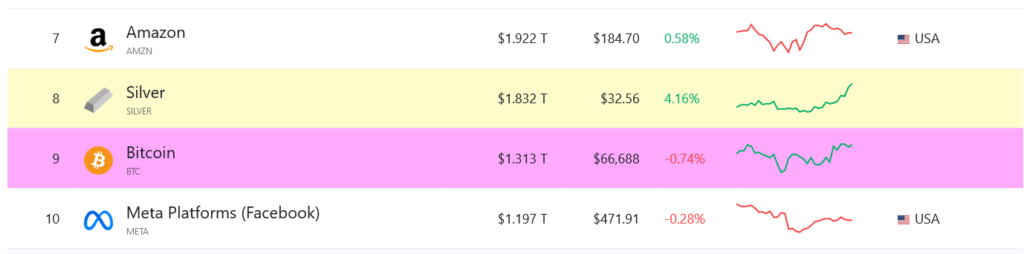

The value of silver on the market has risen over $500 billion, and Bitcoin needs to hit $93k to surpass silver.

In 2024, silver has demonstrated a remarkable recovery compared to Bitcoin, superseding the cryptocurrency as the eighth-largest asset by market capitalization after its loss in March.

Since Bitcoin BTC ticked down $66,660 and reached a record $73,737 on March 14, the world’s second most valuable metal has increased by 33.4%, while Bitcoin has retraced 9.5%, according to CoinGecko.

Consequently, according to Companies Market Cap, silver’s current market capitalization of $1.83 trillion is $500 billion greater than Bitcoin’s current market capitalization of $1.31 trillion; Bitcoin would have to increase by 40% to $93,000 to surpass silver’s current market capitalization (all else being equal).

Bitcoin ranks the ninth-largest asset globally, placing it lower than silver, Microsoft, Apple, Nvidia, Google, Saudi Aramco, and gold.

Gold has also distinguished itself, with Trading Economics reporting a 22.4% increase since February 13. Its market capitalization is $16.4 trillion at present.

Speculators in the industry were divided as to the trajectory of Bitcoin’s price after its record-breaking surge in March.

Analyst Dylan LeClair has previously observed that Bitcoin tends to double within a few months of attaining new highs, especially near-halving events.

Bitcoin’s current market capitalization is considerably more significant than in 2020, 2016, and 2012, increasing the difficulty of accomplishing such an accomplishment.

Mike Novogratz, founder and chief executive officer of Galaxy Digital, predicts that Bitcoin will remain in a “consolidation phase” between $55,000 and $75,000 for the next month, with a possible increase by the end of the second quarter.

Bitfinex, a platform for trading cryptocurrencies, forecasts that Bitcoin could reach $150,000 within twelve months.

Numerous industry analysts have cited the spot Bitcoin exchange-traded funds and the post-halving effect as the primary drivers of these exorbitant forecasts.

Bitcoin’s market sentiment rating currently stands at 70 out of 100 on the Crypto Fear and Greed Index, placing it squarely within the “Greed” category.