Bitcoin hovers near $100K as traders await a cycle-defining move with eyes on support levels and the potential for a breakout or reversal ahead

Bitcoin has maintained its status as one of the most successful large-cap assets, with its value increasing by nearly 25% over the past month.

It is even more remarkable that the Bitcoin price has maintained its position above the six-figure valuation threshold despite the sluggish market conditions of the past week.

After a few weeks of robust bullish activity, the premier cryptocurrency appears to have stabilized within the consolidation range of $102,000 to $105,000.

The Bitcoin price seems to be experiencing a degree of uncertainty among investors despite market-wide declarations that it will reclaim its all-time high.

The price of Bitcoin may be on the brink of a decline.

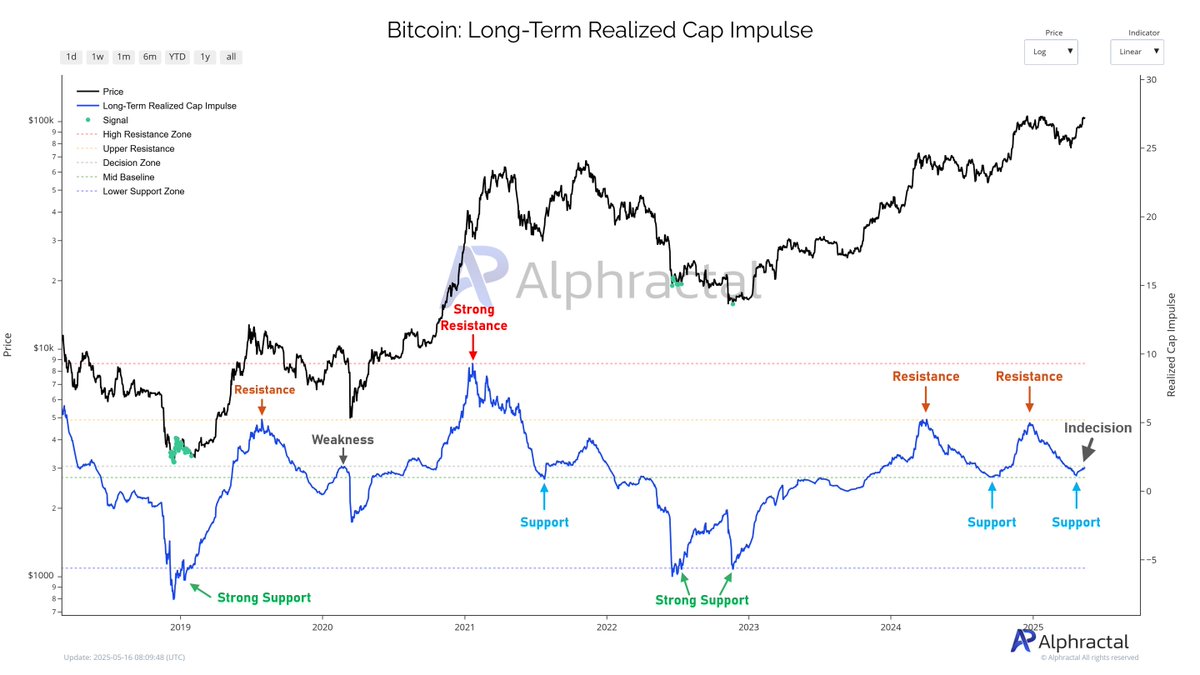

According to a post on the social media platform X on May 16, Alphractal, an on-chain analytics firm, the Bitcoin price is currently at a critical juncture that could significantly impact its future trajectory.

This on-chain assessment is grounded in the Long-Term Realized Cap Impulse, a metric that quantifies the rate of development in the realized capitalization of long-term holders.

For clarification, a positive value for the Long-Term Realized Cap Impulse indicates that long-term investors purchase more BTC at a higher price. When long-term holders are in accumulation mode, this trend typically shows the beginning of a bull market or a bullish period.

Conversely, a negative Long-Term Realized Cap Impulse metric suggests that long-term holders sell their coins at lower prices than their cost bases. This is typically observed when long-term investors distribute their assets in late bull cycles and early decline markets.

In addition, the Long-Term Realized Cap Impulse indicator provides a window into the supply and demand dynamics of Bitcoin, emphasizing significant support and resistance zones.

The Bitcoin price is currently at a critical juncture, as indicated by the horizontal line in the chart provided by Alphractal. This level is referred to as the “indecision level.”

The Long-Term Realized Cap Impulse metric’s breakout from this level could be critical to the long-term health of Bitcoin, as it would indicate sustained strong demand and potential price appreciation, according to the market intelligence firm.

Nevertheless, Alphractal attributed historical significance to this level, observing that the Long-Term Realized Cap Impulse metric was denied at the indecision zone shortly before the COVID-19 dump in March 2020.

Investors may wish to monitor this level for any rejection, as it could potentially precipitate a substantial decline if historical precedent is any indication.

Brief Overview of the Bitcoin Price

At the time of this writing, the price of BTC was approximately $103,713, a mere 0.6% increase over the past 24 hours.