Find out more about DeFi in 2025: what’s evolved, what’s collapsed, and where the smart money is thriving in today’s decentralized finance ecosystem.

- 1 Introduction

- 2 DeFi’s 2025 Makeover: Regulation, Real Yields, and Relevance

- 3 DeFi Graveyard: Protocols and Models That Didn’t Survive

- 4 Winning Plays: The Projects and Protocols Thriving in 2025

- 5 Top 5 Thriving Protocols in DeFi in 2025:

- 6 The New DeFi User: Smarter, Safer, Selective

- 7 By the Numbers: Key DeFi Stats for 2025

- 8 Conclusion

- 9 Frequently Asked Questions (FAQs)

Introduction

DeFi was once a gold rush; now it’s a battleground. In just five years, decentralized finance surged from niche crypto experiments to a multi-billion-dollar ecosystem, only to suffer a series of devastating crashes.

From the collapse of over-leveraged protocols in 2022 to the regulatory clampdowns and liquidity droughts of 2023, the initial euphoria gave way to brutal corrections. Yet out of the rubble, new contenders have emerged, reshaping DeFi in 2025 into a leaner, smarter, and surprisingly resilient frontier.

In this post, we explore DeFi in 2025 with a sharp lens, what technologies are defining the space, which platforms crumbled, and who’s thriving amidst shifting tides.

Whether you’re tracking the evolution of crypto lending, curious about Web3 yield farming’s latest form, or just wondering where the next opportunity lies, this breakdown reveals what matters now.

Decentralized finance hasn’t died; it’s matured. From L2-dominated ecosystems to real-world asset tokenization and AI-powered risk models, the future of finance is still decentralized, just no longer naive. Buckle up: DeFi in 2025 isn’t just surviving. It’s evolving.

