South Korea finalizes crypto rules, setting stricter exchange standards and nonprofit sale guidelines to welcome institutional investors.

South Korea is implementing new guidelines for nonprofit crypto sales and stricter listing standards for exchanges in anticipation of allowing institutional actors to enter its crypto market.

This includes a tightening of regulations regarding digital asset transactions.

The Financial Services Commission (FSC) of South Korea announced the completion of comprehensive new measures during its fourth Virtual Asset Committee meeting on May 20.

The updated regulations, which are scheduled to be implemented in June, will permit nonprofit organizations and virtual asset exchanges to sell cryptocurrencies, provided that they adhere to new compliance standards.

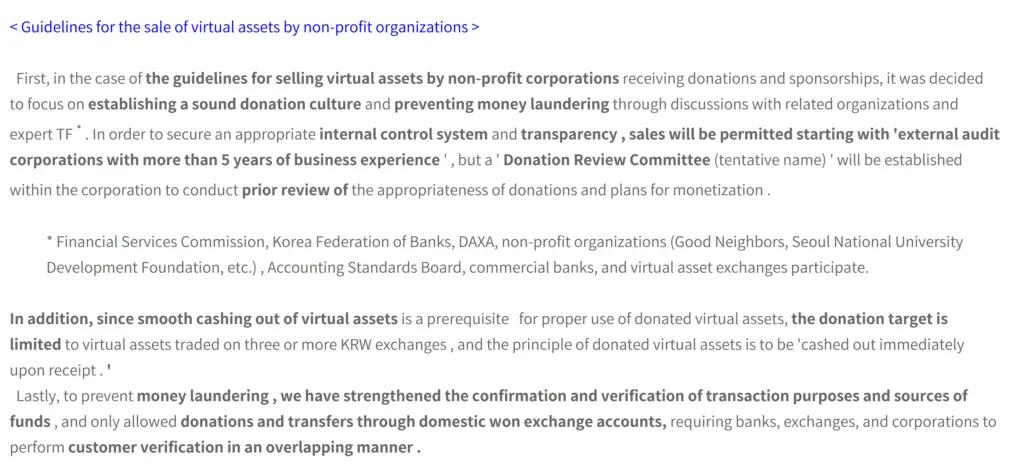

To be eligible for the receipt and sale of virtual asset donations, nonprofit entities must possess at least five years of audited financial history.

Additionally, they will be required to establish internal Donation Review Committees to evaluate the propriety of each donation and the liquidation strategy.

To mitigate the risk of money laundering, all donations must be transferred through verified Korean won exchange accounts.

The verification process is the responsibility of the nonprofits, banks, and exchanges.

Additionally, it is anticipated that liquidation will occur immediately upon receipt, and only cryptocurrencies listed on at least three leading domestic exchanges will be eligible.

Exchange Purchases Will Be Restricted

Crypto exchanges will be permitted to liquidate user fees paid in cryptocurrency, provided that they are used to offset operational expenses.

Sales will be restricted to daily limits, typically no more than 10% of the planned quantity.

Additionally, purchases will be restricted to the top 20 tokens by market capitalization on five won-based exchanges.

It is crucial to note that exchanges are prohibited from selling tokens on their platforms to prevent conflicts of interest.

Additionally, South Korea is implementing more stringent regulations regarding listing digital assets.

The revised rules are designed to mitigate the instability caused by sudden price spikes by mandating a minimal circulating supply for tokens before trading and temporarily restricting market orders following their listing.

Memecoins with unclear utility and zombie tokens with low volume and thin market capitalization will be subject to increased scrutiny.

For example, exchanges must delist tokens if they do not meet liquidity benchmarks or community engagement thresholds.

In June, exchanges and nonprofits can register for real-name accounts to facilitate these sales.

The FSC intends to expand the availability of real-name accounts to professional investors and listed firms later this year.

By publication, Cointelegraph had not received a response from South Korea’s Digital Asset eXchange Association.

South Korean Candidates Advance Pro-Crypto Agenda

Lee Jae-myung, the leader of the Democratic Party in South Korea, has suggested establishing a stablecoin linked to the Korean won.

The objective is to reduce capital migration and enhance the country’s financial autonomy.

Lee stated at a recent policy forum that a won-based stablecoin could assist in preserving domestic wealth and reducing reliance on foreign-backed digital currencies, such as USDt and USDC.

In addition to the legalization of spot crypto exchange-traded funds (ETFs), the initiative is a component of Lee’s broader campaign for digital asset reforms.

His opponent, Kim Moon-soo of the ruling People Power Party, indicates bipartisan momentum and has also expressed support for introducing spot crypto ETFs.