These are the top weekly crypto movers: HYPE, SUI, PEPE, ARB, and HBAR, who are soaring off July’s opening rally.

Introduction

After a blockbuster start to Crypto Week and Bitcoin’s fresh all-time high (ATH), a new group of mid-cap tokens is stealing the spotlight. The spotlight isn’t just reserved for BTC and ETH anymore; savvy traders know that weekly crypto movers often carry the most explosive potential.

But what exactly are “weekly crypto movers”? In the simplest terms, they’re the standout cryptocurrencies that experience notable price shifts, whether surging rallies or sharp corrections, over the course of a week. Catalysts such as tech upgrades, exchange listings, whale activity, or trending social sentiment often drive these movers.

For traders, identifying weekly crypto movers is crucial. They serve as a real-time pulse check on market momentum, altcoin rotation, and sector-based capital inflow.

Monitoring these weekly crypto movers can reveal hidden opportunities, validate trend reversals, or signal overvalued assets on the verge of correction.ts on the verge of correction. In a market where timing is everything, knowing which tokens are moving, and why, is a strategic advantage.

This week, tokens such as HYPE, SUI, PEPE, ARB, and HBAR are leading the way, each achieving double-digit gains and reshaping the altcoin leaderboard. In this breakdown, we’ll explore what’s fueling their rallies, what it means for your portfolio, and how these weekly crypto movers could impact the next wave of market action.

Market Context: Crypto Week & Bitcoin’s Surge

As the U.S. House begins Crypto Week, which spans from July 14 to 18, the momentum for policy is accelerating.

Landmark bills like the Genius (stablecoin), Clarity (asset classification), and Anti-CBDC acts are advancing, signaling a seismic shift toward formal regulation

These measures aim to define federal oversight, clarify crypto’s legal standing, and even block a government digital dollar, yielding a regulatory tailwind that’s electric for markets.

Riding that wave, Bitcoin shattered records, peaking near $123,153 before stabilizing around $122K–$123K. That marks roughly a 30% year-to-date surge, lifting total crypto market cap to approximately $3.8 trillion.

The rally reflects a convergence of institutional inflows, macroeconomic nuances (like interest rate expectations), and growing recognition of BTC as a “reserve asset” .

Altcoins Step In

With Bitcoin blazing a trail, altcoins—especially mid-caps and memecoins—are following suit. Ether recently hit a five-month high near $3,060, while XRP and Solana also posted solid gains, fueling renewed interest across the board.

This spirited move is a textbook case of how weekly crypto movers often emerge during big BTC breakouts, as capital rotates into eagerly awaited secondary plays.

Why Mid-Caps & Memes Matter Now

Historically, when Bitcoin signals a new bull phase, mid-caps and meme-driven tokens take center stage. That pattern is unfolding now—as outlined by numerous analysts—where speculative memecoins and dynamic mid-caps are showing the kind of volatility that defines weekly crypto movers.

From a strategic standpoint, these sectors offer outsized returns (and risks), perfect for agile traders eyeing this week’s headlines and momentum flows.

In short, regulatory clarity has ignited Bitcoin—and in its wake, weekly crypto movers across the altcoin spectrum are lighting up charts and portfolios.

Token Deep Dives

HYPE (Hyperliquid):

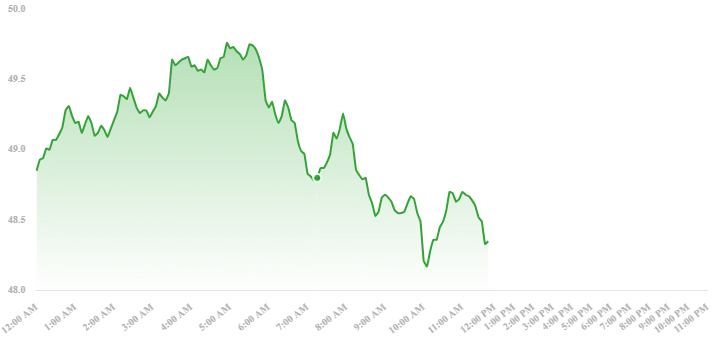

HYPE is currently trading around $48.4 with a market cap of roughly $16 billion. Over the past week, HYPE has exploded — trading volume is up ~66%, fueling a +50%+ week-over-week price surge.

