Osprey funds stated that the deal for Bitwise to acquire the Osprey Bitcoin Trust was canceled due to a lack of required regulatory approvals.

Osprey Funds, an investment management firm, has announced its intention to convert its Osprey Bitcoin Trust (OBTC) into an exchange-traded fund (ETF) following the termination of the acquisition agreement with Bitwise.

The firm announced on January 14 that it will submit a Form S-1 to the US Securities and Exchange Commission, including a registration statement, “as soon as is feasible.”

Before GBTC transitioned to a spot Bitcoin ETF in January 2024, OBTC was a competitor to the much larger Grayscale Bitcoin Trust.

Currently, the fund has $181 million in assets under management (AUM) and monitors the price of Bitcoin without holding the actual asset, as per the OBTC description.

Osprey has announced that the agreement for Bitwise Asset Management to acquire the assets of OBTC, which was announced in August, has been terminated.

According to a statement from Osprey Funds, the agreement was “terminated” because the parties failed to obtain all required regulatory approvals by December 31, 2024.

It is the result of the increasing number of firms entering the ETF market, as the SEC approved the Bitcoin and Ether index ETFs of Hashdex and Franklin Templeton on December 20, respectively, and the spot Bitcoin ETF market experienced substantial growth.

VettaFi, a global ETF database service and analytics provider, reports that the United States currently trades 32 distinct Bitcoin ETFs.

Nevertheless, there are only 11 spot Bitcoin ETFs.

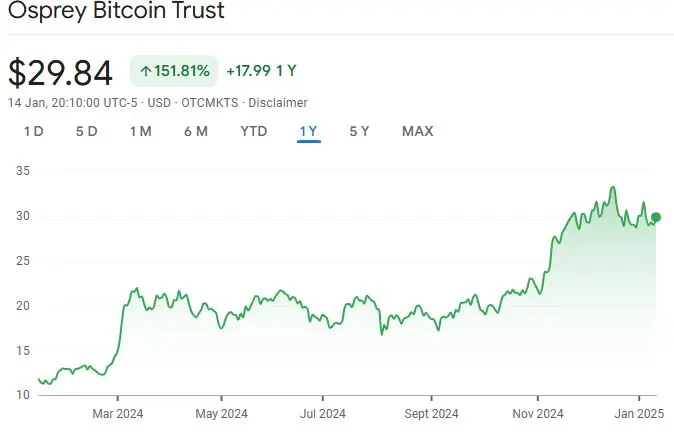

According to Google Finance, Osprey’s unit price of OBTC was up 3% to $29.84 in the most recent trading session and has increased by over 151% in the past year, even though the announcement was made after the stock market closed.

Nevertheless, it remains below its all-time high of $50, which it reached on February 12, 2021, when the trust officially launched.

In February 2021, Osprey Funds, which is situated in Fairfield, Connecticut, initiated trading of its OBTC on the OTC market.

Osprey filed a lawsuit against Grayscale in January 2023, asserting that the asset manager acquired a monopoly stake in the Bitcoin OTC trust asset market as a result of its misleading advertising and promotion regarding the likelihood of its trust becoming an ETF.

The lawsuit continues to be litigated.

The company disclosed in March that it had initiated discussions regarding the potential sale or liquidation of the trust due to the fact that units were trading at a discount to the value of Bitcoin.