Tether strengthens its dominance with a growing market cap, leading the $243 billion stablecoin space as demand surges for dollar-pegged digital assets

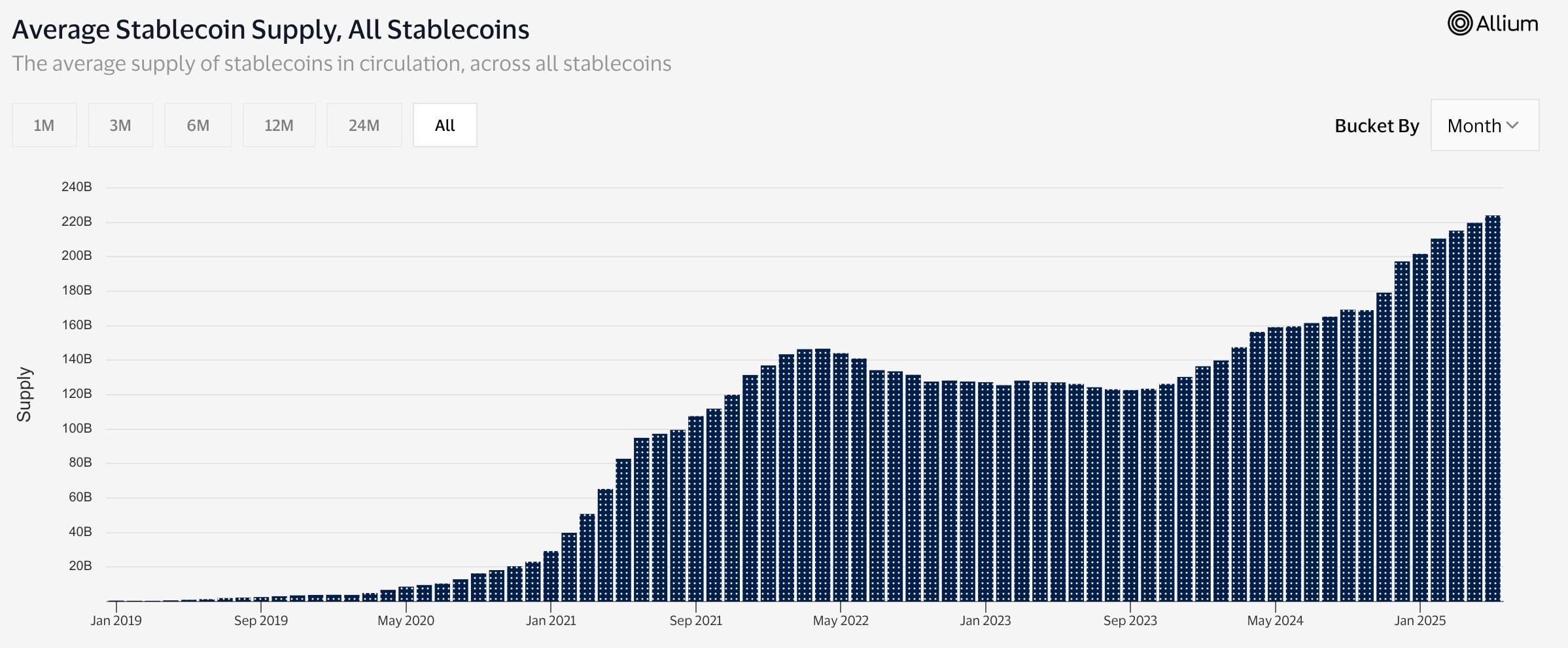

The market capitalization of stablecoins, such as Tether USD Coin, reached a record high of $243.8 billion this week as they continued to experience robust growth.

Since the beginning of the year, these coins have increased their assets by mover$38 billion from $240 billion.

Tether’s market capitalization has increased to mover$151 billion, indicating a 62% market share.

It is succeeded by USDC, which has assets totaling $60.4 billion, and Ethena USDe, which has nearly $5 billion.

President Donald Trump’s World Liberty Financial has recently launched the USD1, which has amassed over $2.1 billion in assets. Most of these funds are presumably associated with MGX’s $2 billion investment in Binance, the largest crypto exchange in the industry.

Other notable stablecoins include Ripple USD and PayPal’s PYUSD, which have accumulated assets of $900 million and $313 million, respectively.

Today, more individuals are incorporating stablecoins into their daily transactions, according to data collected by Visa. Over 192.2 million unique sending addresses in the past year have transacted, and 242.7 million have received stablecoins. The total number of active distinct addresses increased to 250 million.

This has resulted in a cumulative transaction count of 5.8 billion and a transaction volume of $33.6 trillion.

Stablecoins have gained significant popularity due to their reduced costs compared to conventional methods. For instance, the charge for sending $1,000 to a user via PayPal is 2.99%, in addition to a variable fee.

The fee associated with using a stablecoin is significantly lower than that. Additionally, these transactions are more efficient than conventional methods such as telegraph transfers.

Citi anticipates that stablecoins will continue to expand their market share in the years ahead.

According to a recent report, the company anticipates stablecoins will be valued at over $1.6 trillion by 2030, while Standard Chartered predicts reaching $2 trillion by 2028.