Michael Saylor’s firm, Strategy, bought $75.1M in Bitcoin in late May, continuing its position as the world’s largest corporate BTC holder.

Strategy, led by Michael Saylor, is the biggest company in the world that owns Bitcoin.

It has revealed that it bought more Bitcoin after the price dropped to $103,000 last week.

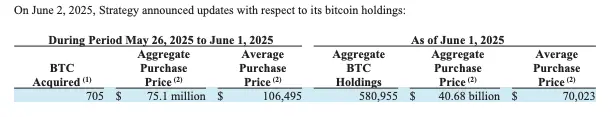

The company said on June 2 that between May 26 and 30, Michael Saylor’s firm bought 705 Bitcoin for $75.1 million.

Bitcoin fell from $110,000 last Monday to an intraweek low of $103,400 by the weekend, when the most recent sales were made.

The average price per coin was $106,495.

The purchase was Michael Saylor’s firm last Bitcoin purchase in May.

It brought the company’s total Bitcoin shares to 580,955 BTC, which it bought for $40.68 billion, or $70,023 per coin.

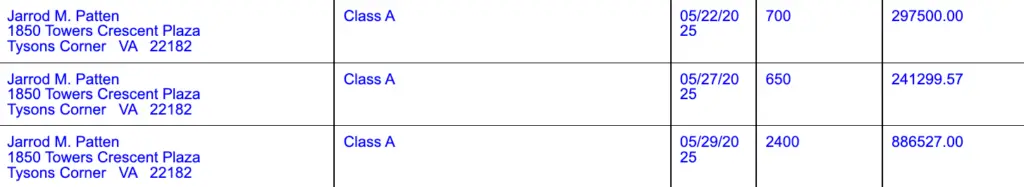

Michael Saylor’s firm new Bitcoin purchase came after director Jarrod Patten made several Class A sales.

The company report of the proposed sale of securities made on May 30 says that Patten sold 3,750 shares worth almost $1.4 million from May 22 to May 29.

After the sales, there was downward pressure on the company’s stock, which trades under the code MSTR. On May 28 and 30, it briefly fell below $360.

TradingView says that the company stock went up and closed last week at $369, but it was selling 1.6% lower before the market opened.

Even though the price of the stock has been going down lately, it is still up about 23% year-to-date and 123% overall.