Intesa Sanpaolo, Italy’s largest bank, invests $1M in Bitcoin, marking the nation’s first bank-backed BTC purchase amid growing institutional interest.

After purchasing more than $1 million worth of Bitcoin when institutional interest was increasing, Intesa Sanpaolo became the first bank in Italy to invest in the cryptocurrency.

On January 13, Intesa Sanpaolo, the biggest bank in Italy, became the first Italian bank to invest in Bitcoin when it bought 11 BTC for roughly 1 million euros ($1.02 million).

The purchase was made slightly over a month after Bitcoin BTC$96,532 crossed the $100,000 threshold in December.

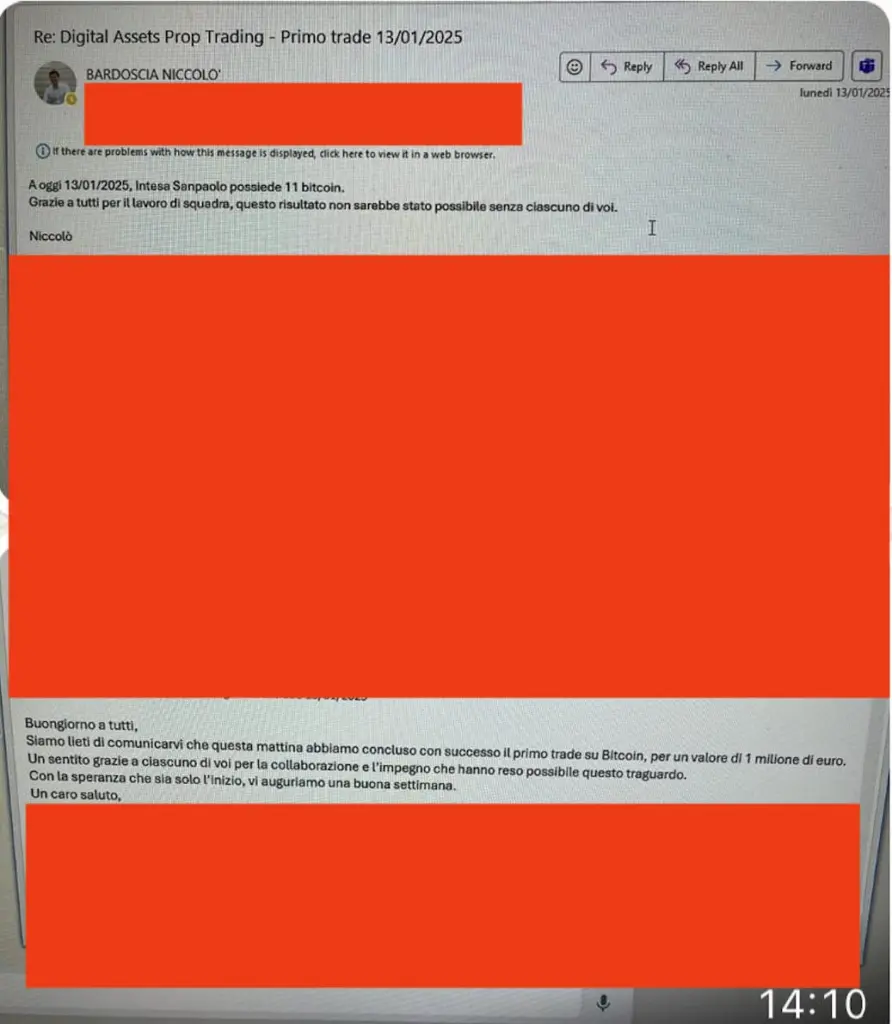

Niccolò Bardoscia, the head of digital assets trading at Intesa Sanpaolo, disclosed an internal email that contained the information. “As of today, 13/01/2025, Intesa Sanpaolo owns 11 bitcoins,” Bardoscia wrote in the email. We appreciate everyone’s cooperation; this outcome would not have been achieved without you.

Intesa Sanpaolo verified the Bitcoin acquisition with the news outlet Wired.

The Italian bank’s investment comes when institutional interest in Bitcoin is growing. On January 13, Bitcoin exchange reserves fell to a level almost seven years lower as cryptocurrency hedge funds bought the decline, boosting predictions of a “supply shock,” which happens when high buyer demand meets a dwindling supply of BTC, resulting in price growth.

Institutions and banks are purchasing the decline in Bitcoin.

According to Cointelegraph Markets Pro statistics, the price of bitcoin has been trading below the psychological $100,000 barrier since January 7.

Institutional investors have also seen this as a chance to purchase the dip. According to a January 13 Cointelegraph article, MicroStrategy increased its corporate holdings of Bitcoin to over 450,000 BTC by purchasing more than $243 million worth of the cryptocurrency at an average price of $95,972.

Even if some analysts believe the current Bitcoin slump will end, Bybit researchers said Bitcoin is still “vulnerable to macro drivers” without favorable regulatory developments.

According to some analysts, a $20 trillion rise in the global money supply is expected to push a Bitcoin cycle high above $150,000 in late 2025, despite macroeconomic worries. This might draw $2 trillion in investment into BTC.