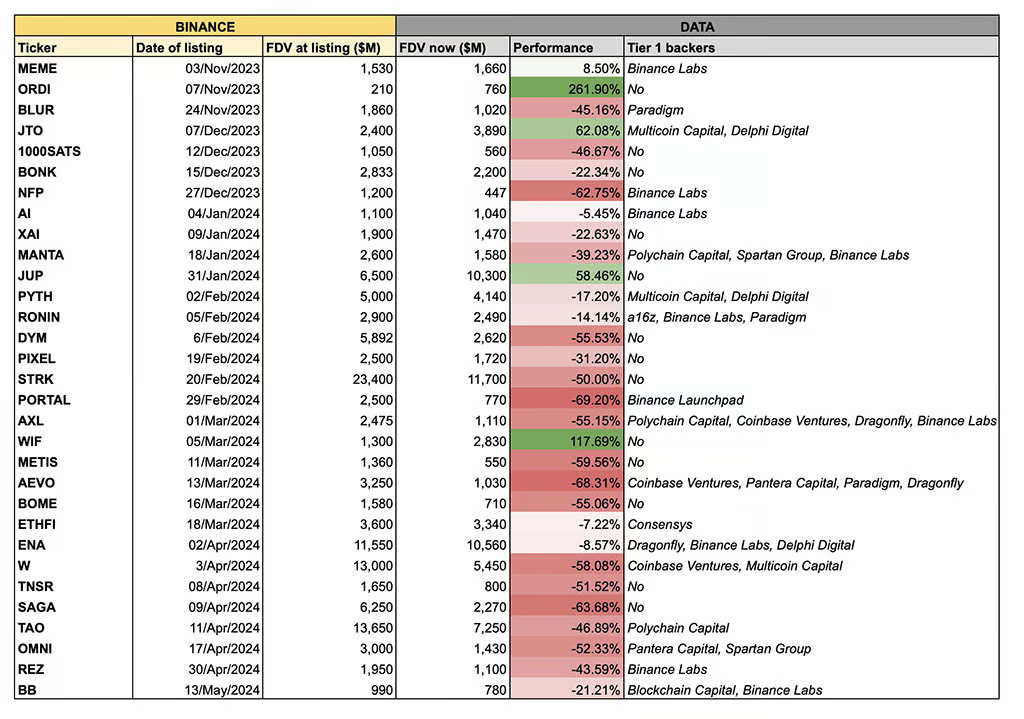

Binance has seen a majority of up to 80% of the new coins decline on the platform in the last 6 months.

Binance, the preeminent cryptocurrency exchange globally in trading volume, must overcome a substantial obstacle. According to a recent study by crypto researcher Flow, the value of over 80% of tokens introduced to the platform within the past half-year has decreased substantially since their initial offering.

Only five out of thirty-one tokens examined, as reported by Flow, retained their value. Memecoin (MEME), Ordi (ORDI), the Jupiter (JUP) token, Jito (JTO), which is based on Solana, and the distinctively named Dogwifhat (WIF) are these five tokens.

New Binance Tokens Have Overestimated Valuation

According to author and blockchain specialist Anndy Lian, this massacre indicates a challenging market environment. Although a few altcoins persist in deviating from the prevailing pattern, the cryptocurrency market as a whole is devoid of the frenetic momentum observed in past bull runs. Lian emphasizes that, in contrast to the previous trend of instantaneous development, specific Binance-listed projects may encounter a period of gradual expansion.

Nevertheless, a more concerning pattern emerges. Notwithstanding their limited user base, these novel tokens have an astounding average completely diluted valuation (FDV) that surpasses $4.2 billion. As per Flow, the exaggerated assessment substantially curtails their capacity for subsequent expansion.

Flow contends, “More often than not, tokens that debut on Binance are no longer investment vehicles.” “Their entire upside potential has been eliminated.” Conversely, they serve as exit liquidity for insiders who exploit the limited access of retail investors to high-quality early investment opportunities.

Increase in Meme Coins Led by Retail Market Participants

Lian asserts that meme currencies’ vitality stems from the enthusiasm of retail investors, which enables them to function relatively autonomously from the wider altcoin market.

“Considering that many of them are long-term investments, many retail investors flocked to meme coins.” This is evident from the results obtained from MEME and WIF. Indeed, a glance at the transaction volume would reveal this. “Six of the most actively traded coins are memes,” Lian explained.

Notably, since its inception, Ordi, a token without venture capital funding, has risen by more than 260%, making it the most lucrative. The price of Dogwifhat, the contentious meme coin, increased by more than 17% in close pursuit.

Although meme currencies may provide investors with a momentary respite from the current market downturn, the Binance token bloodbath is a cautionary tale that urges prudence. Due to their exorbitant valuations and dearth of established user bases, numerous new listings are risky investments.