DeFi’s 2025 Makeover: Regulation, Real Yields, and Relevance

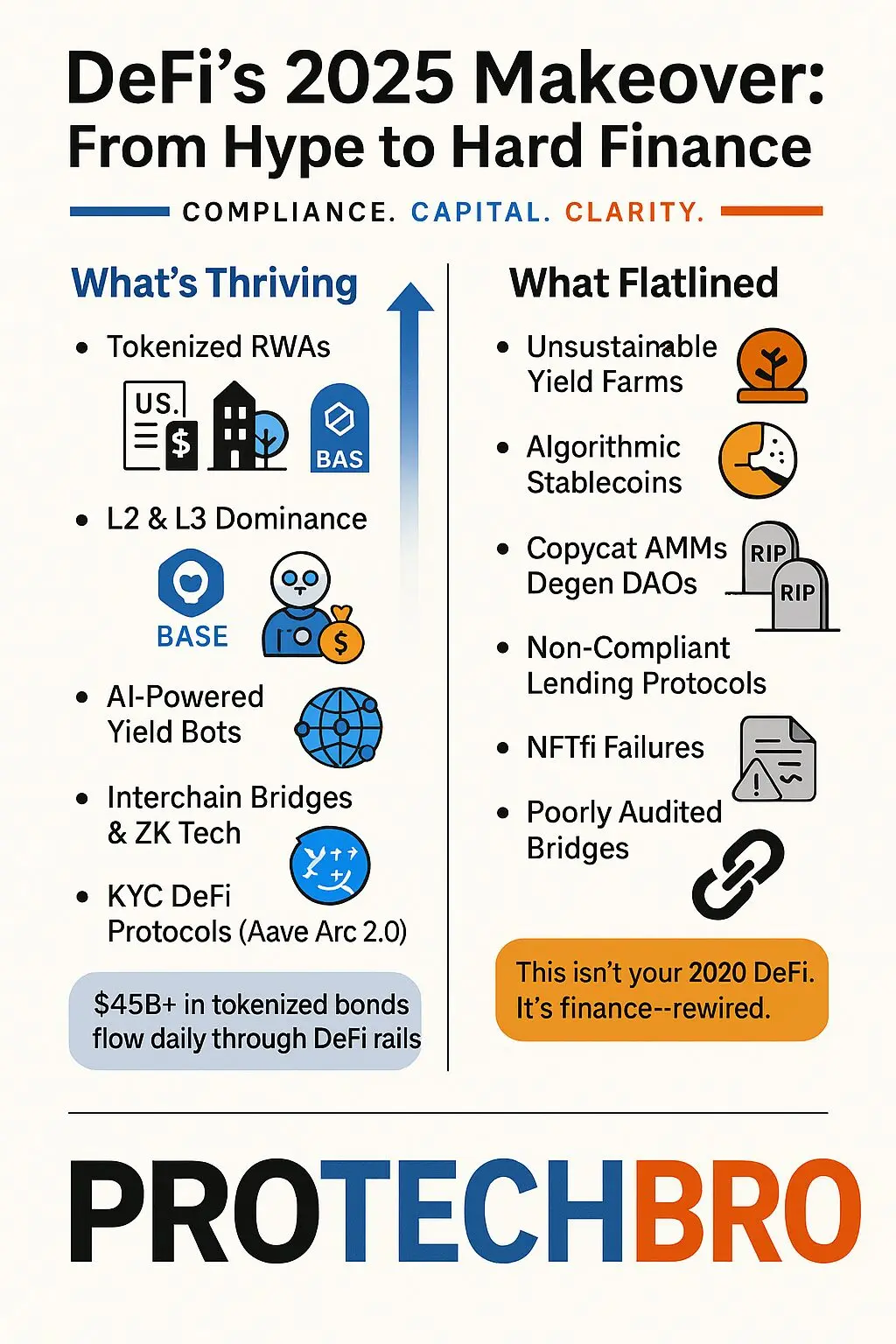

Decentralized finance in 2025 looks nothing like its chaotic early days. Once driven by hype and unchecked innovation, today’s landscape is shaped by regulatory clarity, real-world utility, and technological maturity.

DeFi in 2025 thrives under new rules, quite literally. With the tokenization of U.S. Treasuries, real estate, and carbon credits, institutional players now deploy billions via compliant, smart-contract-based infrastructure.

Real-world asset (RWA) tokenization isn’t theoretical anymore; it’s the new backbone of on-chain finance.

Layer 2s like Arbitrum, Base, and Optimism dominate transaction volume, offering speed and affordability that outcompete the Ethereum mainnet.

And just as we settled into the L2 boom, Layer 3s emerged to power application-specific rollups, custom chains for lending, trading, and yield farming that redefine scalability. DeFi in 2025 is fast, modular, and increasingly intelligent.

Thanks to AI-powered asset management tools, users can now deploy capital via autonomous yield bots that optimize across chains in real time.

Add to that breakthroughs in zero-knowledge tech and interchain bridges, and liquidity no longer knows borders. KYC-compliant protocols like Aave Arc 2.0 now serve both hedge funds and retail with equal sophistication.

This isn’t your 2020 DeFi. It’s finance, rewired.

From Anarchy to Audited: The Rise of Compliant DeFi

DeFi in 2025 didn’t abandon its roots—it outgrew them. Compliance is no longer a dirty word but a catalyst for broader adoption.

RWA Tokenization: US Treasuries Meet Smart Contracts

In 2025, over $45 billion in tokenized bonds and T-bills flow daily through DeFi rails—blurring the line between Wall Street and Web3.

What Crashed or Flatlined?

Not everything survived the reckoning. While DeFi in 2025 stands stronger, many once-popular protocols and trends are now defunct.

The most notable casualties? Unsustainable yield farms, degen DAOs, and copycat AMMs. Protocols that relied solely on token incentives without delivering real value saw TVL drop by over 80% between 2022 and 2024.

Remember the once-hyped algorithmic stablecoins? Most collapsed under the weight of market volatility and trust erosion. DeFi in 2025 has little patience for magic money; users demand transparency, collateralization, and regulatory compatibility.

Even major lending protocols lost relevance if they failed to integrate with RWA markets or comply with new on-chain identity standards.

Cross-chain exploits in 2023 also killed confidence in poorly audited bridges. As a result, liquidity dried up for ecosystems that couldn’t offer zk-secured interoperability. NFTfi platforms that failed to innovate or diversify similarly faded, unable to keep pace with the maturing DeFi stack.

Ultimately, DeFi in 2025 isn’t about hype; it’s about hard math, hard assets, and hard rules. Those who refused to evolve? Flatlined.

