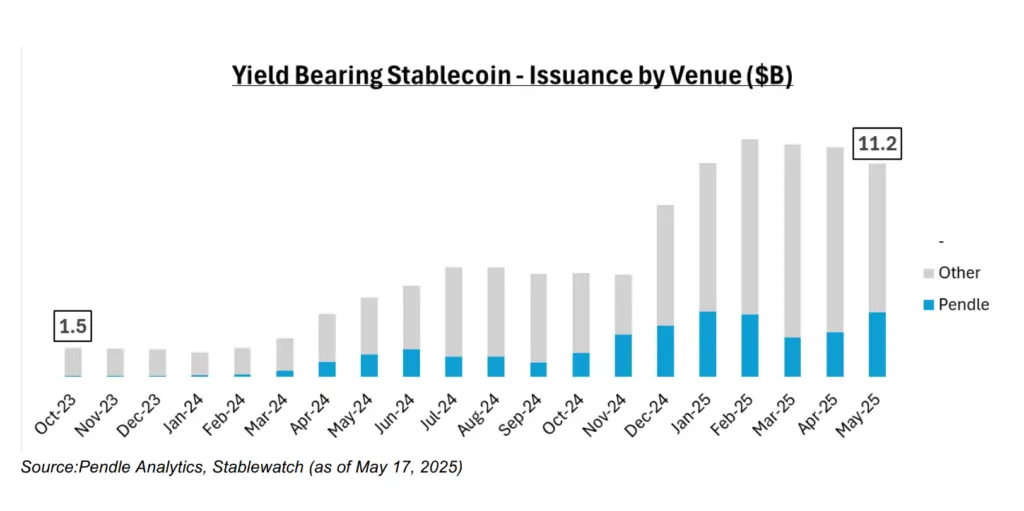

Due to changes in regulations and rising consumer demand, yield-bearing stablecoins have increased to $11 billion, with Pendle accounting for 30% of that total.

From just $1.5 billion and a 1% market share at the beginning of 2024, yield-bearing stablecoins have skyrocketed to $11 billion in circulation, or 4.5% of the stablecoin market.

Pendle, a decentralized system that lets users speculate on changing interest rates or lock in fixed yields, is one of the greatest beneficiaries. According to the company, Pendle currently holds almost $3 billion, or 30% of the total value locked (TVL) of all yield-bearing stablecoins.

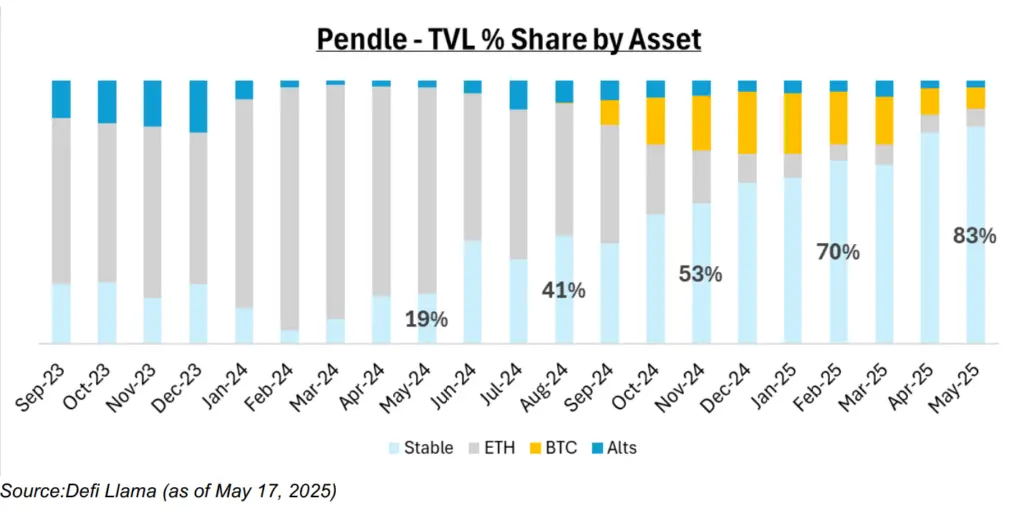

According to Pendle, 83% of its $4 billion total value secured comprises stablecoins, a significant increase from less than 20% a year ago. On the other hand, assets like Ether (ETH) at $2,529 that once made up 80% to 90% of Pendle’s TVL have decreased to fewer than 10%.

The holders of traditional stablecoins, such as USDt USDT$1.00 and USDC USDC$0.9997, do not get interest. According to Pendle, investors of stablecoins are losing out on more than $9 billion in annual income, given that there is more than $200 billion in circulation and that US Federal Reserve interest rates are at 4.3%.

Yield-bearing stablecoins benefit from increased regulatory certainty.

The increase in yield-bearing stablecoins coincides with the US President Donald Trump’s administration’s increased regulatory clarity.

Instead of outright prohibiting them, the February US Securities and Exchange Commission authorized yield-bearing stablecoins as “certificates” governed by securities law. Yield-bearing stablecoins can now function within specific guidelines, such as investor protections, disclosure obligations, and registration.

A positive path is indicated by proposed legislation such as the Guiding and Establishing National Innovation for US Stablecoins (GENIUS) and the Stablecoin Transparency and Accountability for a Better Ledger Economy (STABLE).

Pendle anticipates that within the next 18 to 24 months, the amount of stablecoins issued will double to $500 billion. Additionally, the company predicts that yield-bearing stablecoins will take 15% of this market with $75 billion in issuance, a 7x increase from $11 billion.

Pendle turns its attention to the yield market.

Pendle has shifted from airdrop farming to acting as an infrastructure layer for decentralized finance yield markets.

Approximately 75% of Pendle’s stablecoin TVL is now represented by Ethena’s USDe stablecoin. However, during the past year, non-USDe assets have risen from 1% to 26%, thanks to fresh players like Open Eden, Reserve, and Falcon.

With plans to enable networks like Solana and interface with Aave and Ethena’s forthcoming Converge blockchain, Pendle is also growing outside Ethereum.

Recently, institutional and retail investors looking to optimize returns on their digital assets have increased interest in yield-generating methods inside the bitcoin space.

Franklin, a hybrid cash and cryptocurrency payroll provider, introduced Payroll Treasury Yield on May 19, leveraging blockchain lending protocols to help businesses generate returns on payroll funds.