Ethereum jumps past $3,900 as SharpLink buys $295M in ETH, raising its holdings to 438K+ ETH amid strong market momentum.

Vigorous market activity has caused the price of Ethereum to surpass $3,900.

This rise followed Sharplink’s acquisition of an extra $295 million in ETH as part of its treasury plan.

ETH Price Rises Amid New Sharplink Acquisition

According to CoinMarketCap data, the price of Ethereum has risen by 2.87% in the past day, topping $3,900.

The daily trading volume of ETH increased sharply during the surge, rising 26.6% to $30 billion.

The primary reason for this growth is Sharplink Gaming’s most recent strategic purchase, which raised its balance sheet by 77,210 ETH, or roughly $295 million.

Just a few weeks earlier, Sharplink had acquired about 80,000 Ethereum for approximately $258 million at an average price of $3,238—its biggest weekly acquisition.

Technical indicators also suggest that ETH will continue to see upward momentum.

Strong demand is indicated by the MACD histogram‘s increase to +21.93 and the RSI-14’s overbought level of 81.75.

The price of Ethereum has broken through the 61.8% Fibonacci retracement level, which is nearly $2,950, and it is now aiming for the next important extension goal at $4,284.

Sharplink Keeps Up Its Vigorous Ethereum Acquisition

As the primary Ethereum treasury holder, Sharplink, which is traded on the Nasdaq under the SBET ticker, has consistently strengthened its position.

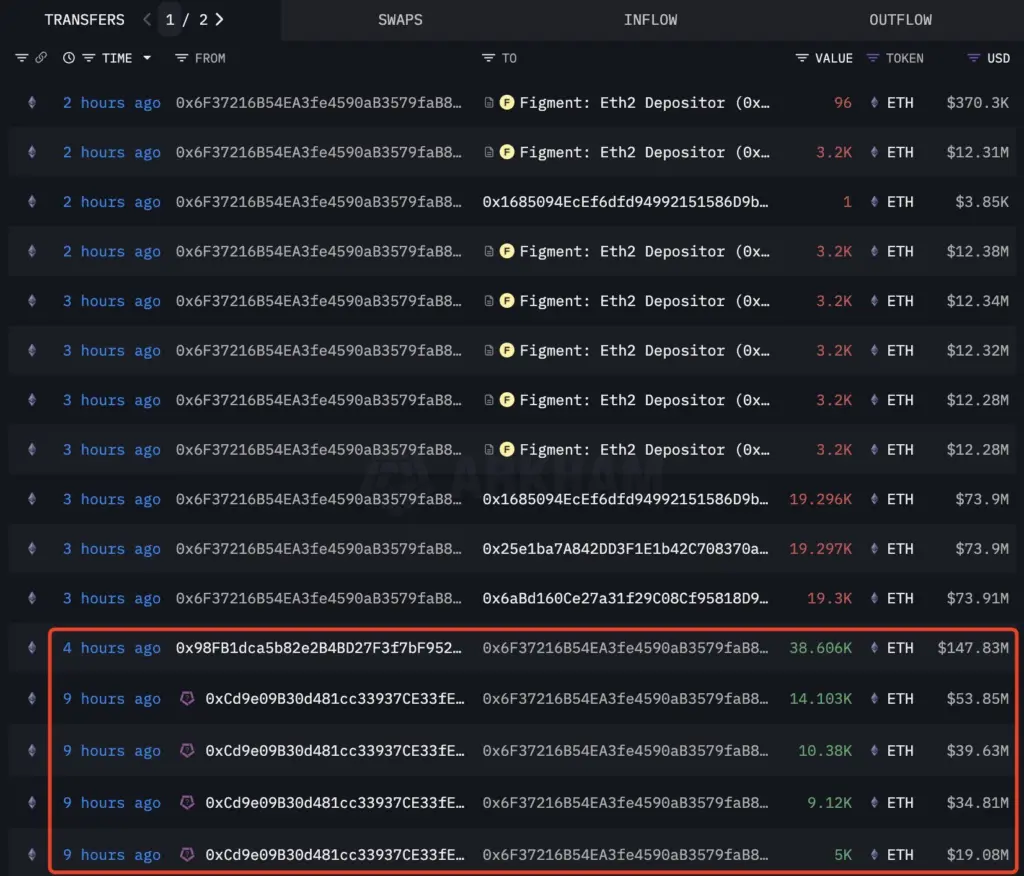

Lookonchain data indicates that Sharplink paid $295 million for another substantial ETH transaction, increasing its total holdings to approximately 438,000 ETH, or about $1.7 billion.

After receiving them from Circle, the company allegedly transferred $145 million of USDC stablecoins to Galaxy Digital.

Analysts saw this as an indication that another ETH acquisition was coming.

Sharplink’s recent acquisition comfortably absorbs the roughly 72,790 fresh ETH that the Ethereum network has recently issued during the last 30 days.

Bitmine Technologies has risen to the top of the corporate ETH treasury race despite Sharplink’s aggressive acquisition. Bitmine has increased its holdings recently, bringing its total to over $2 billion, or 566,776 ETH.

This happened after billionaire Peter Thiel made a substantial $500 million investment, allowing the business to focus more on tactics centered around Ethereum.

Sharplink remains in second position with 438,017 ETH. In the meantime, among institutional holders, the Ethereum Foundation itself has fallen to third place.

Earlier this month, GameSquare Holdings acquired roughly 1,819 Ethereum at an average price of $2,749, launching their $100 million Ethereum treasury campaign with a $5 million buy.

Additionally, the company intends to make money by utilizing DeFi protocols and other Ethereum ecosystem resources.

The price of Ethereum is still lower than its peak of $4,863.

However, the altcoin might reach unprecedented heights in the coming months due to rising interest from institutional investors.