Hong Kong uses tokenized legal notices to target anonymous cryptocurrency wallets holding stolen assets.

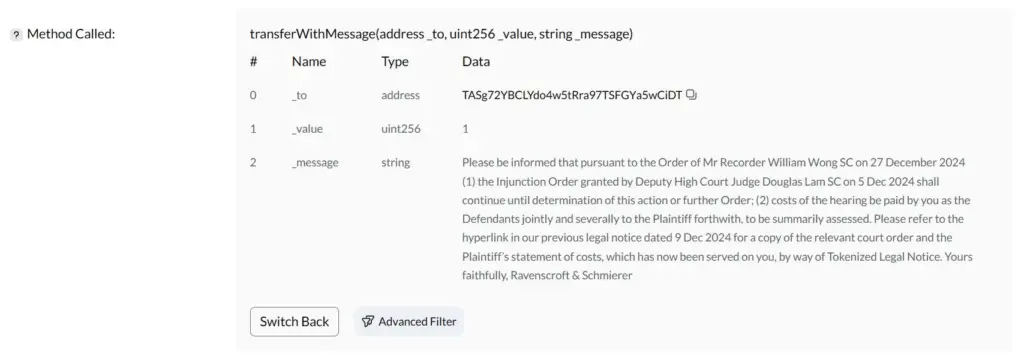

Now, anonymous owners of illegal wallet addresses can get tokenized legal notices from Hong Kong courts over the blockchain.

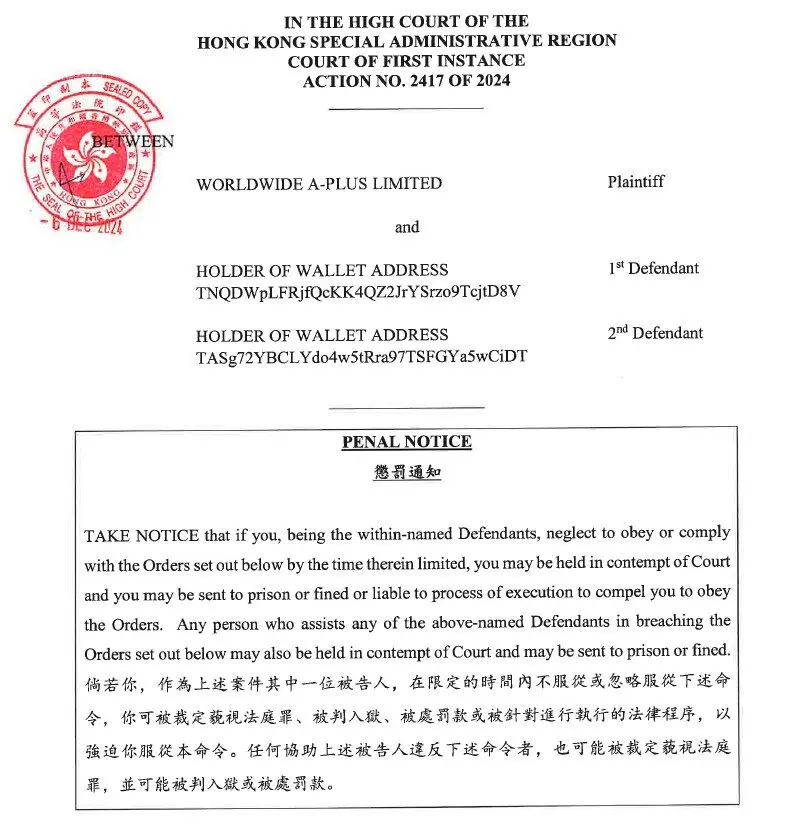

Two wallet addresses on Tron that got tokenized legal letters to freeze their funds were revealed in a court injunction order.

Although earlier US and UK decisions have demonstrated how courts can adjust to new approaches, Hong Kong’s most recent tokenized notices set it apart by forbidding ignorance as a defense.

Joshua Chu, a cybersecurity consultant at Macro Systems, the tech company that provides the tokenized legal notices, said “if a transaction proceeds, it will be against criminal law, and if centralized exchanges are involved, they would likely be hesitant to engage with these wallets due to their statutory [Anti-Money Laundering and Know Your Blockchain] obligations.”

In-person service, where the recipient receives the documents in person, has historically been the most popular way to serve legal documents. Under some circumstances, several jurisdictions also permit sending papers by fax, email, or registered mail. Notices have been posted online or in newspapers where the recipients cannot be found.

Moses Park, the plaintiff’s lawyer in the Hong Kong lawsuit, said that delivering court paperwork on wallet holders had previously been difficult, if not impossible, due to current procedural restrictions.

A digital police tape about the 2.65 million USDT the victim lost in an online scam was placed thanks to the court’s injunction. However, the suspects had already transferred some funds to exchanges when the tokenized court orders reached the suspicious wallets.

Approximately one million USDT was still in the wallets when writing.

Chu declined to comment further, saying the rest was “dealt with separately.”

Adoption is being hampered by tech hesitancy.

One of the most popular chains among criminals is Tron. In 2023, it was responsible for about half of all unlawful transactions. In addition to Tron, Macro Systems has tested its technology on Ethereum and Polygon, among other networks.

According to Chu, it is theoretically feasible to use Bitcoin as well, and by 2025, he plans to keep refining the technology to extend it into other networks.

