South Korean Democratic lawmakers aim to fast-track the rollout of a KRW-backed stablecoin, citing financial innovation and global digital currency trends

The most significant political party in South Korea is advocating for the rapid implementation of KRW stablecoins following the Trump Administration’s recent initiatives to establish a stablecoin bill.

Legislators from the South Korean Democratic Party are advocating for the government to begin institutionalizing Korean won-pegged stablecoins, as per a report from local media outlet Edaily.

Min Byeong-deok, the chairman of the party’s Digital Asset Committee, thinks that the global stablecoin market has the potential to surpass semiconductors and artificial intelligence shortly.

Min underscored the necessity of establishing stablecoins linked to the Korean won. He perceives it as a means of fortifying its national fiat currency through crypto and potentially increasing the global demand for won-backed assets.

“We must assume the responsibility of institutionalizing stablecoins before U.S. dollar-based stablecoins become firmly established.” “That is the sole method by which we can guarantee our position in the global competition for stablecoin hegemony,” Min stated in his public statement.

Lee Jae-myung, the presidential candidate of the South Korean Democratic Party, is currently the frontrunner in the lead-up to the South Korean presidential elections.

According to inside sources, Lee is interested in expediting the implementation of KRW stablecoins to establish them rapidly before the United States implements stablecoin notes.

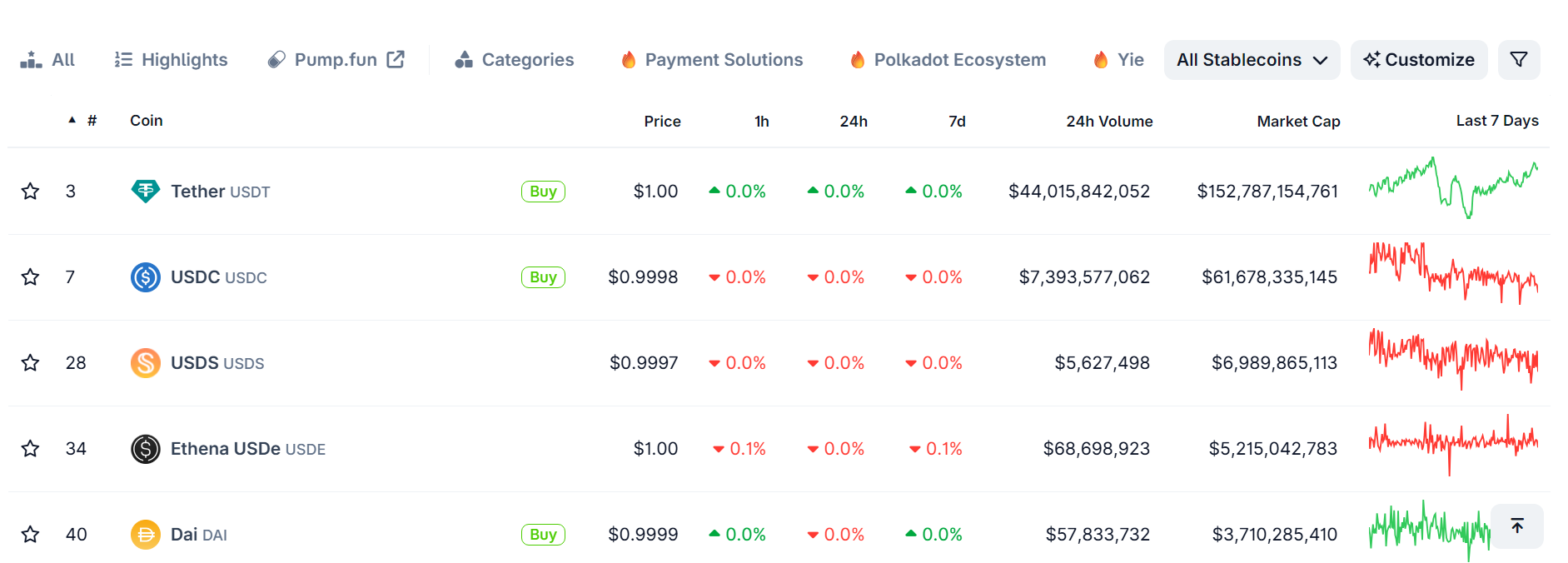

These regulations can potentially increase the market dominance of U.S. dollar-backed stablecoins from companies such as Circle and Tether.

Min continued, “These two [stable]coins account for 90% of the stablecoin market in the United States and are also used in certain areas of Korea, such as Dongdaemun, where many foreign payments are made.”

Min stated that he is currently advocating for the passage of a stablecoin bill by South Korean legislators. He has a working draft titled “Basic Act on Digital Assets.” It has been reported that Min has engaged in a second review process with industry professionals and the media. He intends to submit the bill after the third review.

The GENIUS Act, also known as the Guiding and Establishing National Innovation for U.S. Stablecoins Act of 2025, was recently enacted by the U.S. Senate with 66 votes in favor. It is presently on the verge of being formalized as the first U.S. stablecoin bill, as it is on its way to a whole floor vote.