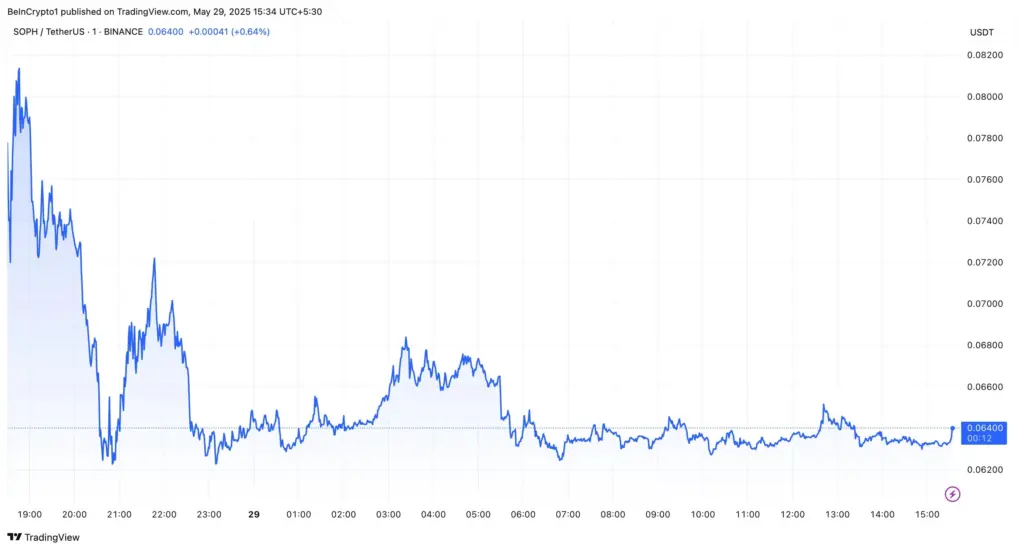

Sophon’s SOPH token plummeted over 33% in 24 hours post-Binance listing, reflecting volatile market sentiment and high trading volume.

The primary factor contributing to the price decline is the airdrop of 900 million SOPH tokens, which represents 9% of the total 10 billion supply and was unlocked at commencement.

What is the reason for the decline in SOPH’s price?

To provide context, Sophon is a Layer 2 ZK (zero-knowledge) blockchain that is a component of ZKsync’s Elastic Chain vision and is constructed on Validium technology. The platform is intended to be consumer-oriented and targeted explicitly for entertainment applications. The blockchain provides Ethereum-level security, minimal fees, and high throughput.

Binance Labs is among the notable investors who have contributed more than $70 million to the enterprise. Binance disclosed SOPH’s listing on May 23 through an X (formerly Twitter) post.

“We’re pleased to announce that Binance will be the first platform to feature SOPHON (SOPH),” Binance posted.

Trading commenced on May 28 at 13:00 UTC. The same day, SOPH commenced trading on other significant exchanges, such as OKX, KuCoin, Upbit, Bitget, and MEXC, indicating a comprehensive expansion.

The token reached an all-time peak of 0.11 shortly after its launch, as indicated by data from CoinGecko. Nevertheless, it experienced a significant decline after this. SOPH’s price has declined by 33.3% in the past day. The altcoin was trading at $0.06 at the time of writing.

Additionally, the decline resulted in a loss of over $80 million in market capitalization. Additionally, there was a 2,724.8% increase in trading volume, which suggests that early airdrop recipients were active in the distribution process.

9% of SOPH’s total supply was released for distribution by Sophon during the Token Generation Event. This comprised 6% for Layer 1 farmers and 3% for eligible early contributors, zkSync users, and NFT holders.

It is important to note that airdrops frequently result in temporary price decreases due to the increased supply. This is particularly accurate when the utility of a token has not yet been completely established.

At present, the immediate utility of SOPH is restricted to the decentralization of sequencers and gas fees. Consequently, this may not yet generate sufficient demand to counteract the sell-off that is prompted by the airdrop.

“We expect the utility to evolve over time as our network and our product offering grows, incorporating new utilities as we do. There is plenty planned on the product front so stay tuned for the evolution of SOPH,” Sophon stated.

Binance implemented a “seed tag” on SOPH, further exacerbating the volatility. The seed tag is a classification used to identify more volatile cryptocurrencies with a higher risk than other tokens. It typically identifies new projects that are susceptible to more significant price fluctuations.

Additionally, the exchange implemented futures trading for SOPH, allowing up to 75x leverage, exacerbating price fluctuations. The market sentiment regarding SOPH remains fragile in light of these factors.

That is not all. An additional 20% of SOPH’s supply, which has been designated as node rewards, will commence to release every week after three months. If market sentiment does not strengthen, this could exert further downward pressure.

Despite this, there is some reason for optimism regarding on-chain activity. Sophon’s total value locked (TVL) reached a high of $20.28 million today, according to data from DefiLama.

This represented a 14.1% increase from the previous day. Furthermore, the volume of decentralized exchanges reached a record high of $47.44 million.