Solana staking ETF approved, letting investors earn yield from SOL without directly trading crypto or managing private wallets.

The Solaana staking ETF, which is expected to be the first-ever yield-generating ETF, has been approved by the SEC.

In the wake of Bitcoin and Ethereum, SOL has emerged as the market leader with hundreds of ETF filings.

Consequently, exchange-traded funds are the subject of considerable interest, particularly due to their inclusion of staking features.

Let us deliberate on the precise meaning of this.

Solana Staking ETF: What Is It?

Solana staking ETF is a unique investment fund that enables investors to engage in SOL like a stock, as its name implies.

Nevertheless, the staking process provides additional advantages by allowing the investors to receive staking rewards.

This process is comparable to the interest earned on a high-yield savings account.

It is important to note that investing in exchange-traded funds relieves the investor of the responsibility of administering crypto wallets, validators, and even exchanges.

The individual must purchase the ETF from a brokerage account that functions similarly to a stock account.

What Is Solana Staking ETF’s Methodology?

An exchange-traded fund (ETF) is established by an ETF issuer, which acquires the underlying digital asset.

The Solana pledging ETF will involve the issuer purchasing and maintaining genuine SOL tokens on behalf of the investors.

The issuer will stake the investor’s interest if they choose to do so.

The Solana network will pay the investor staking rewards to secure it and profit from it.

To the individual, it will be comparable to earning interest on their investment.

$SOL

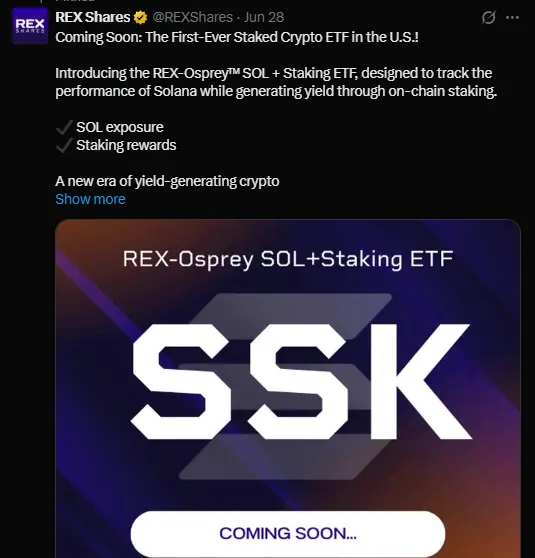

How does a Solana Staking ETF pay yields (and taxes)?REX Shares just launched the first-ever Solana Staking ETF — the REX-Osprey™ SOL + Staking ETF — trading starts this Wednesday!

Now, $SOL investors can earn staking rewards and price upside — all through a traditional… pic.twitter.com/OjXumsnioL

— Cobak (@CobakOfficial) July 1, 2025

The Solana price fluctuations will determine the reward for the investor who is investing in the ETF.

If the price of SOL increases, the investment will increase. Furthermore, the act of staking would provide an additional incentive to invest in the project.

REX-Osprey SSK SOL ETF Commencing Operations On July 2

REX-Osprey SSK, the inaugural Solana Staking ETF, will be operational in the United States on July 2.

This is a significant milestone in the crypto industry, as investors have been eagerly anticipating the introduction of an altcoin ETF this year.

Notably, the exchange-traded fund will be listed on the Chicago Board Options Exchange (CBOE) and will be launched with the SSK ticker.

Interestingly, this crypto trust is structured under the Investment Company Act of 1940 using a C-Corporation format, which sets it apart from others.

This renders the staking process lawful and enables the distribution of the rewards without any regulatory or custody-related complications.

This SOL staking ETF has the potential to establish a precedent for other altcoin-based funds.

The price of Solana may also experience an upward trend, similar to the one that Bitcoin experienced following the introduction of its exchange-traded fund.

In addition, this could impact the SEC’s decision regarding the Ethereum staking ETFs, which they had previously opposed.