Bitcoin hits an all-time high, drawing investment from funds, individuals, and traditional firms across sectors, fueling a new crypto wave.

From cybersecurity to education, healthcare, and housing construction, large and small businesses worldwide are vying to accumulate Bitcoin. They regard it as a strategic asset reserve, representing a significant change in companies’ perception of cryptocurrencies.

Industry-Wide Bitcoin Accumulation in May

Genius Group, a publicly traded education corporation, has recently disclosed a 40% increase in its Bitcoin reserves. This action further solidifies its dedication to digital assets over the long term. Basel Medical Group, a healthcare company headquartered in Singapore, caused a significant stir by announcing a $1 billion Bitcoin acquisition.

These actions demonstrate that Bitcoin is no longer restricted to technology or investment firms. It is now expanding into previously unrelated sectors.

H100 Group was Sweden’s first publicly traded corporation to implement a Bitcoin reserve strategy in Europe. It acquired 4.39 BTC by making an initial investment of 5 million NOK. Similarly, Blockchain Group, the first corporation in Europe to maintain Bitcoin reserves, has recently increased its treasury by 227 BTC, bringing its total holdings to 847 BTC. This reinforces its pioneering status in the region.

“Europe stacking sats at the corporate level,” Nic, CEO & Co-founder of Coin Bureau, commented on the news.

These actions underscore the increasing recognition of Bitcoin as a strategic asset, particularly as its value continues to soar.

The movement is being joined by manufacturing and retail companies

Additionally, cybersecurity and manufacturing organizations are participating. BOXABL, a modular home manufacturer, has designated Bitcoin as a reserve asset. This action indicates the construction industry’s transition to digital finance. Simultaneously, JZXN, a publicly traded US electric car retailer, authorized the acquisition of 1,000 BTC within the following year.

Bitcoin is increasingly becoming a popular option for corporate portfolio diversification, as evidenced by the involvement of companies from ostensibly unrelated industries, such as automotive and housing.

Numerous Web3-related organizations also increased Bitcoin reserves in May following its new all-time high. SecureTech, a cybersecurity company, disclosed its reserve strategy. Roxom Global raised $17.9 million to expand its media network and finance its Bitcoin reserve.

These endeavors indicate a robust desire to integrate digital assets with innovative business models.

Bitcoin is transformed into a macro asset with a restricted supply

According to recent reports, retail investors were mainly absent during the most recent rally. Nevertheless, the abundance of company Bitcoin acquisition announcements suggests a surge in institutional FOMO (fear of missing out).

One of the organizations that is spearheading this trend is Strategy. The value of its BTC holdings increased to $64 billion as Bitcoin reached new highs. However, they have not ceased. The organization recently disclosed its intention to raise an additional $2.1 billion to sustain its Bitcoin acquisition strategy.

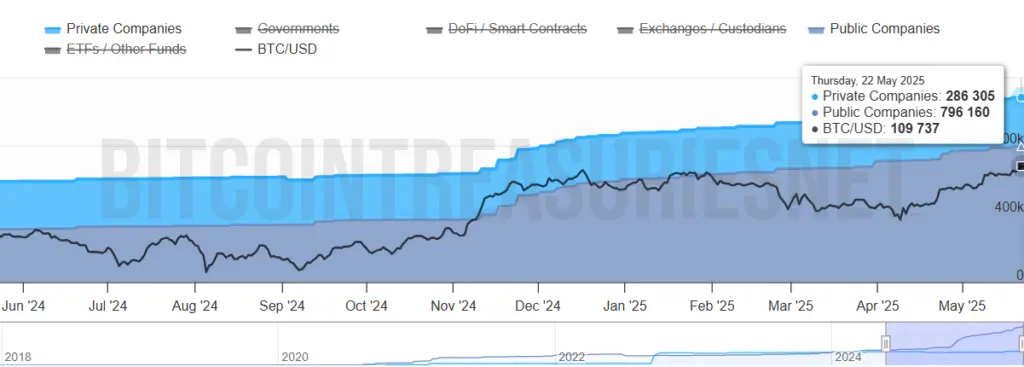

According to data from Bitcoin Treasuries, private and public corporations currently possess over 1 million BTC, which accounts for over 5.4% of the circulating supply. On the other hand, the quantity of companies that accumulate Bitcoin is increasing every month while its supply remains constant.

“Bitcoin breaking through $110,000 reflects the new reality: it’s no longer a fringe asset—it’s a macro instrument, ETF inflows, sovereign interest, and structurally limited supply are driving institutional demand at scale. For funds sitting on cash in a low-yield world, Bitcoin is starting to look less like a risk and more like a benchmark.” said Mike Cahill, CEO of Douro Labs.

This trend demonstrates that institutional trust in Bitcoin is increasing in 2025. It is no longer regarded as a financial mirage. Instead, it is being acknowledged as a strategic asset of the future.