Dogecoin’s price holds $0.142 in support of a double-bottom pattern. With ETF hype boosting long positions, a rally to $0.47 may follow.

This month, Dogecoin (DOGE) has experienced significant volatility, mirroring the broader market’s erratic movements due to various macro factors, such as geopolitical tensions.

Today, June 27, the price of Dogecoin is $0.16, with a modest 0.3% decrease in the past 24 hours.

Nevertheless, the price is poised to reach $0.47 after successfully defending critical support levels amid a surge in bullish long wagers and the proliferation of DOGE ETF approval rumors.

Dogecoin Price Remains Stable Amid Speculation Regarding Exchange-Traded Fund (ETF)

The price of Dogecoin is currently experiencing significant volatility; however, traders are effectively protecting critical support levels.

The $0.13 level has been robust support since November 2024, suggesting that purchasers have entered the market at this price point to prevent a significant decline.

The optimism surrounding the approval of a spot DOGE ETF is one of the reasons this critical support level remains in place.

Currently, 70% of dealers anticipate that this ETF will be approved before the end of the year, according to Polymarket data.

Yesterday, speculation regarding approval was rife following Bitwise’s submission of an amended S-1 for a DOGE ETF.

According to Bloomberg analyst Eric Balchunas, the most recent filing was a “positive indication” that the SEC was engaged with the issuers.

Futures traders were encouraged by this development.

The demand for long positions increased as traders initiated speculative wagers that the Dogecoin price was on the brink of a rebound.

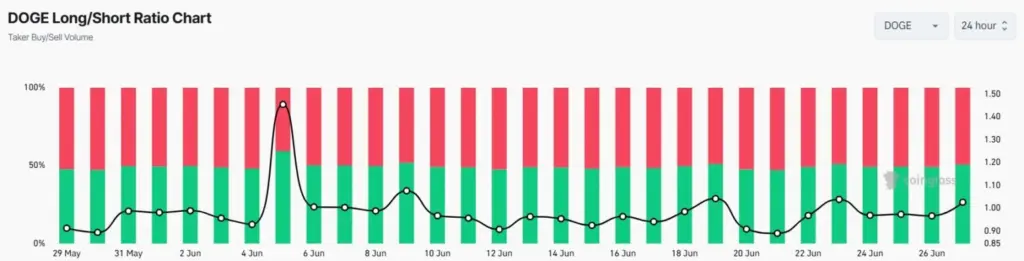

The DOGE long/short ratio has exceeded 1 for the first time in four days, as evidenced by Coinglass data.

Simultaneously, Dogecoin’s funding rate remains positive, indicating that these long-term traders are willing to pay a charge to preserve their positions.

How high will the price of this top meme coin rise amid the optimistic market sentiment?

DOGE Is Aiming For $0.47 As Double Bottom Is Emerging

A double-bottom pattern has been observed in the weekly timeframe, indicating that Dogecoin long traders anticipate a potential price increase.

This double bottom typically signifies that a sudden upward movement is imminent.

The critical support level to monitor in this pattern is $0.142.

In April 2025, the Bulls effectively defended this support and are currently doing so.

The initial price target will be the neckline resistance at $0.26 if it remains in place and the upward reversal commences.

The target of this pattern is $0.47 if bulls successfully surmount this obstacle and convert it to support.

By angling downwards, the ADX corroborates this bullish Dogecoin price prediction.

This suggests that the downward trend that commenced at the neckline resistance is becoming increasingly fragile, creating an opportunity for recovery.

Nevertheless, if the RSI indicator remains below the mean level of 50, the DOGE price may consolidate around this support level.

The bullish thesis of a rally to $0.47 will be validated when the indicator crosses above the mean level, as it is currently trending north, indicating an increase in purchasing activity.

In conclusion, the price of Dogecoin is at a critical juncture as there is a surge in optimism regarding the approval of a spot DOGE ETF.

Long speculators appear to be anticipating a recovery as bulls defend the double-bottom support at $0.142.

The double-bottom target of $0.47 could be achieved if retail traders and titans accumulate DOGE at this price.