Sequans Communications launches $384M Bitcoin Treasury, diversifying from 5G/4G IoT semiconductors with $195M in equity.

The Bitcoin treasury season is still sweeping across industries as more companies place significant bets on the pioneer cryptocurrency. Sequans Communications, an electronics company headquartered in Paris, is the most recent entity to adopt this trend, diversifying its portfolio through a BTC initiative. The organization has disclosed a remarkable $384 million investment in Bitcoin, which indicates its revised financial strategy.

Sequans Communications Contributes $384M to Bitcoin Treasury

Sequans Communications has made a substantial investment of $384 million in BTC, which is the most recent development in the Bitcoin treasury trend. This suggests the platform is expanding its strategic scope beyond its semiconductor cellular IoT foundation. In an X post earlier today, the company announced, “Exciting news from Sequans! We have initiated the Bitcoin Treasury Initiative, an ambitious initiative that complements our leadership in cellular IoT.

It is essential to mention that the company intends to raise approximately $384 million through private placements. This will comprise $195 million in equity securities and $189 million in convertible secured debentures. The organization intends to collaborate with Swan Bitcoin, a distinguished specialist in Bitcoin treasury administration, to implement this initiative. Georges Karam, Sequans’ CEO, observed,

“Our bitcoin treasury strategy reflects our strong conviction in bitcoin as a premier asset and a compelling long-term investment. We believe bitcoin’s unique characteristics will enhance our financial resilience and deliver significant value to our shareholders.”

Karam further stated that the company will maintain its concentration on its IoT semiconductor operations despite its diversification into BTC. He stated, “We are committed to providing our customers with a comprehensive 4G and 5G product roadmap, which delivers innovative solutions to meet the changing needs of IoT applications and guarantees a smooth transition from 4G to 5G.”

Anthony Pompliano’s ProCap Financial is another significant platform that has embraced the Bitcoin Treasury trend. The company has recently announced a $1 billion merger and has raised $750 million.

The Bitcoin Treasury Season is the focal point

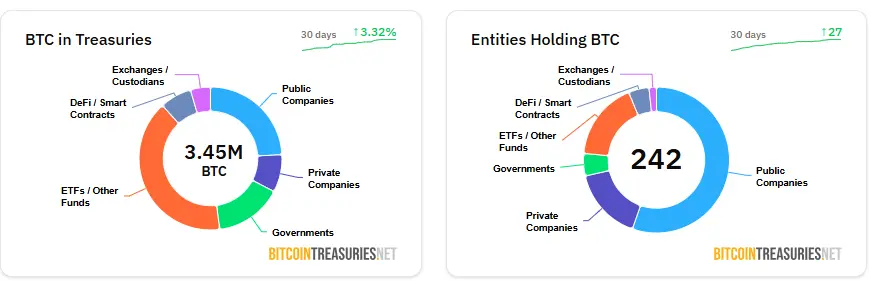

The investment in Bitcoin by prominent industry actors is on the rise as BTC continues to hover above the critical $100,000 threshold. The number of public companies holding Bitcoin on their balance accounts has nearly doubled, increasing from 124 to at least 240 firms, as per data from BitcoinTreasuries.net. It constitutes approximately 3.96% of the total BTC supply.

Michael Saylor’s Strategy, one of the largest public holders of Bitcoin, has recently enhanced its BTC portfolio. The company increased its total holdings by $26 million by acquiring 245 BTC. The firm currently maintains a total of 592,345 BTC. Additionally, Asia’s Metaplanet has acquired 1,111 Bitcoins, which are valued at $118.2 million, bringing its total Bitcoin holdings to 11,111 BTC.

Adam Back, CEO of Blockstream, suggested that the Bitcoin treasury trend has become the new altcoin season for cryptocurrency speculators in response to this rising trend. He observed that “it is time to transfer ALTs to BTC or BTC treasuries.”

In the past, Back predicted that institutional and government adoption could unleash a $200 trillion market opportunity for BTC. He believes that Bitcoin treasury firms are preparing for the potential hyperbitcoinization, in which Bitcoin’s adoption as a global currency could surpass traditional fiat currencies due to its economic advantages.