Canary Capital files an amended S-1 for Solana ETF, partnering with Marinade Finance to add SOL staking and enhance its fund offering.

To enhance the fund’s offerings, Canary Capital has submitted an amended version of its Solana ETF to the US Securities and Exchange Commission (SEC).

To reflect its new partnership with Marinade Finance for SOL staking, the asset manager has updated the ETF’s name as part of the amendment.

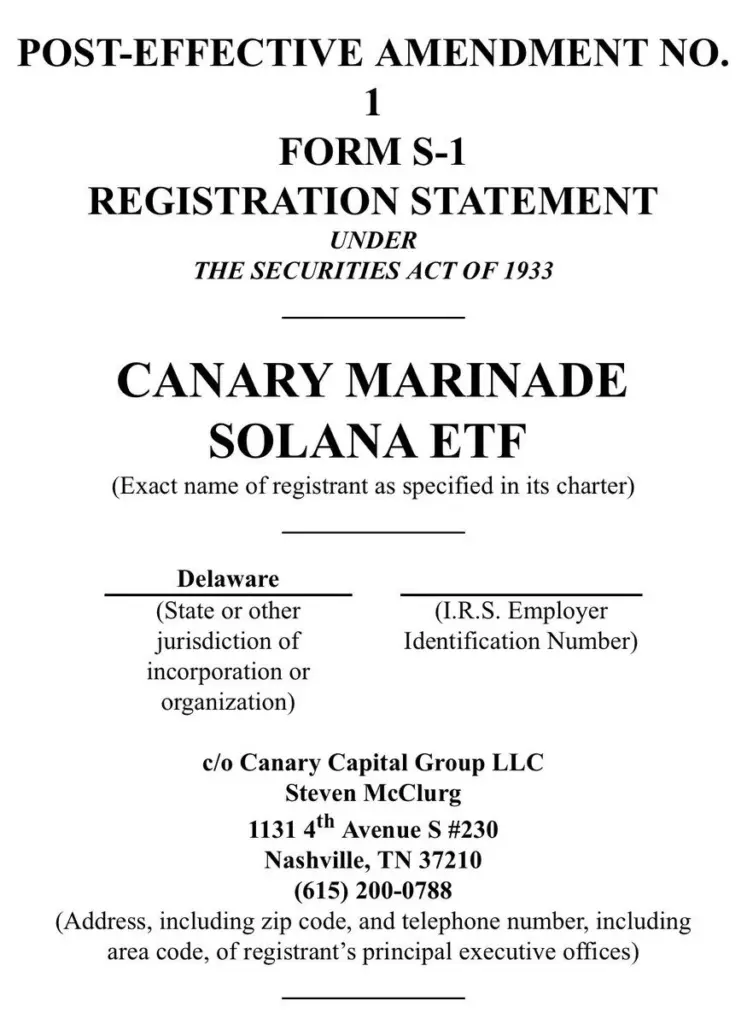

Canary Capital Submits Revised Solana ETF Prospectus

The asset manager has submitted an amended version of the registration statement for its SOL ETF in a recent SEC filing.

Canary Capital has altered the fund’s moniker to ‘Canary Marinade Solana ETF’ as part of the modifications.

As Bloomberg analyst James Seyffart observed, the amendment indicates the partnership between Marinade Finance and SOL for staking in the ETF wrapper.

Yesterday, the Solana DeFi protocol also hinted at a significant announcement today, teasing about the partnership.

Asset managers avoided including staking in the Ethereum ETFs before their introduction due to the opposition of the Gensler-led administration to its inclusion in any ETFs.

Nevertheless, the current administration has become more receptive to the concept, which has resulted in these fund managers submitting revised versions for the ETH ETFs and other altcoin ETFs, such as the Solana ETFs.

This development coincides with the US SEC’s decision to postpone the applications for 21 Shares and Bitwise’s SOL ETF.

The Commission also postponed its decision on Canary Capital SOL ETF filing, with the next deadline set for August 17.

According to Seyffart, the SEC is unlikely to sanction any filing until late June or early July at the “earliest.” Nevertheless, he thinks a sanction is more probable in the first quarter of the year.

It is also important to note that the agency has postponed its decision on other crypto ETFs, such as the XRP ETFs.

Grayscale’s Dogecoin and XRP ETF filings, as well as 21Shares’ XRP ETF filing, were the most recent delays, as reported by CoinGape.

Nevertheless, the SOL and XRP ETFs are most likely approved this year, as indicated by Polymarket data.

This Year, There Is 82% likelihood Of Approval

According to Polymarket data, the SEC is expected to authorize a Solana ETF in 2025 with an 82% probability.

In the interim, there is an 18% likelihood that an approval will be granted before July 31.

In the interim, Bloomberg analysts James Seyffart and Eric Balchunas anticipate that the Solana ETFs will be approved with a 90% probability.

The analysts cited the SEC’s current classification of Solana as a commodity and that the altcoin already has a regulated futures market through the CME as contributing factors to their prediction.

The SOL ETFs are expected to receive approval by the ultimate deadline of October 10.

This would be comparable to the Commission’s approach for the Bitcoin and Ethereum ETFs, as all funds were approved by the most recent deadline.

At approximately $169 at this time, the Solana price has increased by more than 2% in the past 24 hours.

The altcoin has already surpassed the $170 threshold on the day, reaching a maximum of $171.68.