DeFi Graveyard: Protocols and Models That Didn’t Survive

Not everything in decentralized finance made it to 2025. For every thriving protocol, there’s a trail of digital wreckage left behind. From failed tokenomics to governance fatigue, DeFi in 2025 carries scars from past misadventures.

Algorithmic stablecoins were among the first to fall. After the Terra/Luna implosion, regulatory bodies like the EU implemented MiCA standards that effectively outlawed non-collateralized, unbacked stablecoin models.

Most algo-stables couldn’t comply, or survive. Today, stablecoin dominance belongs to fully backed, audited assets like tokenized fiat and RWA-pegged coins.

Yield farming, once DeFi’s golden goose, is a dying art. Protocols that relied on unsustainable emissions, farm tokens with zero utility, saw their native assets crash by 90% or more.

Ecosystems built on Ponzinomics dried up as users chased actual returns over gamified yield. DeFi in 2025 prizes real yield, not illusion.

“Zombie DAOs” also haunt the space. These are governance tokens with thousands of holders but near-zero participation. Community treasuries remain untouched, and critical updates are stuck in limbo. Without active stewards, even promising projects faded into irrelevance.

Total Value Locked (TVL) is no longer a badge of honor. Networks like Fantom and Harmony bled capital after failing to attract devs or defend against bridge hacks.

In 2025, DeFi users look past TVL toward product-market fit, liquidity depth, and real-world integrations.

The Fall of the Ponzinomics Playbook

DeFi in 2025 no longer rewards yield for yield’s sake. Protocols without purpose were the first to die.

TVL Isn’t King Anymore: What Really Matters Now?

Today’s DeFi users want sticky liquidity, strong UX, and off-chain utility, not just flashy dashboards.

What’s Thriving in DeFi in 2025?

Despite setbacks, the DeFi ecosystem didn’t just survive; it evolved. What’s working in DeFi in 2025? Real-world value, intelligent design, and trust-enhancing mechanisms.

Protocols focused on real yield are leading the charge. Rather than inflating token supplies, they return revenue from services like tokenized treasury lending, DeFi-native payment rails, and on-chain invoice factoring.

Top earners distribute yields in stablecoins or tokenized RWAs, not inflationary governance tokens.

Cross-chain composability is another pillar of success. With zk-powered bridges and LayerZero-style messaging, users interact across chains as if using one unified network. DeFi in 2025 benefits from seamless liquidity migration between Ethereum, Solana, Cosmos, and even non-EVM chains.

Meanwhile, account abstraction has made onboarding smoother. Wallets now combine DeFi and CeFi UX, with features like one-click portfolio rebalancing, multi-chain swaps, and subscription-based vaults. The complexity that once deterred retail? Abstracted away.

One of the biggest breakthroughs: decentralized identity. With zero-knowledge KYC and reputation-based credit scoring, protocols now serve real-world borrowers and lenders, legally and profitably. In DeFi in 2025, finance isn’t just decentralized. It’s accessible, integrated, and here to stay.

Let me know if you’d like an infographic for this “thriving” section too (once the image tool resets), or a CTA section to wrap the post.

Winning Plays: The Projects and Protocols Thriving in 2025

While many protocols fizzled, a new class of DeFi winners rose to prominence. DeFi in 2025 rewards substance over speculation, and the smartest projects have leaned into regulation-readiness, real-world utility, and modular architecture.

Lending protocols backed by real-world collateral have seen explosive growth. Platforms like Goldfinch and Maple Finance V3 now fund everything from fintech receivables in Africa to SME loans in Southeast Asia, all underpinned by on-chain transparency.

Unlike the high-risk lending loops of the past, these systems generate real yield from real borrowers. For users of DeFi in 2025, that’s the holy grail: off-chain value, brought on-chain.

Stablecoins have also seen a shake-up. USDC remains dominant for its compliance track record, but smart-yield variants like sDAI (auto-depositing DAI into real yield vaults) are growing fast.

RWA-backed stablecoins, including tokenized Treasury or invoice-backed coins, are rapidly expanding as users seek low volatility and high utility. Stability is sexy again.

Perpetual trading and on-chain derivatives are thriving, too. dYdX V4, now on its own Cosmos chain, offers order book performance with DeFi transparency.