That volume spike has attracted institutional attention, with record-high inflows coinciding with broader DeFi enthusiasm. HYPE’s zero-gas, high-throughput Layer-1 design for perpetual trading resonates strongly during bullish cycles, reinforcing its spot among prominent weekly crypto movers.

SUI

SUI is now trading at $3.93, with a market cap of approximately $13.6 billion. This week, it rallied double digits — up ~70% from last week, including a sharp ~23% move in a single day. Underpinning its climb is robust developer activity and growing institutional interest. As its Layer 1 ecosystem gains traction, analysts are flagging SUI as one of the standout weekly crypto movers, driven by fundamentals and momentum.

PEPE

PEPE, a top-tier memecoin, remains volatile yet compelling — currently priced at 1.11 ×10⁻⁹ USD. It’s surged ~15% in the past 24 hours and between 30–68% on the week, depending on data sources. Volume activity is skyrocketing, and technicals now flash strong “buy” signals. In the current meme-frenzy, PEPE stands out among weekly crypto movers, capturing trader imagination and capital flow.

ARB (Abitrium)

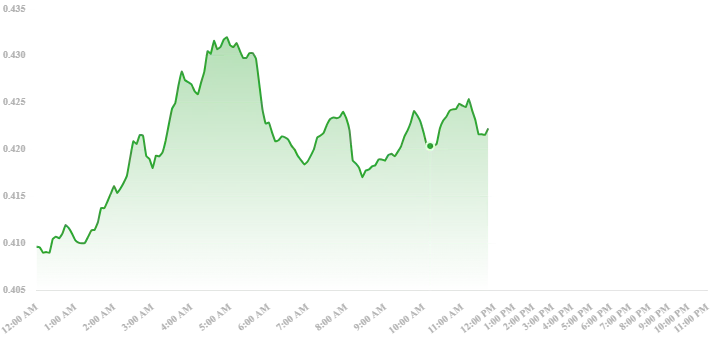

Arbitrum One Exceeds 1 Billion TransactionsARB sits at around $0.4224. It has recently posted a 24–40% weekly rally. The upswing follows rumors of a Robinhood listing and the launch of SocialFi features on Arbitrum’s network, boosting sentiment and trading momentum. Smart-money rotation into layer‑2 ecosystems positions ARB firmly on the list of high-impact weekly crypto movers.

HBAR (Hedera)

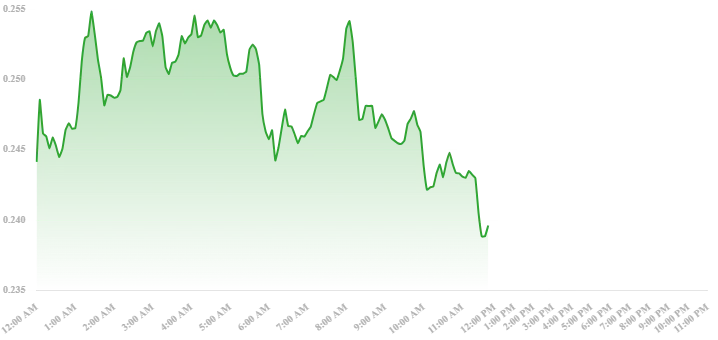

HBAR is currently priced at $0.2397. After being included in the Grayscale Digital Large Cap Fund, it gained ~4.7%, rallying a total of 4–14% this week.

Technical indicators suggest rising funding rates and a trend reversal—reinforcing HBAR’s position as one of these week’s consistent weekly crypto movers.

Each of these tokens illustrates how dynamic mid-caps and memecoins are unfolding in this cycle. From institutional inflows (HYPE, SUI, HBAR) to meme-driven fervor (PEPE) and layer‑2 innovation (ARB), these weekly crypto movers showcase both diversity and opportunity in today’s market. Let me know if you’d like to unpack technical setups, compare risk profiles, or explore next steps!

