Bybit has launched a significant security upgrade after its $1.4B February hack, enhancing audits, wallet safety, and info security across the board.

Bybit is the second-largest cryptocurrency exchange in the world by trade volume.

After a $1.4 billion hack in February, the company has announced a complete security overhaul.

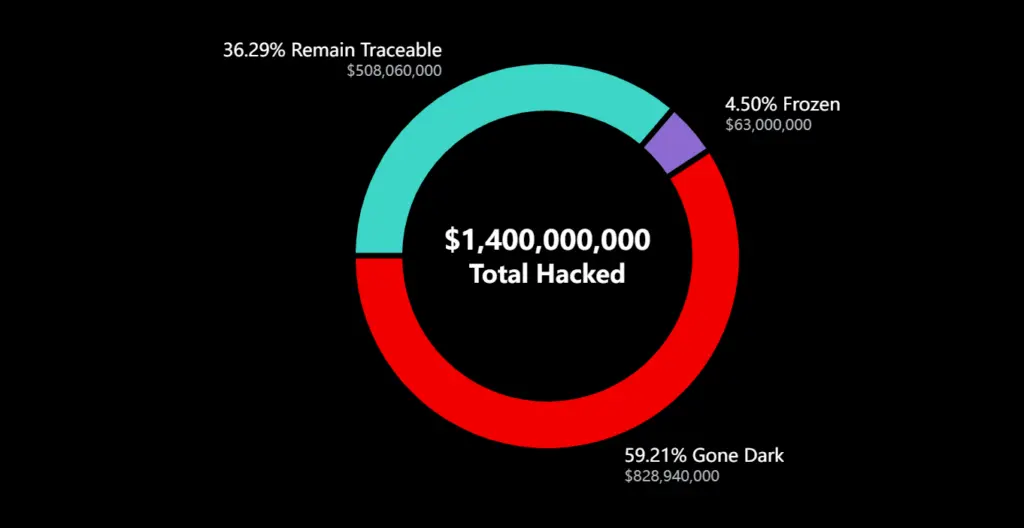

Over $1.4 billion in liquid-staked Ether, Mantle Staked ETH (mETH), and other ERC-20 tokens were stolen from Bybit on February 21.

This is one of the most significant security breaches in the history of crypto.

According to an announcement shared with Cointelegraph on June 4, the digital asset platform has adopted a three-pronged security upgrade.

The upgrades focus on security audits, wallet fortifications, and better information security.

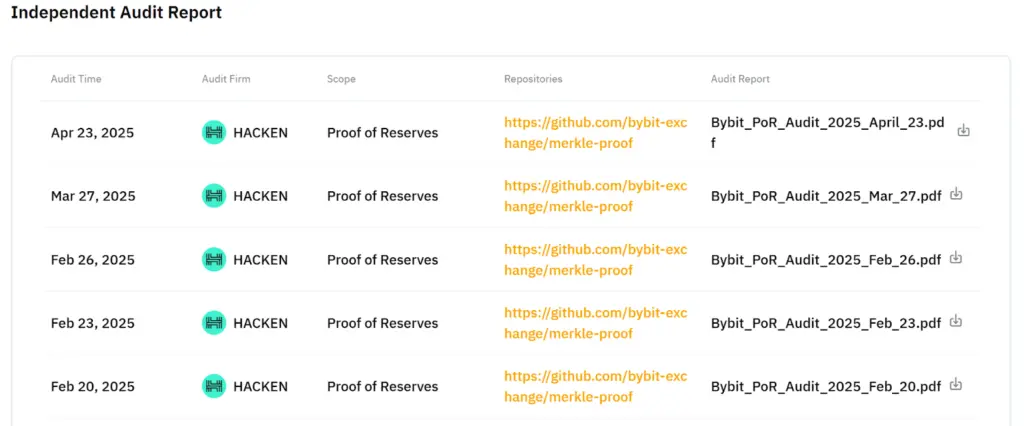

The exchange finished nine security audits within a month of the breach.

These audits were done by both in-house experts and independent outside experts.

As a result, the announcement said 50 new security measures were put in place.

Certifications, Safety For Cold Wallets

In terms of hardware, the digital asset platform said it had tightened protocols for cold wallets, changed the operating safety procedure so that security experts must watch over the whole wallet process, and added multiparty computation to improve wallet security.