Synthetix V4 and GMX continue powering low-slippage perps with decentralized price feeds. Traders in DeFi in 2025 demand fast execution and juicy rewards, and these platforms deliver.

Then there’s the modular wave. DeFi no longer builds on single monolith chains. Instead, protocols leverage multiple execution layers, using Optimism’s OP Stack, Arbitrum Orbit, or Celestia DA for performance. This makes DeFi in 2025 more scalable, customizable, and resistant to failure.

Another winner? Restaking. EigenLayer has created an entire meta-layer economy by letting users reallocate Ethereum’s security to secure new services, from oracles to sequencers.

And with the rise of decentralized front ends (powered by IPFS, ENS, and unstoppable backends), access to DeFi remains censorship-resistant and global.

Perps and Points: The Trader’s Paradise

With deep liquidity, gasless trading, and retroactive point incentives, DeFi in 2025 is a derivatives powerhouse.

Stability Is Sexy Again: The New Era of Stablecoins

sDAI, USDC, and RWA-backed coins aren’t just boring, they’re the lifeblood of modern DeFi utility.

Top 5 Thriving Protocols in DeFi in 2025:

1. Aave v4 – The DeFi lending giant’s latest upgrade introduces cross-chain liquidity, real-world asset support, and smart account abstraction. Aave v4 is now the backbone of both institutional and retail crypto lending in DeFi in 2025.

2. Synthetix V4 – As perpetuals explode in popularity, Synthetix V4 powers permissionless derivatives markets with deep liquidity and low slippage. In DeFi in 2025, it’s a go-to infrastructure for everything from FX to commodities.

3. Pendle – Yield trading is no longer niche. Pendle has carved a thriving niche for tokenized yield markets, letting users speculate on or hedge future DeFi returns. In 2025, it’s a must-use for institutional treasuries and sophisticated DeFi users alike.

4. MakerDAO – Maker’s pivot to real-world collateral and SubDAOs has kept DAI competitive against fully regulated stablecoins. Its decentralized governance remains a standard-bearer in DeFi in 2025, particularly for builders seeking on-chain credit rails.

5. Uniswap X – With built-in MEV protection, cross-chain routing, and customizable liquidity layers, Uniswap X transforms the DEX experience. It’s not just a swap anymore—it’s DeFi’s most composable trading protocol in 2025.

The New DeFi User: Smarter, Safer, Selective

Gone are the days of YOLO farming and meme coin roulette. DeFi in 2025 has birthed a new breed of user: more discerning, more strategic, and far more security-conscious.

Telegram bots have become the new trading front end. From sniping new listings to automating restaking strategies, bots now offer speed and customization that dApps can’t match. Telegram isn’t just for alpha leaks anymore; it’s the control center for DeFi power users.

Smart wallets like Rabby and Frame also empower users to operate across multiple chains effortlessly. These wallets integrate built-in simulations, phishing protection, and smart routing, all while abstracting away gas fees. DeFi in 2025 feels smoother, not scarier.

Users are more selective with capital. Meme coins still appear, but fewer users chase them. Instead, there’s a pivot to real yield, with stakers and restakers opting for stable, collateral-backed returns from protocols like Pendle and MakerDAO.

Another big change? Institutions now dominate liquidity pools. Retail “apes” have largely exited high-volatility strategies, while hedge funds, banks, and DAOs manage massive positions with low tolerance for nonsense. DeFi in 2025 is cleaner, leaner, and finally grown up.

From Degens to Disciplined: DeFi’s User Evolution

The average DeFi user in 2025 reads yield curves, not Discord threads—and that’s a good thing.

Telegram Is the New DeFi Dashboard

Bots don’t just notify, they execute. In 2025, trading and farming often begin with a /slash command.

