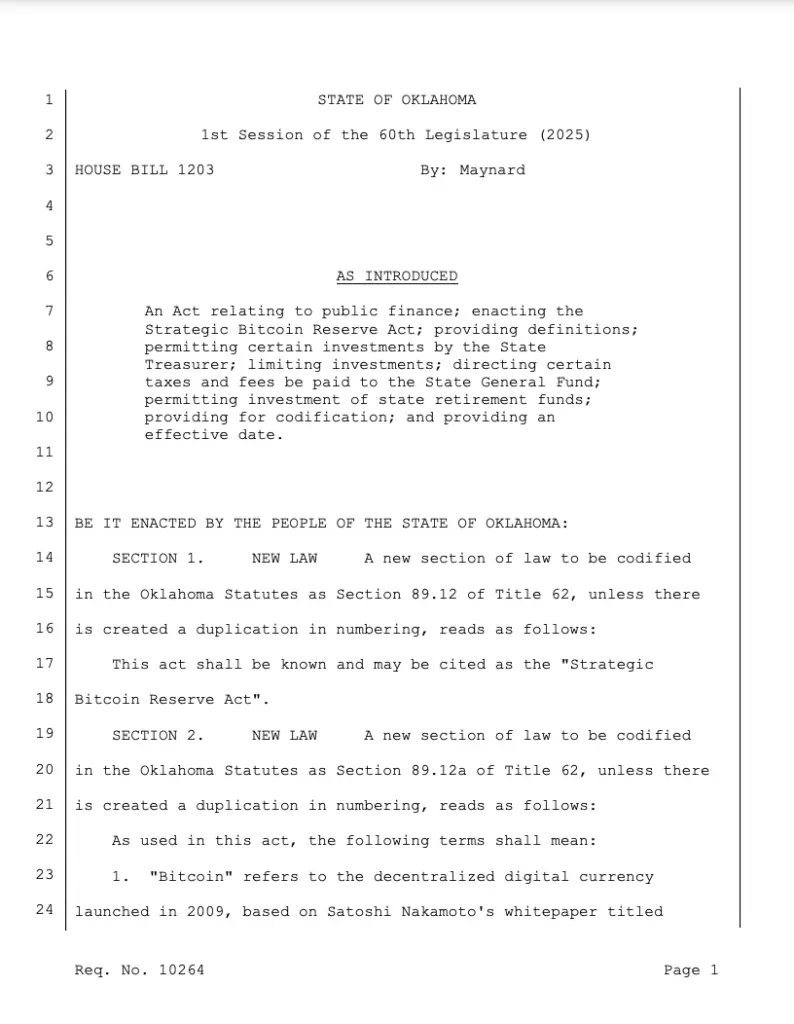

Oklahoma Rep. Cody Maynard introduced a bill on Jan. 15 to designate the strategic Bitcoin reserve assets.

On January 15, state Representative Cody Maynard introduced a new bill to the Oklahoma House of Representatives that would designate Bitcoin as a strategic reserve asset.

The Strategic Bitcoin Reserve Act, also known as House Bill 1203, would enable Oklahoma’s pension funds and state savings accounts to allocate a portion of their assets to Bitcoin BTC to hedge against inflation.

Rep. Maynard stated, “Bitcoin symbolizes the liberation of our purchasing power from bureaucrats who are printing it.” The state representative continued, stating:

“As a decentralized form of money, Bitcoin cannot be manipulated or created by government entities. It is the ultimate store of value for those who believe in financial freedom and sound money principles.”

The digital asset is gaining mainstream, institutional adoption, and numerous state pension funds have already diversified into Bitcoin.

Additionally, numerous US states have pending legislation to establish a Bitcoin strategic reserve.

Proposals For Bitcoin Reserves Are Emerging In Numerous States

In November 2024, Pennsylvania lawmakers proposed the establishment of a Bitcoin strategic reserve in the state.

This reserve would enable the state Treasury to invest up to 10% of its assets in Bitcoin.

State Representative Mike Cabell contended that Pennsylvania should emulate the Bitcoin diversification methods employed by private sector asset managers such as BlackRock and Fidelity, which employ Bitcoin to protect their investments from macroeconomic risks.

Cabell further stated that Bitcoin was a means of safeguarding the purchasing power of states during periods of economic instability and inflation.

Giovanni Capriglione, a state lawmaker in Texas, filed the Texas Strategic Bitcoin Reserve Act on December 12.

Capriglione suggested that the Texas comptroller of public accounts, who serves as the state’s chief financial officer, maintain Bitcoin as a reserve asset for a minimum of five years.

North Dakota and New Hampshire followed suit on January 10, introducing Bitcoin strategic reserve bills.

The New Hampshire bill employs the general term “digital assets,” which suggests that the state may expand its crypto holdings beyond Bitcoin.

Dennis Porter, the co-founder and CEO of the Bitcoin advocacy group Satoshi Action Fund, has reported that the North Dakota bill has already garnered the support of 11 co-sponsors.