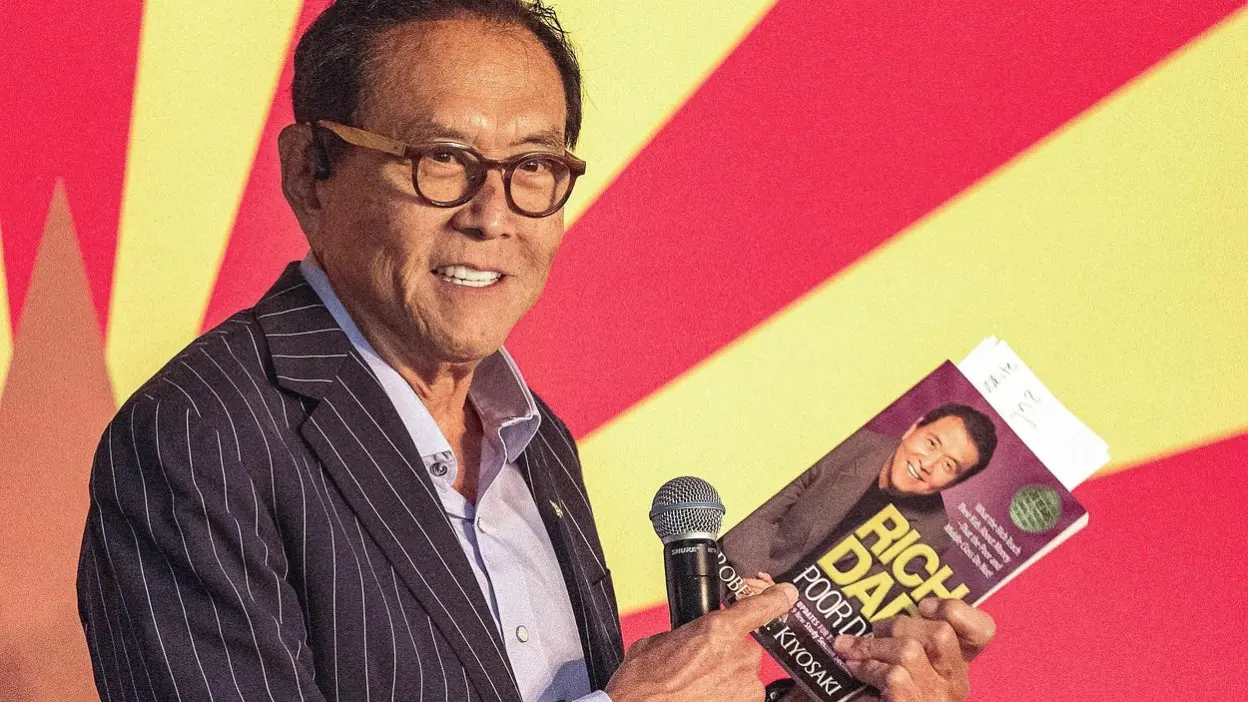

Robert Kiyosaki warns of a 1929-style U.S. market crash, urges investors to hold Bitcoin, gold, and silver as safe havens.

Robert Kiyosaki, the author of Rich Dad Poor Dad, has emphasized the bubble forming in the US equity market and anticipates a collapse reminiscent of the Great Depression in 1929. Kiyosaki’s most recent message indicated that it is more prudent to maintain a cautious stance regarding Bitcoin, silver, and gold in the future. As the US-EU trade agreement continues, the BTC price is increasing in strength, with a trend toward $120,000.

Robert Kiyosaki Predicts Stock Market Crash and Designates Bitcoin as a Safe Haven

Robert Kiyosaki has issued a stark warning regarding the possibility of a significant financial downturn. Kiyosaki stated in his most recent message on the X platform that the present circumstances could lead to the 1929 stock market collapse and the Great Depression. Immediately following the most recent rounds of tariff negotiations, his remarks were made as the US-EU trade agreement continues.

In a recent post, Kiyosaki expressed concerns regarding the security of retirement accounts, such as 401(k)s and IRAs, that are substantially invested in equities. Kiyosaki cited Warren Buffett and Jim Rogers, two renowned investors, stating that they have sold most of their equities and bonds and are holding cash or silver instead.

“If you do not know why Buffett and Rogers have sold their stocks and bonds, you may want to find out,” Kiyosaki wrote.

In light of the increasing debt levels in the United States and the excessive production of money, Kiyosaki reiterated his support for Bitcoin. Silver and gold. “I maintain investments in Bitcoin, silver, and gold,” he stated. Kiyosaki has been a fierce advocate for Bitcoin, actively raising awareness of the increasing US National Debt, which has now surpassed $37 trillion.

Kiyosaki Critiques Bitcoin Exchange Traded Funds

Robert Kiyosaki has been advocating for Bitcoin for years. Still, he has opposed Bitcoin ETFs, arguing that they are not equivalent to possessing one’s own Bitcoins. He argues that crypto exchange-traded funds (ETFs) are less credible and more akin to fiat or “paper” money because they do not represent direct ownership of the underlying assets. “An ETF is akin to possessing a photograph of a firearm for personal protection,” he stated.

Conversely, spot Bitcoin ETFs have experienced substantial demand since their introduction in January 2024. The aggregate net assets under management of all US ETF issuers have exceeded $175 billion. The Bitcoin ETFs will receive in-kind redemptions, enabling issuers to exchange assets for cash.