Metaplanet adds 780 BTC for $92.5M, raising its total to 17,132 BTC worth $2B, ranking 7th among corporate holders.

Asia’s largest public Bitcoin holder, Metaplanet, has once again garnered attention with a substantial addition to its BTC portfolio. 780 Bitcoin have been added to the Japanese investment firm’s holdings, increasing the total to 17,132 BTC, which is estimated to be worth $1.73 billion. With this most recent acquisition, Metaplanet solidifies its position as a significant player, positioning itself as a formidable competitor to Michael Saylor’s Strategy.

Metaplanet Amasses $780 in Bitcoin, Bringing Total Holdings to $1.7B

In its most recent transaction, Metaplanet acquired 780 Bitcoin, which is estimated to be worth $92,500,000. At an average price of $118,622 per BTC, this acquisition has increased the asset manager’s total holding to 17,132 BTC, which is estimated to be worth approximately $1.73 billion. Per coin, the average procurement cost is $101,030. As of July 28, 2025, CEO Simon Gerovich asserted in an X post that this acquisition has generated a year-to-date BTC yield of 449.7%.

It is important to note that the most recent acquisition coincides with Michael Saylor’s recent declaration to increase Strategy’s collection of Bitcoin. According to the report, Strategy has a valuation of approximately $71.8 billion and 607,770 BTC. As a result, Strategy is BTC’s largest public holder, while Metaplanet is ranked seventh.

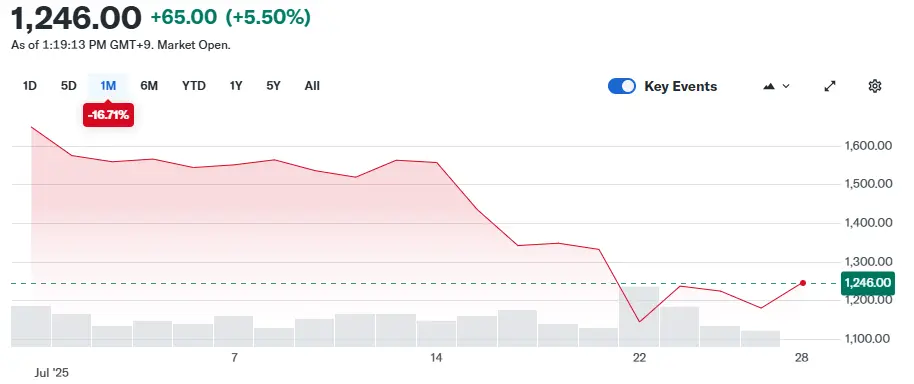

Surges in Metaplanet Stock Price

After this transaction, Metaplanet’s stock price experienced an impressive five percent increase. Despite the current surge, the stock price has declined by 6.9% and 16.7% over the past five and thirty days, respectively, to 1,241 yen.

Transitioning to a Higher Position

This action is particularly noteworthy in light of Metaplanet’s recent acquisition of 797 Bitcoin for $93.6 million, which occurred at approximately $122k, the new all-time high for Bitcoin. The asset manager’s strategic acquisition of BTC is consistent with the company’s vigorous Bitcoin accumulation strategy, which aims to accumulate 210,000 by the conclusion of 2027.

As a result of this strategic accumulation of BTC, Metaplanet has become one of the top ten public companies that hold Bitcoin. It has recently surpassed industry titans such as Tesla, CleanSpark, and Galaxy Digital to achieve the fifth position.

Nonetheless, the rankings have been rearranged due to the recent increase in institutional adoption of Bitcoin. Notably, Bitcoin Standard Treasury Company and Trump Media have enhanced their portfolios, respectively, occupying the fourth and sixth positions among public holders.