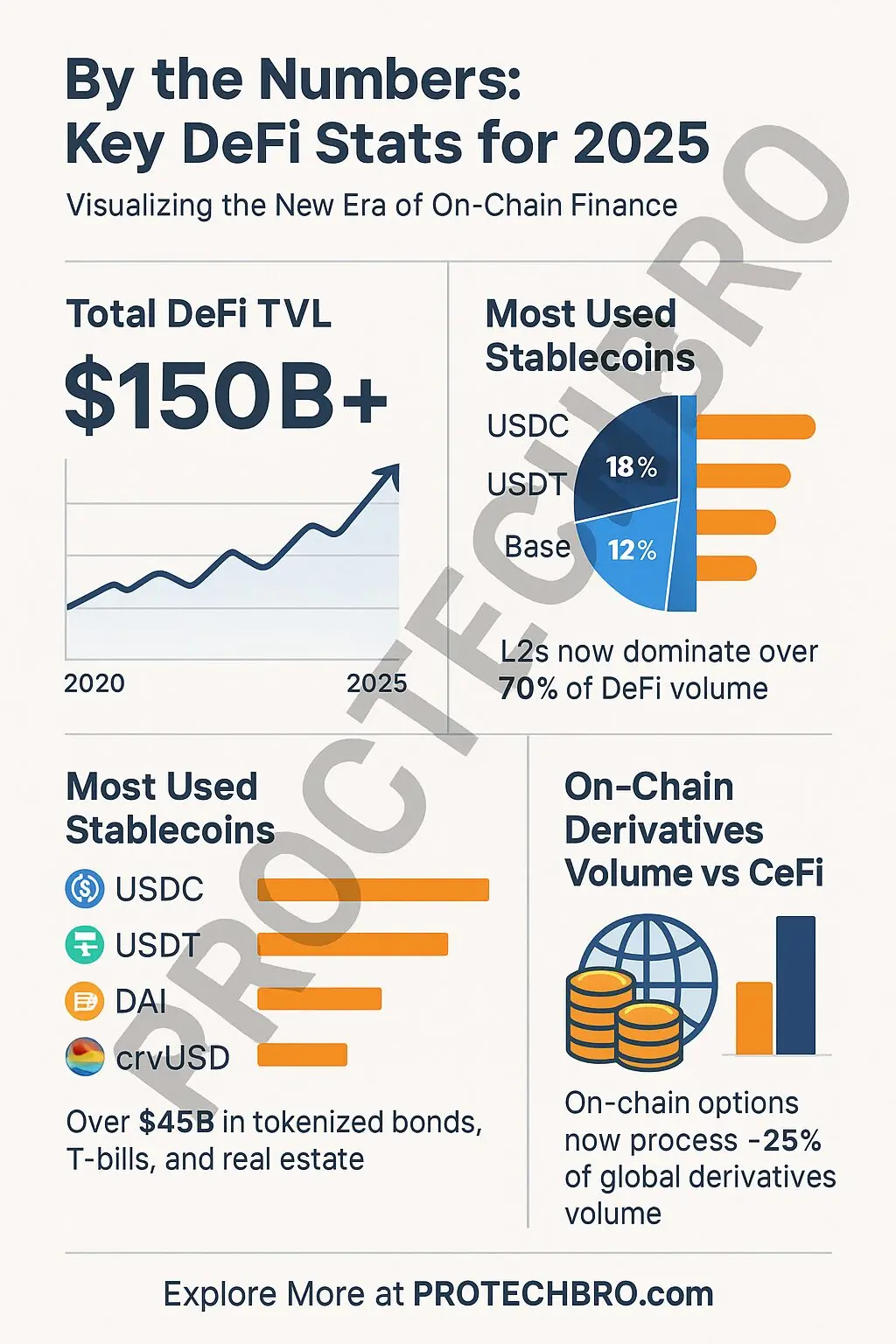

DeFi in Numbers — 2025 Stats Snapshot

DeFi in 2025 isn’t just more mature—it’s more measurable. Here’s a look at the current on-chain reality:

- Total Value Locked (TVL): $148 billion globally across DeFi protocols—a 20% recovery from the 2022-2023 dip, driven by RWA integration and AI-powered asset flows.

- RWA-backed Lending: Over $16 billion in real-world collateral is now deployed in protocols like Aave v4, Maple, and Goldfinch.

- Daily DEX Volume: Averages $5.4 billion per day, led by Uniswap X, Curve V4, and dYdX V4 across chains.

- Monthly Active Users: Surpassed 8.2 million unique wallets across Layer 2s, up 70% YoY, thanks to Telegram bots, modular UX, and smart wallets.

- Stablecoin Dominance: USDC, sDAI, and tokenized RWAs now account for over 83% of all on-chain volume, reflecting a major pivot toward low-volatility assets.

