Crypto prices tumble as Bitcoin slips below $107K, Ethereum under $5.9K, Dogecoin and Shiba Inu drop as geopolitical tensions fuel market sell-off.

Large-cap cryptocurrencies, including Bitcoin, Ethereum, Dogecoin, and Shiba Inu, have all seen losses in the recent drop in the crypto prices.

Investor confidence has been rocked by fresh concerns about a possible trade war, which is mostly to blame for this decrease.

What’s Causing Today’s Crypto Prices To Drop?

The recent decline in Bitcoin is a significant factor in this overall downturn, as it has once again pulled Ethereum, Dogecoin, and Shiba Inu lower because of their close price ties to the leading cryptocurrency.

Dogecoin has dropped 4% in the last day alone, whereas Ethereum and Shiba Inu have experienced almost identical losses.

As its volatility declines, Bitcoin is currently experiencing a period of stability, trading within a narrow price range.

According to Coinglass data, Bitcoin has seen liquidations totaling more than $562 million, although it is still trading at about $108,000.

China has alerted the Trump administration to heightened tariff threats that have caused global markets to get uneasy.

Cryptocurrency assets are among the first to be impacted by growing economic pressures, and the August 12 deadline for a trade agreement adds even more uncertainty.

Investors have also been uneasy due to Trump’s threat of a 10% tariff on nations supporting the BRICS and growing rumors of economic decoupling.

Citing unfair trade practices that have led to large U.S. trade deficits with both South Korea and Japan, he slapped a 25% duty on imports from those countries.

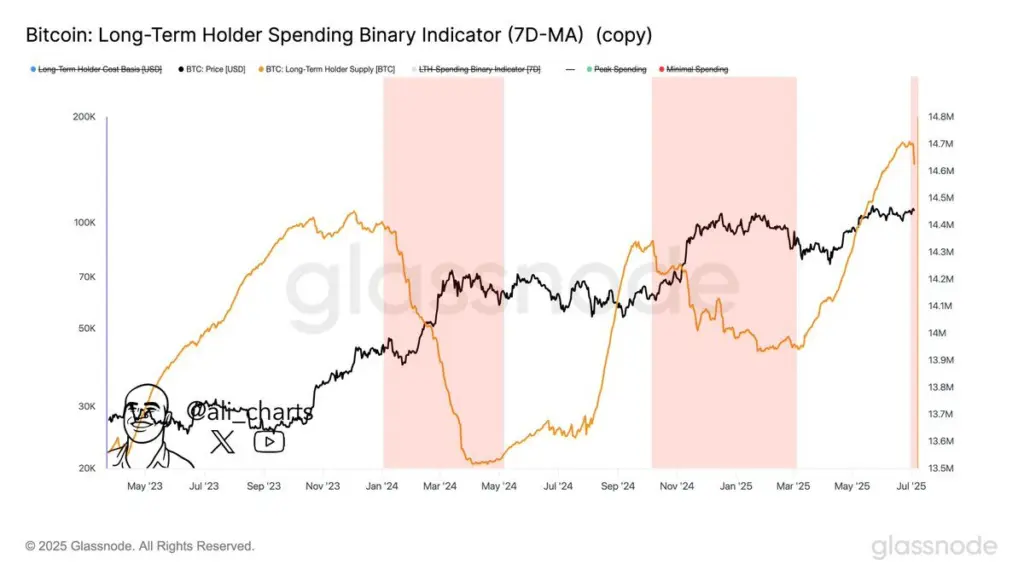

Additionally, more long-term Bitcoin holders are starting to cash in on recent gains, according to cryptocurrency expert Ali Martinez, which feeds concerns about a possible market downturn.

Despite the audacious accumulation of Bitcoin treasury activity, many investors are locking in profits during the current rise.

Because market volatility is minimal, traders are reluctant to enter the market for fear of losing money if crypto prices continue to decline.

Altcoin owners who often closely monitor Bitcoin’s developments, such as Shiba Inu and Dogecoin enthusiasts, are also concerned about this fall.

Do Cryptocurrency Investors Sell?

Despite the recent downturn, many market observers are still optimistic about Bitcoin, Ethereum, Dogecoin, and Shiba Inu.

A descending expanding wedge is emerging between the $90,000 $110,000 levels on Bitcoin, according to technical analyst Mr. Wall Street.

This pattern is typically linked to accumulation and ultimately explosive upside.

According to one analyst, essential measures, such as MVRV (Market Value to Realized Value), are still below their peak levels.

The continuous rise in global liquidity implies that the bull market is still strong.

They predict crypto prices may surpass $117,000 and hit $140,000 to $170,000.

The expert also discussed current concerns over significant transfers in Bitcoin wallets.

They clarified that these significant transfers were not sales but rather internal changes.

They pointed out that the last shakeout before a price increase is frequently indicated when retail investors panic and sell.