President Donald Trump intends to appoint Brian Quintenz, the head of policy for a16z’s crypto unit, as the Commodity Futures Trading Commission’s next chair.

Brian Quintenz, the head of policy for the cryptocurrency division of venture capital company Andreessen Horowitz (a16z), is apparently in the running to be appointed chair of the Commodity Futures Trading Commission by US President Donald Trump.

Bloomberg reported on February 12 that a document submitted to the White House from Capitol Hill disclosed Trump’s intention to appoint Quintenz as the CFTC’s next head.

It is generally anticipated that Brian Quintenz will advocate for pro-crypto policy changes and position the CFTC as the primary regulator of the cryptocurrency sector, replacing the Securities and Exchange Commission, if he is approved as the agency’s director.

According to the same document, Trump appointed Jonathan Gould, a partner at the international law firm Jones Day, as the Comptroller of Currency, who will lead the organization that oversees all US national banks.

The paper also disclosed that Trump appointed Jonathan McKernan, who left the Federal Deposit Insurance Corporation on February 11, as the new permanent director of the Consumer Financial Protection Bureau.

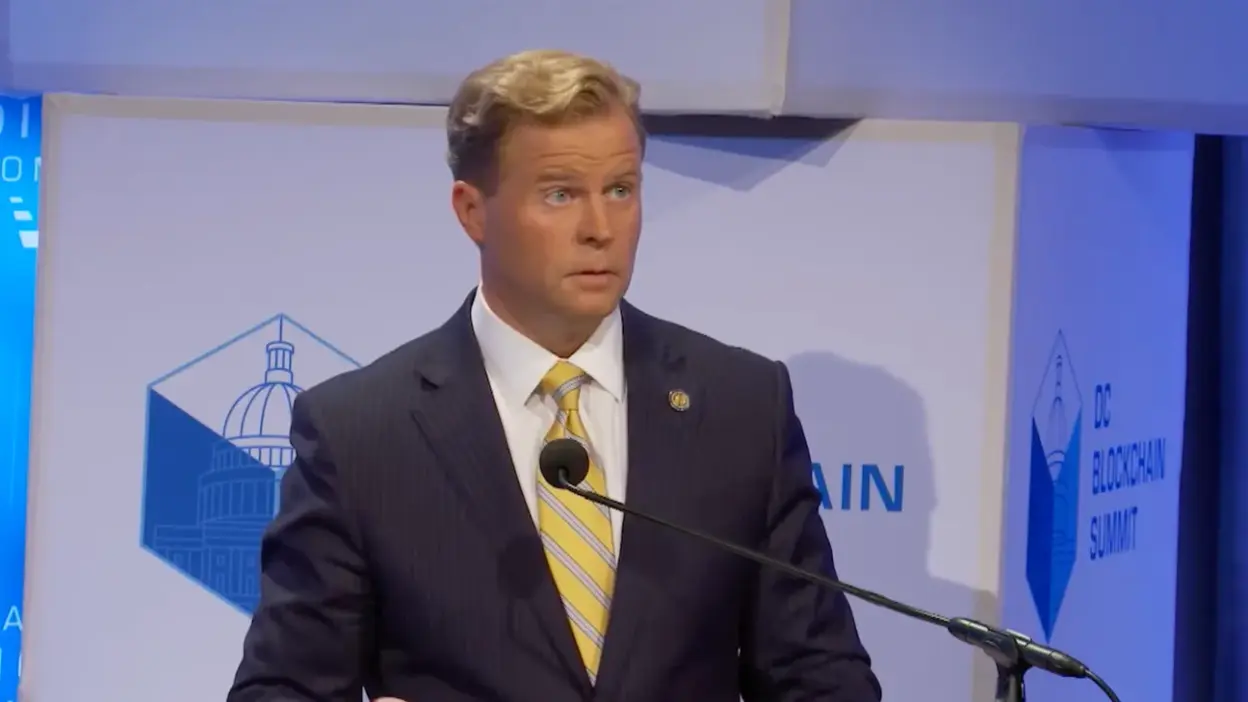

The background of Brian Quintenz at the CFTC

From 2016 to 2020, Brian Quintenz was a Republican commissioner of the CFTC in the first Trump administration.

He strongly supported including cryptocurrency products and digital asset derivatives in the federal agency’s regulatory framework while employed at the CFTC.

Quintenz chastised the Gensler-led SEC in March for handling Ether’s legal status (ETH $2,610).

He criticized the regulator for treating Ether inconsistently, saying that when it authorized Ether futures exchange-traded funds (ETFs) in October 2023, the SEC had “explicitly acknowledged” that ETH was a non-security asset.

“If the SEC had any doubt about the regulatory treatment of ETH […] it wouldn’t have approved the ETF,” Quintenz stated, adding that future contracts specified by the CFTC “would be illegal” if the asset were a security.

A16z stated in November that it anticipates “more freedom to try new things” in the wake of the Trump administration’s regulatory overhaul of the cryptocurrency industry.

One of the biggest VC firms in the cryptocurrency space, A16z has invested in hundreds of startups, including Maker (now Sky), Solana, Avalanche, Aptos, EigenLayer, Lido, Nansen, OpenSea, Coinbase, and many more.