Upbit lists MANTRA (OM) weeks after its $5.5B crash, sparking a double-digit price surge for the token.

The exchange will also facilitate trading for Access Protocol (ACS), GoChain (GO), Observer (OBSR), Quiztok (QTCON), and Rally (RLY).

MANTRA (OM) obtains an Upbit listing

Trading for OM will commence at 15:00 Korea Standard Time (KST) on May 21, as per Upbit’s official announcement.

“Supported Markets: KRW, BTC, USDT Market. Trading opens at: 2025-05-21 15:00 KST (estimated time),” Upbit posted on X.

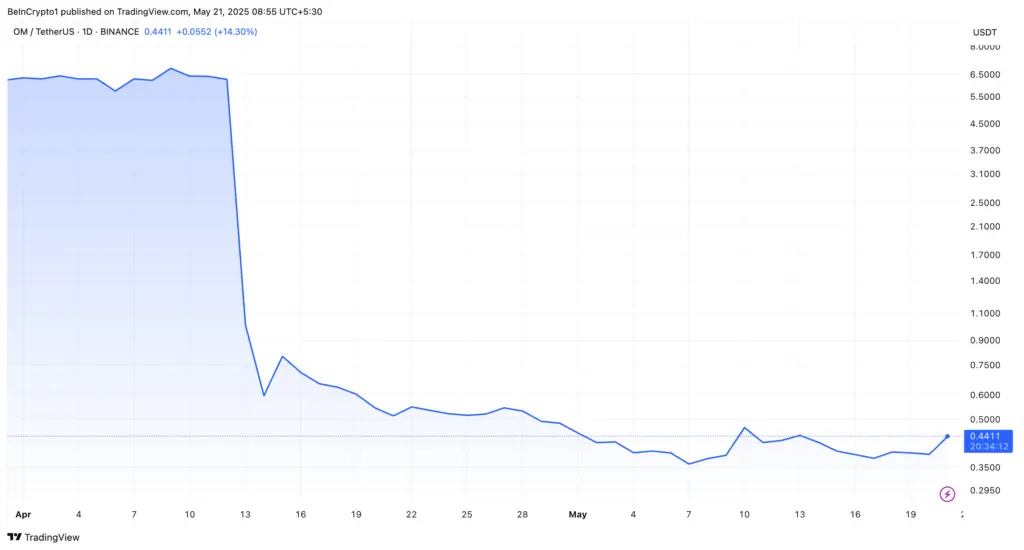

Notably, the most recent announcement from Upbit resulted in a 15.7% increase in OM, as indicated by the data. The token was priced at $0.44 at the time of this writing.

Furthermore, there was a 154.4% increase in trading volume, which indicates the potential for increased investor interest and market activity.

The listing follows the catastrophic price collapse of MANTRA (OM) on April 13, 2025. The collapse, which was caused by forced liquidations during low trading volume hours, resulted in a 90% decline in the price of OM, significantly undermining investor confidence in MANTRA.

John Patrick Mullin, the CEO of MANTRA, declared his intention to burn his complete allocation of 150 million team tokens in response to the crisis. Furthermore, MANTRA was collaborating with partners to destroy an additional 150 million OM tokens, resulting in a total of 300 million OM being removed.

The objective of this initiative was to diminish the supply in circulation and reestablish investor confidence. Although it provided a minor price increase, OM remains significantly below the $1 threshold.

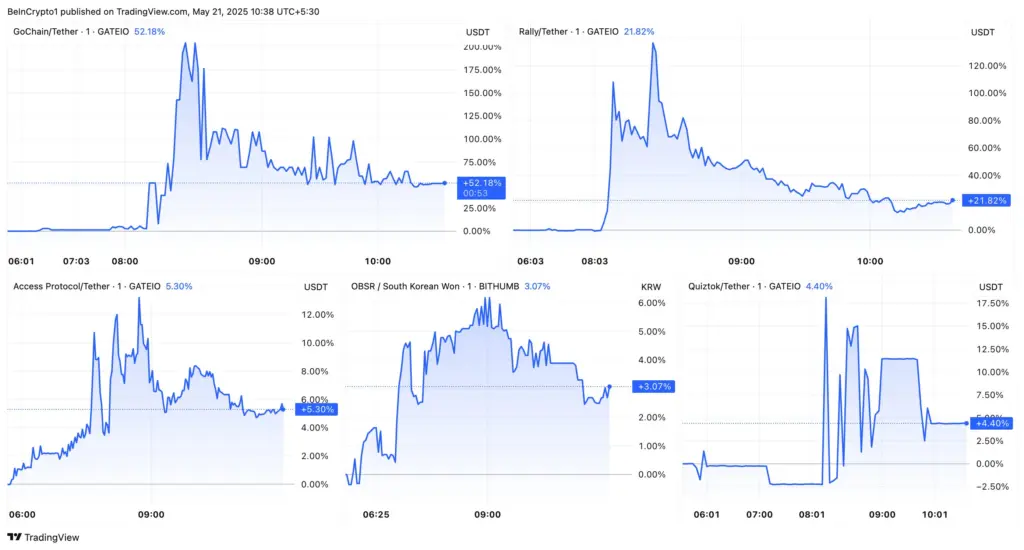

In a separate announcement, Upbit affirmed that ACS, GO, OBSR, QTCON, and RLY will be available to trade in Tether (USDT) pairs. Trading for these five altcoins will commence at 13:00 KST on May 21.

The market responded promptly. Within minutes of the announcement, GO and RLY experienced the most significant gains, with 105.8% and 136.3%, respectively. Their gains have been adjusted to 52.1% and 21.8% at the time of publication.

Additionally, ACS experienced a 12% increase, OBSR increased by 6%, and QTCON gained 18%. Much like GO and RLY, the tokens also experienced a minor correction.

ACS was up 5.3%, OBSR was up 3.0%, and QTCON was up 4.4% at the time of writing. Even though these increases were more modest, they significantly improved investor engagement and market sentiment.

These price fluctuations underscore the market influence of Upbit. The exchange maintains a trust score of 8 out of 10 and provides access to more than 240 assets, as indicated by the most recent data from CoinGecko. Furthermore, its 24-hour trading volume is $1.81 billion.