However, victims’ knowledge is still lacking because they are typically unaware of new technology opportunities. The JPEX case, the most prominent cryptocurrency scam in Hong Kong, has left thousands of victims without a way to recover their losses through the judicial system.

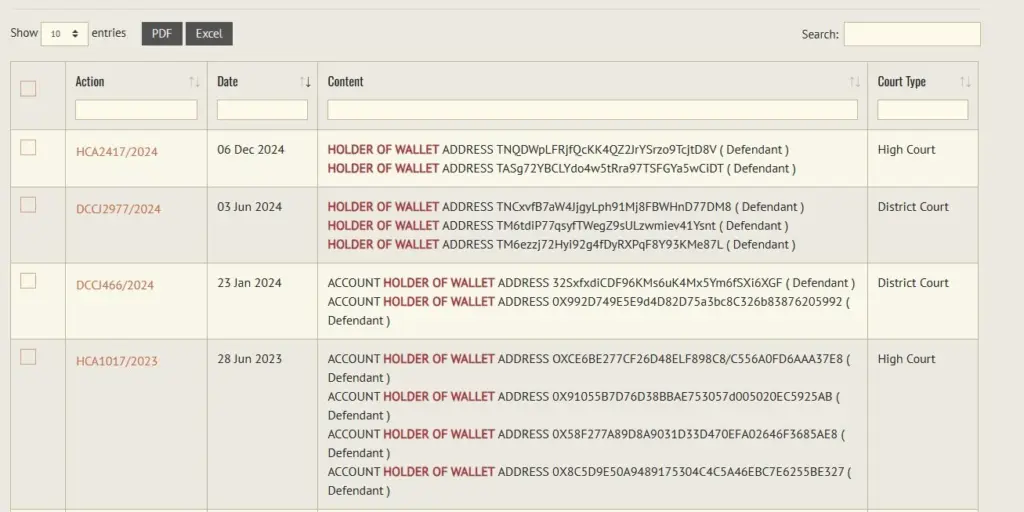

According to D-Law, an online repository of court cases, four court orders have banned blockchain addresses in Hong Kong since 2023.

The use of blockchain technology in legal settings is still relatively new. Adoption is being slowed because many judges, legal professionals, and institutions are unfamiliar with its workings, advantages, or actual application, Laurenth Alba, a legal consultant and business development head at Rome Protocol, told Cointelegraph.

“Airdropping [non-fungible tokens] (NFTs) or tokenized documents requires technical expertise and investment. For many cases, this complexity may not seem justified unless anonymity or cross-border challenges make traditional methods impractical.

UK legal precedents

Because of more than 150 years of British colonial control that ended in 1997, Hong Kong’s legal system is comparable to that of the United Kingdom.

The UK has also adopted cutting-edge blockchain-based legal procedures.

Fintech consultant Lavinia Osbourne, for example, was the victim of a cyber theft in the 2023 case of Osbourne v. Persons Unknown & Ors when two of her NFTs from the “Boss Beauties” collection were illegally taken from her cryptocurrency wallet.

Osbourne sought legal assistance from the High Court of England and Wales, which upheld English law’s recognition of NFTs as property. The court issued an injunction to freeze the assets and stop additional illegal activities. It then allowed the unnamed defendants to receive legal documents through NFTs.

A precedent created in the 2022 case of D’Aloia v. Persons Unknown & Others was followed by this creative strategy.

In this instance, people running phony online brokerage tricked Fabrizio D’Aloia, the founder of an online gambling company.

The High Court acknowledged the potential culpability of cryptocurrency exchanges as constructive trustees of the embezzled assets and authorized the serving of court documents via an NFT airdropped straight into the defendants’ wallets.

Digital justice is being adapted in courtrooms.

The US follows a legal system similar to England, such as that of Hong Kong and the UK. However, there are significant variances because of its constitutional framework and federal system.

Blockchain technology has also been used to serve court documents in the biggest economy in the world.

The case LCX AG v. John Doe Nos. 1-25 is a noteworthy illustration. According to the New York Supreme Court, by airdropping a special NFT into the defendants’ cryptocurrency wallets, the plaintiff was able to serve court documents on anonymous defendants. Despite the defendants’ anonymity, this approach ensured they were informed by including a link to a website with the court records.

Chu stated that their employment of NFTs offered extraordinary obstacles of their own, such as defendants’ potential to send them away, even though prior precedents in big economies like the US and UK show that courts are adaptable to modern technologies.

Blockchain does not change the data but makes the matter more complicated.

Alba added that a more unified legal framework is necessary to enforce legal measures against frozen assets or pseudonymous parties.

She also said:

“Global jurisdictional complexities and the lack of standardized protocols make enforcement difficult, highlighting the need for collaboration between legal systems and blockchain technology.”

Alba added that US courts and lawmakers would hesitate to use blockchain for legal notifications if there aren’t any explicit, consistent norms.

Chu pointed to a Consumer Financial Protection Bureau proposal to make wallet developers responsible for onchain fraud. Still, it added that the Macro System’s technology isn’t exclusive to Hong Kong, and the US regulatory trend is moving toward consumer protection.

Chu remarked, “This case is exciting because it’s no longer theoretical.” “We have demonstrated the ability to issue and enforce injunctions.”