SharpLink Gaming surpasses Ethereum Foundation as the largest ETH holder with 270K ETH, driven by a $463M acquisition and staking strategy.

SharpLink Gaming has surpassed the Ethereum Foundation regarding the number of ETHs held due to a surge in purchases over the weekend. As on-chain data indicates, the Nasdaq-listed company currently possesses 270,000 ETH, with unrealized profits exceeding $81 million. The token has exhibited significant strength, as evidenced by the recent 18% weekly increase in ETH price. A bullish sentiment is evident.

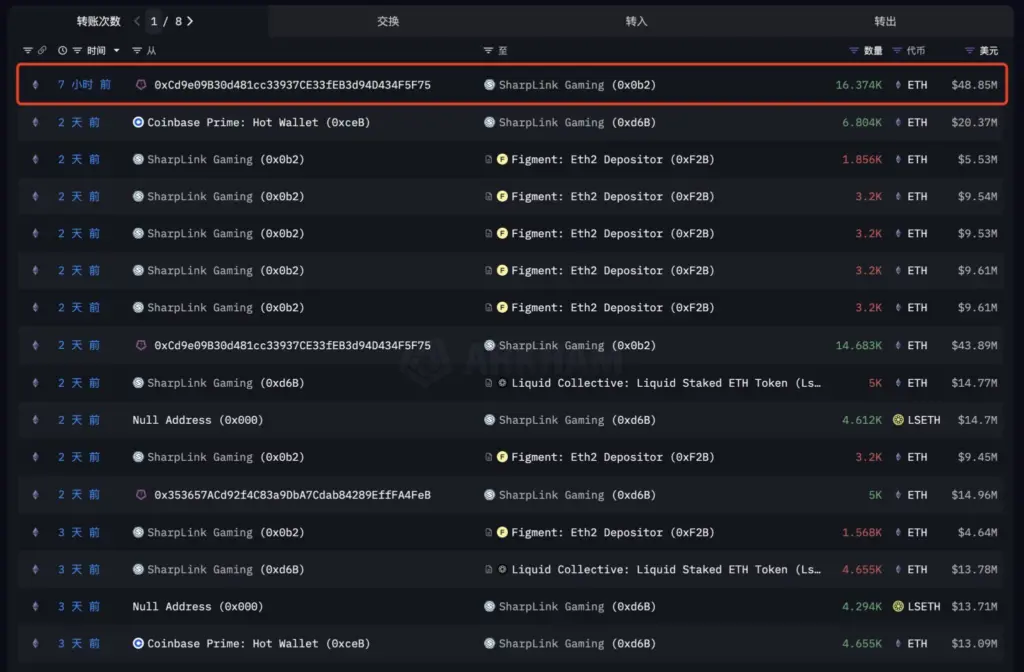

In a single week, SharpLink Gaming accumulates 60,582 ETH

Nasdaq-listed SharpLink Gaming has been acquiring ETH at an unprecedented rate, amassing over 60,582 ETH in the past five days alone. This accomplishment was achieved with a substantial investment of $180 million. Over the past 24 hours, the organization acquired an additional 16,374 ETH, resulting in a $50 million investment. Additionally, it surpassed the Ethereum Foundation in terms of total ETH holdings. The company presently maintains 270,000 coins, as indicated by EmberCN’s data.

SharpLink, imitating Microstrategy’s Bitcoin strategy, has accumulated Ethereum methodically since early June. The company has acquired this substantial Ethereum balance in a remarkably brief period, with an average ETH price of $2,667 per coin. The firm is resting on an unrealized profit of $81.8 million, as noted by blockchain analytics firm EmberCN, despite Ethereum trading at a significant increase.

SharpLink Gaming acquired over 10,000 ETH from the Ethereum Foundation last week. Most of these acquisitions were conducted through over-the-counter (OTC) transactions, which mitigated any significant fluctuations in the price of ETH.

Due to the development, SBET’s stock has experienced a significant increase of over 60% in the past month. Additionally, the stock has been trading at a rate of 275% since the beginning of the year. Other organizations, such as GameSquare, have emulated SharpLink’s initiative to establish their own Ethereum treasury.

The price of ETH is on the rise

The price of ETH has increased by 18% in the past week, surpassing the critical resistance of $3,000, bolstered by robust institutional interest. The bullish sentiment of traders is indicated by the fact that the daily trading volume has already increased by 43%, approaching $25 billion.

Ethereum ETFs registered $900 million inflows last week, marking the most successful week since their introduction in mid-2024, indicating significant institutional interest in ETH. Eric Jackson, the proprietor of EMJ Capital, announced that staking to Ether ETFs would be implemented before October 2025.

“ETH will become the first yield-bearing crypto ETF in the history of the United States once that occurs,” he observed. Jackson anticipates that the price of ETH will rise to $10,000.