Bitcoin holds near $110K after hitting an all-time high, with whale profit-taking slowing momentum, per on-chain data.

Bitcoin’s price has increased by more than 30% from $84,000 since April 20. However, the rally has stagnated since reaching a record high of $111,970 on May 22. According to analysts, the price plateau may be associated with the selling pressure exerted by whale addresses that have been recently established.

Is the price of Bitcoin being influenced by the arrival of new whales?

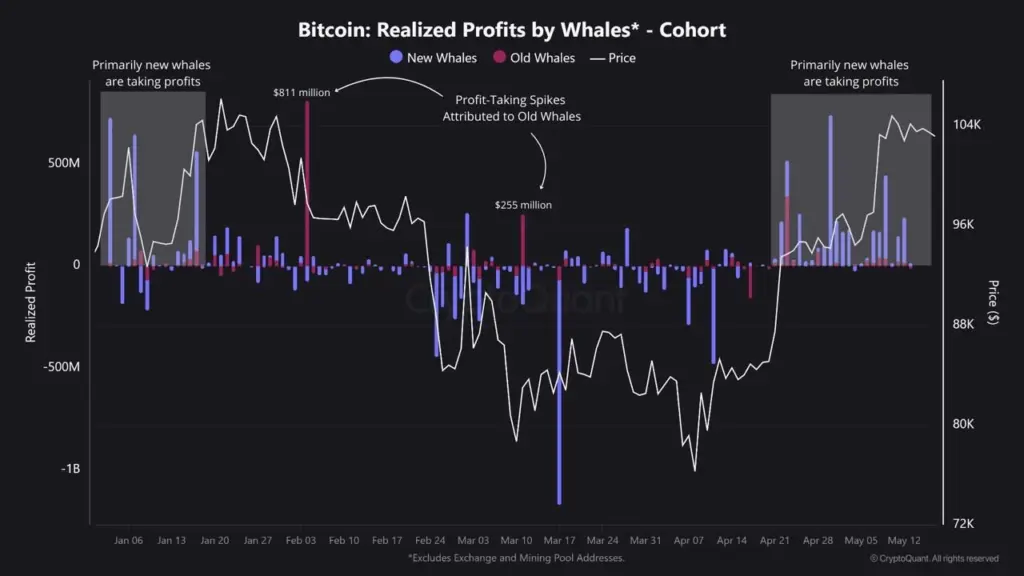

A distinct pattern is evident in CryptoQuant’s cohort analysis. New whales have exploited the rally to secure gains, resulting in the majority of profit realization over the past month.

To be more precise, these investors acquired BTC at an average cost basis of $91,922.

“With such a rally, it’s important to monitor whether profits are being realized by new or old whales. Surprisingly, the data shows that 82.5% of the profit-taking since April 20th has come from new whales,” J.A. Maartunn of CryptoQuant.

The data also indicates that the profits of new Bitcoin billionaires totaled approximately $3.21 billion. It is considerably larger than the $679 million of older whale wallets.

Resistance is exerted by this rotation of gains just below the $112,000 level.

The CryptoQuant chart below illustrates how this trend manifested before BTC’s all-time high last week. Since late April, the profit-taking columns have been dominated by blue bars representing new whales.

The most recent grey-shaded section emphasizes the heightened activity of these newer market participants.

In contrast, the $811 million and $255 million events in February and March, which were earlier increases in realized profits, were attributed to older whales.

In the interim, the trend of profit-taking has persisted this week.

This behavioral change implies that new whales are exploiting recent highs to abandon positions they likely entered during the downturn of Q1. These departures generate persistent overhead selling pressure, which impedes further upward movement.

Simultaneously, older whales are mainly inactive. Their reluctance to sell indicates a longer-term confidence in Bitcoin’s trajectory, which could mitigate downside risk in the near term.

Bitcoin may encounter difficulty in conclusively surpassing its present levels until this new wave of whale selling ceases. Market observers will closely monitor whether this cohort continues to offload or pauses, potentially enabling the price to regain momentum.