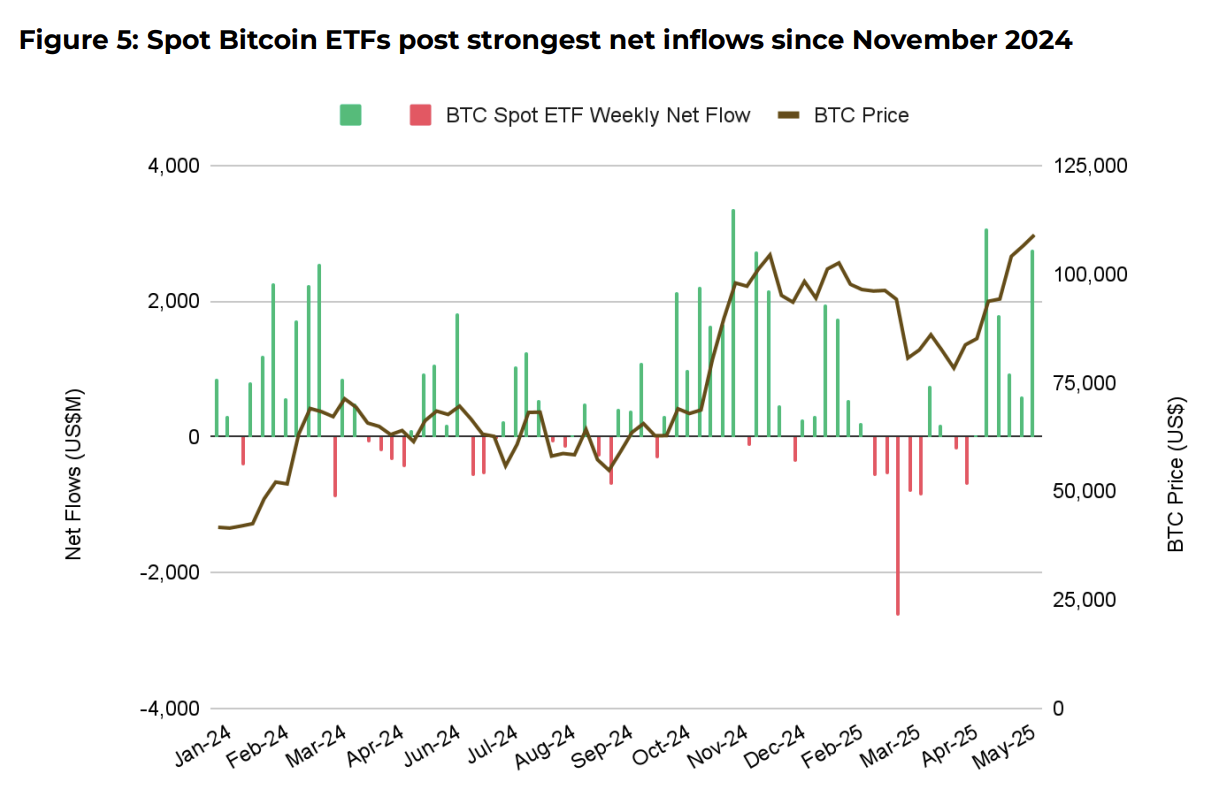

Bitcoin ETF inflows surge to $5.2 billion, driven by record highs and rising institutional interest in crypto-backed investment products

Institutional interest in Bitcoin and Ethereum ETFs was the primary focus of key crypto trends in May, which were influenced by favorable regulatory developments.

Bitcoin achieved a new all-time high in May, with substantial inflows into Ethereum (ETH) and Bitcoin (BTC) exchange-traded funds. The crypto markets were resilient in the face of volatility caused by ambiguity regarding U.S. trade policy, as indicated by a report released by Binance Research on June 5.

The trade agreement between the United States and the United Kingdom resulted in nearly $1 billion in liquidations due to increased volatility. The United States announced a tariff halt on the European Union, which resulted in an additional $183 million in liquidations.

Interest in Bitcoin ETFs remained robust despite the substantial volume of liquidations. These products attracted $5.2 billion in net inflows, the highest level since November 2024. It is important to note that these inflows occurred simultaneously with Bitcoin’s all-time peak of $111,970 on May 22.

Positive regulatory momentum substantially bolstered ETF inflows. The GENIUS Act, which proposed the nation’s first stablecoin regulation framework, garnered momentum in the U.S. Senate. The report also noted the increasing regulatory support for stablecoins in Hong Kong.

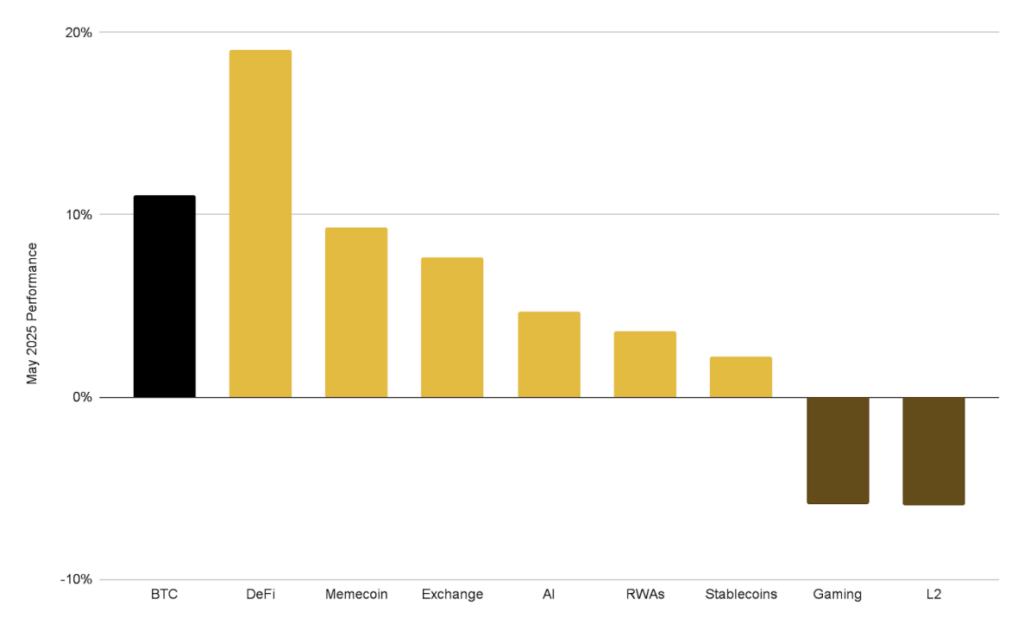

According to Binance Research, DeFi outperforms Bitcoin

BlackRock’s iShares Bitcoin Trust (IBIT) was the most popular ETF product in May, attracting nearly 100% of the total net inflows. Conversely, Grayscale’s GBTC was subject to $320 million in net outflows, suggesting a potential winner-takes-all trend.

In May, DeFi was the sole significant sector to surpass Bitcoin, with a 19% increase in growth compared to BTC’s 11.1% increase. Furthermore, the total value secure in DeFi protocols has attained its highest level since early February.

Additionally, there was an increase in demand for Bitcoin from corporate treasuries. One hundred sixteen public companies held 809,100 BTC as of May. The all-time high of Bitcoin and favorable regulatory developments have heightened corporate interest. According to reports, companies such as Trump Media invested billions in Bitcoin to increase their allure to investors.