Comparative Summary

As the crypto market enters a new phase of momentum fueled by regulatory clarity and Bitcoin’s breakout, several mid-caps and memecoins have emerged as dominant weekly crypto movers. Here’s how they stack up:

HYPE (Hyperliquid)

- Weekly Move: +50%+

- Key Driver: Record-high trading volume and surging institutional interest in zero-gas perpetuals

- Trader Sentiment: Bullish — high conviction play among pro traders and whales targeting derivatives exposure

- Weekly Crypto Movers Take: Strongest volume-based breakout of the week; momentum likely to sustain near-term

SUI

- Weekly Move: ~+70%

- Key Driver: Developer activity and institutional capital flowing into Sui’s Layer 1 ecosystem

- Trader Sentiment: Confident — favored by long-term holders and builders alike

- Weekly Crypto Movers Take: Combines narrative strength with on-chain fundamentals; high potential continuation

PEPE

- Weekly Move: +30%–68% depending on exchange

- Key Driver: Meme-driven rally backed by surging volume and strong technical indicators

- Trader Sentiment: Euphoric — short-term speculative surge, but warning signs of FOMO and possible exhaustion

- Weekly Crypto Movers Take: Leading memecoin of the moment; high-reward, high-risk trade

ARB (Arbitrum)

- Weekly Move: +24%–40%

- Key Driver: SocialFi rollout buzz and Robinhood listing rumors

- Trader Sentiment: Optimistic — renewed interest in Layer 2 ecosystems

- Weekly Crypto Movers Take: Good mix of speculative hype and solid roadmap execution; watch for consolidation

HBAR (Hedera)

- Weekly Move: +4%–14%

- Key Driver: Grayscale fund inclusion and shifting technical momentum

- Trader Sentiment: Cautiously bullish — still under the radar, but supported by improving funding rates

- Weekly Crypto Movers Take: Quiet climber with strong institutional backing; potential sleeper play

These weekly crypto movers reflect the evolving priorities of the market — from scalability and speed (SUI, ARB, HYPE) to community-driven speculation (PEPE) and long-term infrastructure bets (HBAR).

For traders and investors scanning for alpha, this week’s roster offers a broad risk-reward spectrum that mirrors the complexity of the broader bull cycle.

Outlook & Conclusion

Despite the optimism surrounding this week’s explosive gains, we should exercise caution. One of the key risks facing the market is the potential for sharp pullbacks.

After such swift rallies, especially in highly speculative assets like memecoins, the probability of profit-taking increases significantly. If sentiment cools or macro headlines shift, traders chasing green candles could find themselves caught in volatile reversals.

Regulatory noise also remains a wildcard. While Crypto Week in Washington has delivered tailwinds in the form of pro-innovation policy proposals and bipartisan support, any delay or pushback in passing these bills could spook markets.

A single offhand remark from a policymaker—or a misinterpreted clause in a regulatory framework—can quickly reverse bullish momentum. This is particularly relevant for memecoins like PEPE, which thrive on community hype but are highly sensitive to shifting sentiment.

Looking ahead, Bitcoin remains the focus of attention. If it sustains price action above the $120K level and continues to digest institutional inflows, it could create a steady current for altcoins to follow.

Conversely, if Bitcoin begins to retrace or stalls, many of this week’s weekly crypto movers may struggle to maintain their gains. Momentum could fragment, shifting attention back to large-caps or stable narratives.

For traders and investors, the key lies in balance. Those looking to ride momentum should consider scaling into strength—focusing on tokens with clear catalysts, sustained volume, and technical support zones.

Meanwhile, those feeling cautious can hedge exposure through stablecoins or consider rotating into less volatile infrastructure plays like HBAR.

The takeaway? Stay nimble, monitor funding rates and sentiment indicators, and remember that in the world of weekly crypto movers, assets that surge one week can easily decline the next.

FAQs

Why is HYPE (Hyperliquid) gaining so much attention this week?

Its record-high trading volume and institutional adoption have driven a 50%+ weekly surge, making it the top momentum play.

What’s fueling SUI’s recent breakout?

Strong developer activity and growing interest from institutional investors have pushed SUI up nearly 70% this week.

Is PEPE still a good buy after such a sharp rally?

PEPE’s volatility is high. While memecoin sentiment is strong, entering after a 30–68% weekly pump carries added risk.

What’s behind ARB’s surge lately?

Speculation around a Robinhood listing and excitement over its SocialFi feature launch have boosted ARB by up to 40%.

Why is HBAR moving more slowly compared to others?

HBAR’s gains are steadier due to its Grayscale fund inclusion and technical support, making it a more conservative mover.