In addition, hardware security parts were brought together to strengthen hardware security.

Currently, the digital asset platform has ISO/IEC 27001 approval for managing risks to information security. The company also said its internal and customer data storage and emails are encrypted.

Recovery Of Liquidity Lazarus Bounty Scheme

Even with the attack, the second-largest cryptocurrency exchange’s cash is almost back to where it was before the hack, and its LazarusBounty program is still looking for the stolen funds.

More than $2.3 million in bounty rewards have been given out through the scheme.

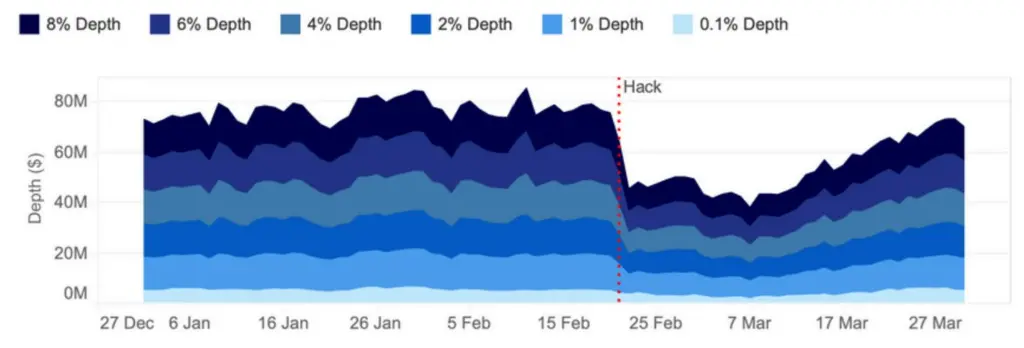

According to Kaiko’s report on Bybit’s liquidity, the Bitcoin market depth had returned to an average of $13 million per day just 30 days after the hack.

This meant that the price had not changed by more than 1%.

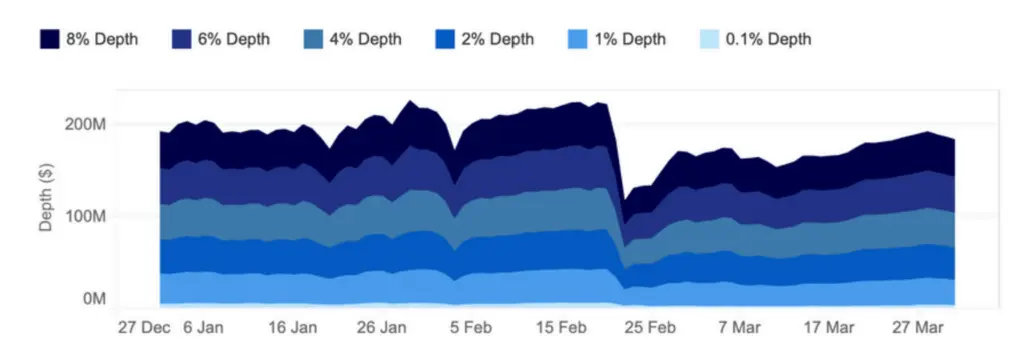

Altcoins’ liquidity also returned, but not as quickly as Bitcoin’s.

Over 80% of the market depth for the top 30 altcoins by market value is back to before the hack.

Part of the quick recovery can be traced back to Bybit’s Retail Price Improvement (RPI) orders, which are meant to bring in institutional capital.

When liquidity was tight, these specific orders helped keep the market stable.

After the hack, there was less non-RPI liquidity for a while. RPI orders were crucial in keeping trade stable and making prices more accurate.

While strengthening infrastructure was a top priority, Bybit warned that hackers are more often taking advantage of mistakes made by people than protocol flaws.

Someone from the digital asset platform told Cointelegraph that there are more “sophisticated attacks” where hackers pretend to be big names and protocols.

“While system-level intrusions remain a concern, attackers are increasingly targeting the human element as the weakest link in the security chain.”

Attackers are using “human behavior rather than code” more and more; as Ronghui Gu, co-founder of CertiK, told Cointelegraph, the changing attack vectors show that smart contracts and blockchain technology are no longer the weakest link.