Bitcoin surged to $120,000 amid reports of Trump planning to fire Fed Chair Powell, though Trump denied these claims, stabilizing markets.

US President Donald Trump is purportedly planning to terminate Federal Reserve Chair Jerome Powell soon, a significant development. This news prompted a rapid increase in the price of Bitcoin, as it could facilitate an imminent reduction in the Federal Reserve’s interest rate. Nevertheless, the president has since denied the reports that he terminated the Fed Chair.

Bitcoin’s value surges amid speculation that Trump may terminate Powell’s employment imminently

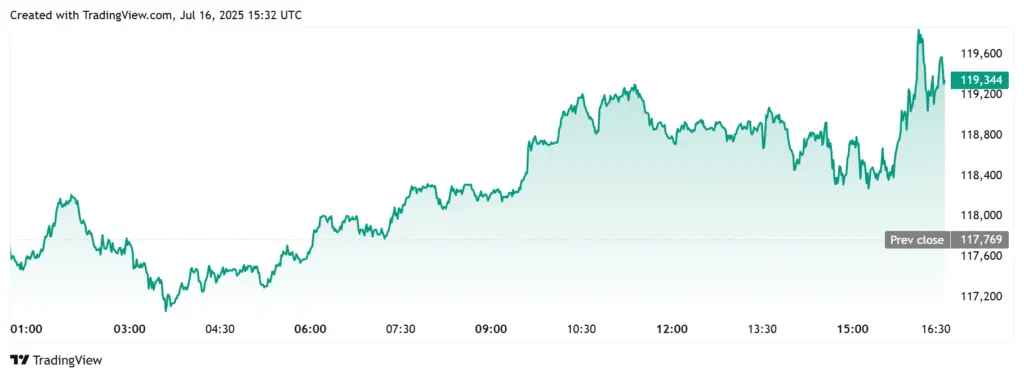

The premier cryptocurrency experienced a significant increase in value, reaching as high as $19,000, according to TradingView data. This was in response to a Bloomberg report that indicated that Trump is expected to terminate Powell soon, as per a White House official.

The price of Bitcoin (BTC) has increased from a low of approximately $18,400 to $19,000 and is currently maintaining a position above the psychological $119,000 level to reclaim the $120,000 level. The report regarding Powell’s appointment is favorable for cryptocurrency prices, as the president can nominate an individual who would reduce interest rates, increasing liquidity in the market.

Trump has been advocating for a reduction in the Federal Reserve’s interest rate for some time, and he has most recently encouraged the US Central Bank to implement a 300-basis-point rate cut. Following the Bloomberg report, the president also held discussions with congressional Republicans regarding his intentions, who expressed their endorsement of this step.

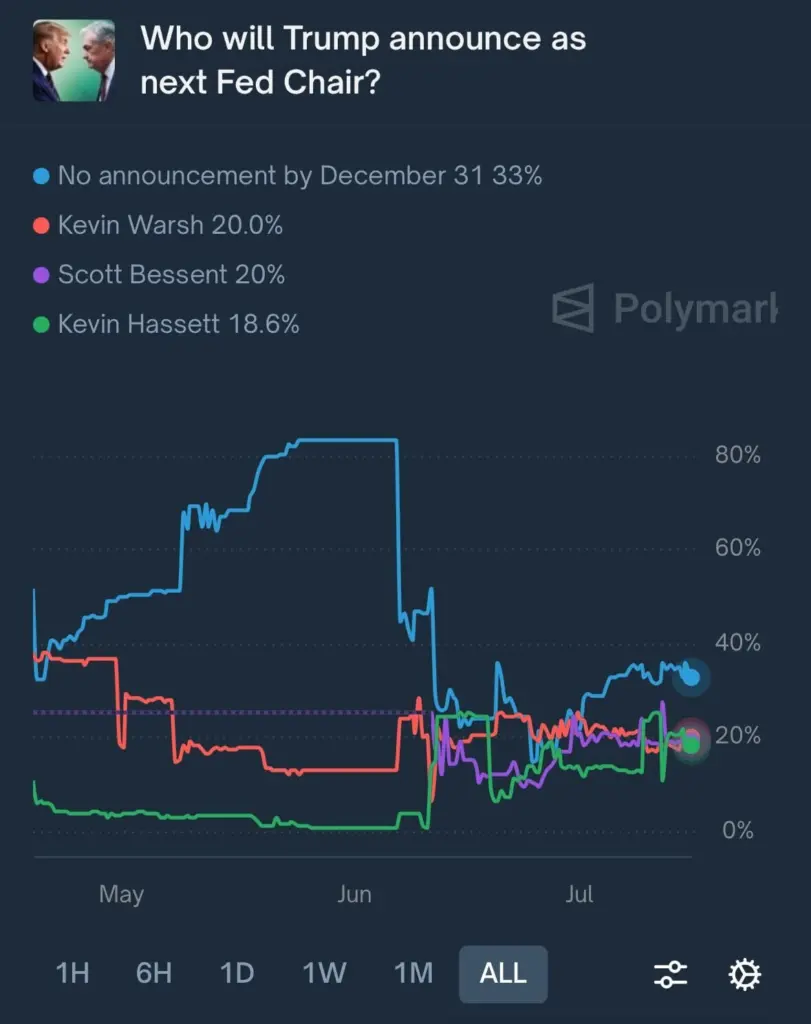

Interestingly, this development occurred just one day after US Treasury Secretary Scott Bessent announced that the process to select Powell’s successor had commenced. According to Polymarket data, the current frontrunner in the competition to succeed Powell is White House Adviser Kevin Hassett.

Hassett has previously declared that the Federal Reserve has ample capacity to reduce rates and may take this action if he is elected as the next Fed Chair. Therefore, the BTC price has already factored in this possibility.

Trump refutes his intention to dismiss Powell

Trump denied allegations that he intended to terminate Powell’s tenure as Federal Reserve Chair, asserting that it is exceedingly unlikely, unless Powell is required to resign due to misconduct. Nevertheless, he acknowledged that he had conversed with Republicans regarding the potential for this to occur. The president’s statement resulted in a decline in the price of BTC, which fell below $119,000.

Another matter that has been the subject of debate is whether or not Trump has the authority to terminate Powell. In June, the Supreme Court issued a ruling that provided clarification that the Federal Reserve Chair is legally protected and cannot be terminated by the president.

Nevertheless, Trump will capitalize on Powell’s purported squandering on a renovation project at the US Central Bank. William Pulte, the Federal Housing Finance Agency (FHFA) Chairman in the United States, has already requested an inquiry into the Federal Reserve Chair. Additionally, he recently disclosed that Powell was purportedly contemplating resignation.