FTX unstaked $31M in SOL, sparking fears of a possible sell-off as the market questions if bullish momentum can absorb the added pressure.

FTX has again unstaked millions of SOL in a new move that raises concerns about potential sell pressure during an already intense bull run.

Some traders consider it normal, while others caution that it can cause short-term volatility in the current bull market.

FTX’s Most Recent Action Unstakes $31 Million In SOL

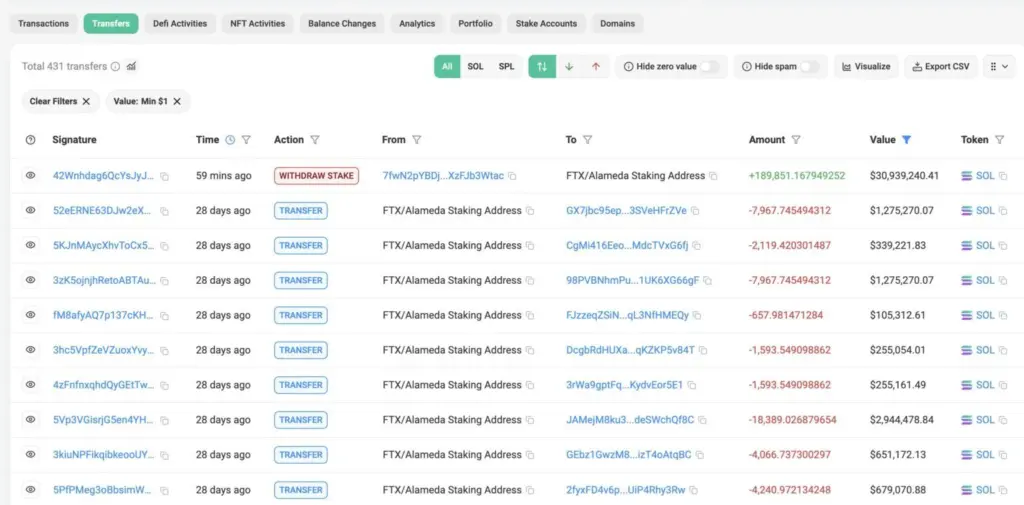

Lookonchain said FTX exchanged around $31.32 million, or 189,851 SOL.

This big move comes as the cryptocurrency market trends in the right direction, and institutional investors are interested in incorporating Solana into their ecosystem.

However, FTX had previously unstaked a sizable portion of SOL. Nonetheless, the market is paying attention due to the timing, which coincides with an ongoing rally.

“Sending it into the market can bring more uncertainty for SOL,” a market analyst said, emphasizing that investors are still wary even in the face of optimism.

Since the exchange has been releasing comparable quantities regularly for months, some market watchers consider FTX’s latest SOL unstaking a regular occurrence.

Many anticipate that any new supply will be absorbed without causing major disruptions, as institutional demand for Solana is said to continue to be high.

Moreover, several analysts see this action as a promising step.

They speculate that FTX may use the unlocked SOL to make opportunistic market purchases or other essential investments.

Others, however, point out that Solana’s network has grown more robust.

It manages more than $30 billion in transactions daily, and previous large-scale liquidations have not halted its long-term development.

Given this, the $31 million that is currently unstaked appears insignificant on the whole network scale.

FTX Repayments, Their Possible Effect On Cost Of Solana

The unstaking behavior is also consistent with the broader framework of FTX’s bankruptcy proceedings.

Approximately $5 billion in assets are being distributed by the exchange.

Approximately 82% of the allegations originate from Chinese users.

However, as bitcoin trading is prohibited in China, these users might have trouble getting their money.

Past occurrences demonstrate how this repayment plan may affect SOL’s cost.

The release of $236 million worth of SOL earlier this year accompanied FTX’s preparations for a multi-billion-dollar settlement.

The price temporarily decreased as a result.

Even while the new $31 million release is less, it raises questions about potential future sell-offs.

What occurs next will determine a lot.

The market impact might be minimal if institutions and major holders decide to hold onto their newly unstaked SOL instead of immediately selling it.

The price of Solana may become more volatile in this bull market, though, if a large quantity is swiftly sold on exchanges.