87 that will progressively increase to $1 over four years.

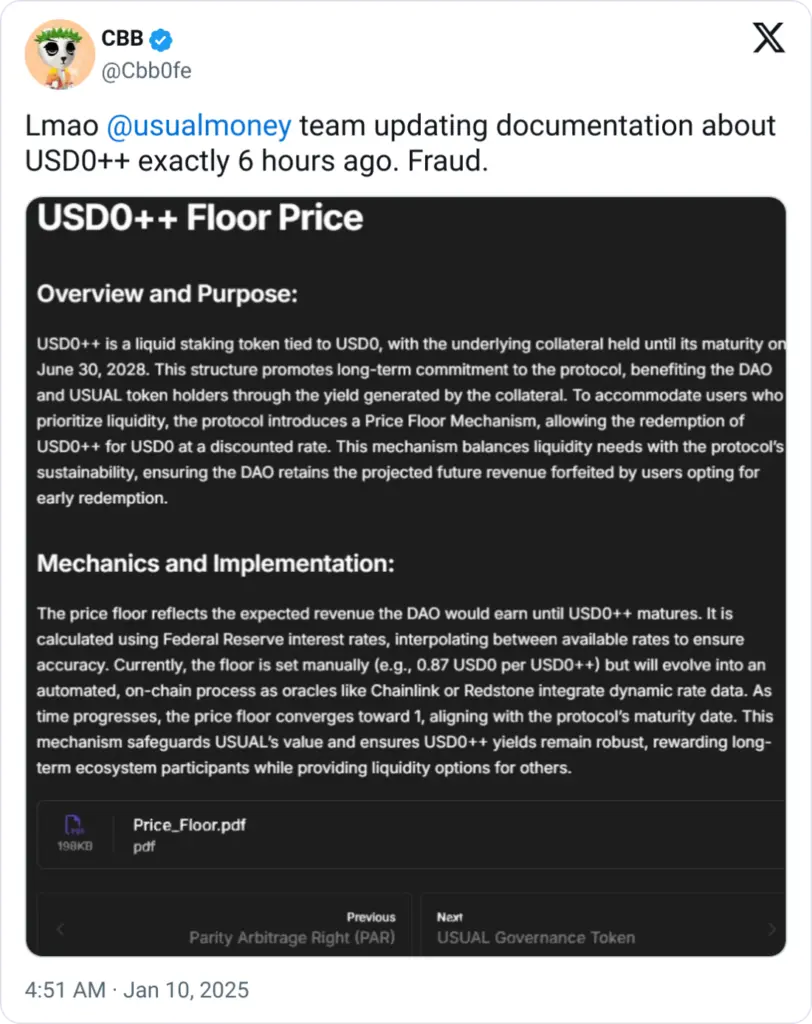

Alongside the DeFi stablecoin issuer’s shift in strategy, the protocol’s official documentation was altered, which one X user allegedly called “fraud.”

Market repercussions

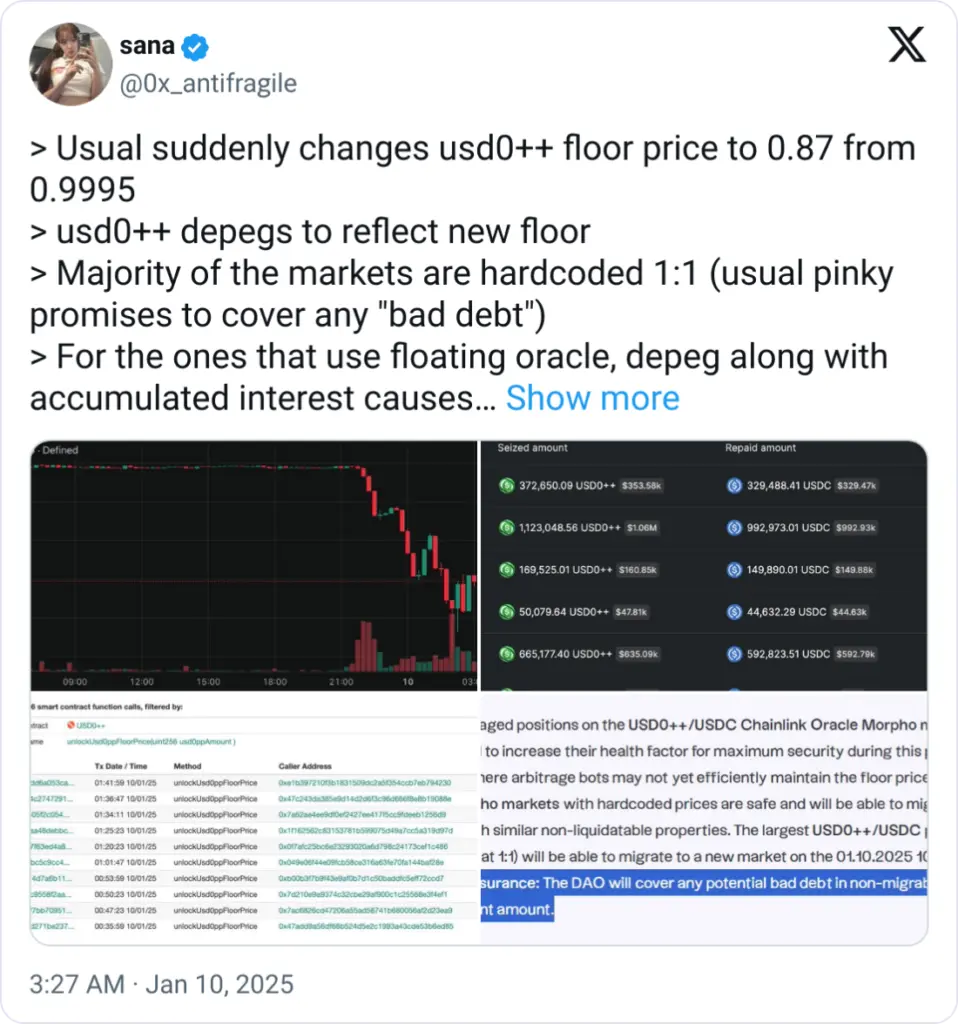

One X user posted that the company’s new floor price of $0.87, down from $0.9995, resulted from market fallout caused by the amended four-year strategy and adjustments to redemption procedures.

Allegedly, abrupt changes in liquidity providers on platforms like Curve Finance and Pendle caused hundreds of millions of USD0++ to leave DeFi, possibly leading to multimillion-dollar liquidations.

Usual’s decentralized autonomous organization will “cover any potential bad debt in non-migrable markets up to the current amount,” the release stated.

USD0 against USD0++

Fully backed by actual assets, like US Treasury bills, USD0++ is the staked form of USD0, a stablecoin intended primarily for usage as a dollar-pegged, collateralized token.

In the staked form of USD0, users lock USD0 into USD0++, creating a bond-like financial product that generates interest (yield) through the emission of USUAL, the native token of the protocol.

A four-year lock-up term that is subject to change dependent on redemption procedures and is not instantly accessible without incurring fines is the trade-off for USD0++.