Peter Schiff rejects Bitcoin as digital gold again, while JPMorgan forecasts BTC will outperform gold in the long run.

Peter Schiff, a renowned economist and critic of Bitcoin, has boldly asserted that Bitcoin is not comparable to gold and subsequently provided an explanation for his opinion. His most recent critique of the premier cryptocurrency coincides with JPMorgan’s forecast that BTC will surpass the precious metal.

Peter Schiff asserts that Bitcoin is the opposite of gold

The market expert stated in an X post that Bitcoin is not comparable to gold, despite BTC being referred to as “digital gold.” He clarified that BTC experienced a surge in value in tandem with other risk assets as investors’ concerns regarding inflation and recession diminished. As a result, he thinks that the flagship cryptocurrency is not a refuge, in contrast to gold, which typically experiences a surge when macro fundamentals are negative.

In contrast to Schiff’s theory, the BTC price experienced a significant increase even though tensions between the United States and China in the ongoing trade war were still elevated. Before China disclosed that trade negotiations would commence on May 10, the premier cryptocurrency was already trading at a price just below $100,000.

Schiff’s declaration coincides with JPMorgan analysts’ forecast that Bitcoin will surpass gold in the latter half of the year. They anticipate that this will occur due to catalysts such as the increasing demand from institutional investors and the initiative by US states to establish a Strategic Bitcoin Reserve. Companies such as Strategy continue to accumulate BTC at an extraordinary rate.

Nikolaos Panigirtzoglou, an analyst at JP Morgan, stated,

We expect the year-to-date zero-sum game between gold and Bitcoin to extend to the remainder of the year, but are biased towards crypto-specific catalysts creating more upside for Bitcoin over gold into the second half of the year

The Subsequent Action of the Bitcoin Price

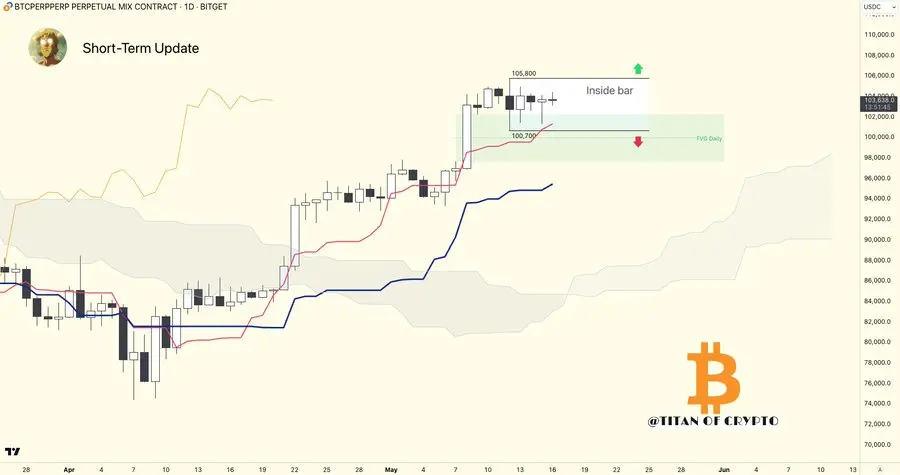

According to Titan of Crypto, a crypto analyst, the Bitcoin price is still subject to a potential increase of $125,000. He emphasized the emergence of an inverse Head and Shoulders pattern on BTC’s chart. In light of this, he maintained that the objective is still legitimate.

Titan of Crypto provided an additional update on the present price action, observing that BTC maintained its strength. The daily Fair Value Gap at $100,000 elicited a strong response, despite calls for significantly lower prices. He also stated that the scenario would remain bullish if the zone remained in place.

Ali Martinez, a crypto analyst, stated in an X post that $98,732 is a significant demand zone, where 1.19 million wallets have accumulated more than 1 million BTC. He also disclosed that whales have sold over 30,000 BTC in the past 72 hours, suggesting that there has been a significant amount of profit-taking this week.

Nevertheless, companies like Basel Medical Group seek to increase their exposure to Bitcoin while billionaires sell. The company has announced its intention to acquire $1 billion BTC for its Treasury reserves.