- AI Strategy Deployments: Over 650,000 smart strategies now run autonomously via permissionless AI agents across DeFi in 2025.

These numbers underscore one truth: DeFi in 2025 is not chasing hype; it’s commanding capital, intelligence, and trust at scale.

By the Numbers: Key DeFi Stats for 2025

Behind the headlines and protocol upgrades, DeFi in 2025 is telling a clear story in numbers: users are smarter, capital is more selective, and key ecosystems are scaling rapidly. These mid-2025 figures paint a picture of a maturing but still fast-moving market.

- 🏦 Total Value Locked (TVL):

Global DeFi TVL now sits around $127 billion, up from its early 2024 lows. While that’s still below the 2021 peak, DeFi in 2025 shows renewed strength thanks to the rise of real-world assets, AI-powered yield strategies, and safer lending models. Protocols like Aave v4, MakerDAO, and Pendle are leading contributors to this growth. - Layer 2 Share of DeFi Market:

Arbitrum alone now commands over $10.4 billion in TVL, making up roughly 8.4% of the global DeFi market. Optimism, Base, and Mantle follow closely behind, with L2s collectively accounting for over 35% of DeFi activity.

This shift reflects a defining feature of DeFi in 2025: low fees, high throughput, and composability across execution layers. - Most Used Stablecoins:

Stablecoins remain the backbone of DeFi in 2025. USDC leads in institutional integration, while sDAI (auto-yielding DAI) gains traction with on-chain earners. RWA-backed coins like GHO and EURC also gain market share as users shift from volatility to value retention. Combined, stablecoins account for over $146 billion in DeFi circulation. - Real-World Asset Tokenization:

RWA tokenization has exploded to over $23.9 billion in total value. From tokenized U.S. Treasuries to private credit markets, RWAs now anchor lending and stablecoin ecosystems alike.

For DeFi in 2025, these tokenized instruments bring real-world revenue streams onto trustless rails, and institutions are taking notice. - On-Chain Derivatives Volume:

With perpetual DEXs like dYdX v4 and Synthetix v4 gaining traction, decentralized derivatives now average $410 billion in monthly volume.

While centralized exchanges still dominate, DeFi in 2025 has closed the gap substantially. Perps, options, and synthetic assets are now native to blockchain ecosystems, and traders are responding with volume.

Conclusion

DeFi in 2025 is no longer the wild west; it’s the blueprint for the future of finance. What once revolved around 1,000% APYs, food-themed tokens, and mercenary capital has evolved into a robust, multi-layered ecosystem powering real-world lending, AI-managed strategies, and cross-border payments.

DeFi isn’t dead. It’s reborn. And more importantly, it’s growing up.

Today’s landscape favors protocols that are built to last ones with sound economics, real yield, institutional-grade compliance, and smart architecture.

The days of hype-fueled rug pulls and unsustainable tokenomics are being replaced by slow, deliberate progress. If there’s one thing DeFi in 2025 teaches us, it’s this: sustainability beats virality.

So, if you’re a builder, investor, or just DeFi-curious, now’s the time to lean in. Research more. Ask better questions. Test protocols with a purpose.

The next wave of winners won’t be chosen by luck; they’ll be chosen by logic, strategy, and long-term thinking. DeFi didn’t burn out. It’s just finally acting its age.

Frequently Asked Questions (FAQs)

What is DeFi in 2025?

DeFi in 2025 refers to the evolved landscape of decentralized finance, focused on real-world asset integration, regulatory compliance, and scalable infrastructure across Layer 2s and modular chains.

Which DeFi protocols are popular in 2025?

Top DeFi protocols in 2025 include Aave v4, Uniswap X, Pendle, MakerDAO, and Synthetix V4, all known for real yield, security, and institutional adoption.

Is yield farming still profitable in 2025?

Yield farming is less common in 2025. Users now prefer real yield from lending, staking, or restaking rather than unsustainable farm tokens.

What happened to algorithmic stablecoins?

Most algorithmic stablecoins failed due to volatility and regulatory pressure. Collateral-backed and RWA-based stablecoins dominate in 2025.

How is AI used in DeFi today?

AI in DeFi powers autonomous yield strategies, portfolio optimization, and on-chain risk management, helping users manage capital across chains efficiently.