Alpaca Finance, a DeFi lending protocol on BNB Chain and Fantom, to shut down all products after Binance delisting, citing financial struggles.

The team’s decision, which was disclosed on May 26, resulted from “extensive internal deliberation and evaluation of future development directions.”

Alpaca Finance Announces Closure

Alpaca Finance began operations without pre-sale, venture capital funding, or pre-mine. Users were permitted to establish leveraged positions by borrowing from deposit vaults. The protocol has encountered many obstacles recently, resulting in this closure announcement.

The team’s primary justification for the closure was their ongoing financial difficulties, as stated in an official statement on their Medium blog and X (formerly Twitter) account.

“In truth, the team has been operating at a loss for over two years, even after significant downsizing of the team. Continuing under these conditions is simply not sustainable,” the blog read.

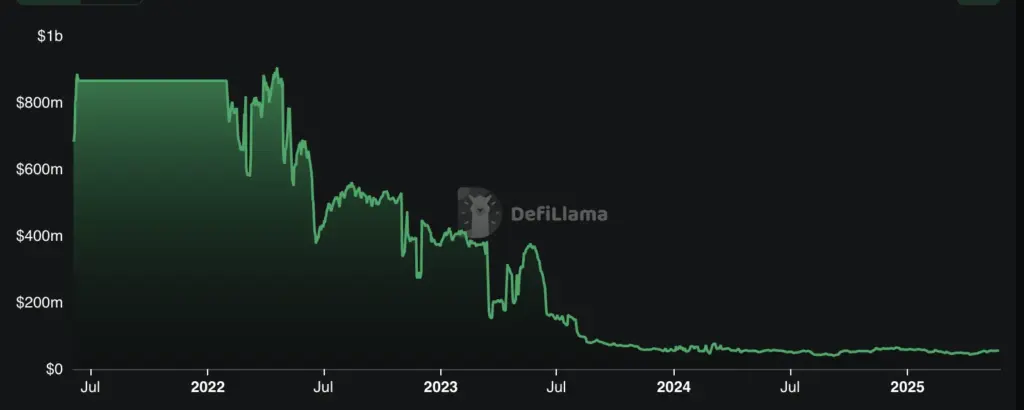

Alpaca Finance’s Total Value Locked (TVL) attained a record high of over $900 million in early 2022, as indicated by DefiLama data. Nevertheless, it has been experiencing an ongoing decline since that time. The TVL was only $54.6 million as of the most recent data.

“With TVL and yields declining, revenue followed suit,” the team added.

Additionally, the team identified market saturation and increased competition as significant factors in its decision. It is worth noting that the announcement was made approximately one month after Binance announced the delisting of its native token, ALPACA.

“The recent delisting of ALPACA from Binance was another major blow. It not only limits token accessibility but also restricts our ability to deploy our remaining warchest effectively toward any new initiatives,” Alpaca Finance shared.

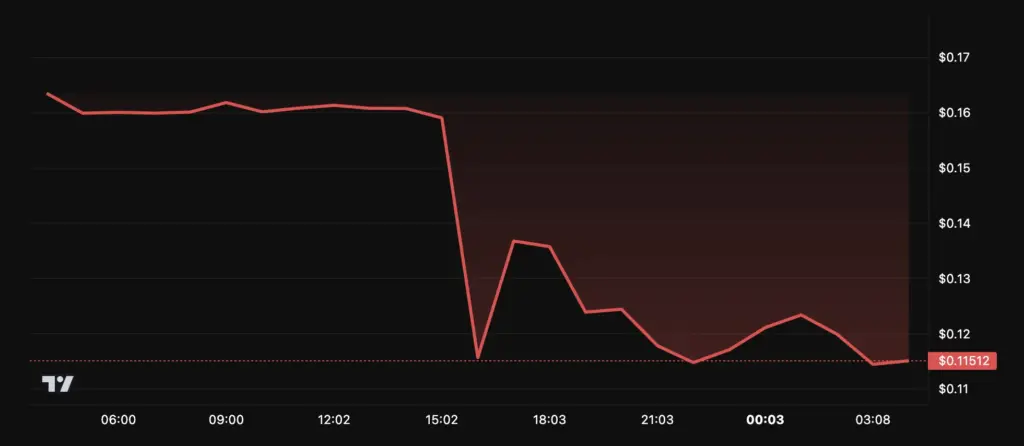

Although the token was delisted, its value experienced a more than 1,000% increase in the following days, contradicting the typical market behavior. The precipitous rally of ALPACA garnered significant attention and prompted apprehensions regarding market manipulation.

However, the gains were transient, and the most recent information has further depressed the price. The price of ALPACA has decreased by 32.1% in the past day, according to data from BeInCrypto. $0.11 was the trading price of the token at the time of this writing.

Alpaca Finance has developed a comprehensive shutdown strategy for all of its primary product lines to guarantee a secure and seamless departure for users. In early June, the platform will cease to accept new positions on the original leveraged yield farming platform (AF1.0). Additionally, it will automatically terminate all remaining positions by June 30, 2025.

Alperp, the perpetual trading product, has been placed in reduce-only mode by the team. By the conclusion of June, it will be entirely decommissioned.

Additionally, all Automated Vaults have been promptly suspended, and any remaining funds have been converted into base tokens and returned to users. By July 30, 2025, the AF2.0 Money Market will prohibit borrowing and automatically terminate open positions.

Additionally, the protocol will terminate its buyback and discard program and allocate revenue to Governance Vault stakeholders. Finally, the platform’s interface will remain accessible for users to withdraw assets until December 31, 2025.