Bitcoin miner MARA Holdings completes $950M raise to grow its 50,000 BTC treasury, marking a significant step in its expansion strategy.

MARA Holdings, the biggest publicly traded Bitcoin miner, has successfully raised $950 million through its most recent private offering.

The business also disclosed plans to increase its treasury and purchase more Bitcoin with some of the net earnings.

MARA Holdings Has Raised $950 Million

On July 25, the Bitcoin miner closed its enlarged offering of 0.00% convertible senior notes due 2032, raising a total principal amount of $950 million, according to a press release.

CoinGape revealed a few days prior that MARA Holdings intended to fund $850 million to purchase additional Bitcoin.

Nevertheless, the company raised an extra $100 million due to the upsizing.

Interestingly, the Bitcoin miner has allowed the original buyers to buy up to an additional $200 million in principal notes within 13 days of the company’s initial note issuance date.

As a result, the business may receive up to $1 billion for additional Bitcoin acquisitions.

However, MARA Holdings disclosed that it had utilized $18.3 million of the net proceeds ($940.5 million) to repurchase a portion of its 1.00% convertible senior notes due in 2026, so it seems unlikely that the entire amount will be used to purchase Bitcoin.

The corporation also covered the expense of the capped call transactions with $36.9 million.

The business anticipates using the remaining net profits for normal business activities and buying more Bitcoin.

Only Michael Saylor’s Strategy, with 607,770 BTC, has a larger public Bitcoin treasury than the Bitcoin miner, with 50,000 BTC.

MARA Stock Increases By 3%

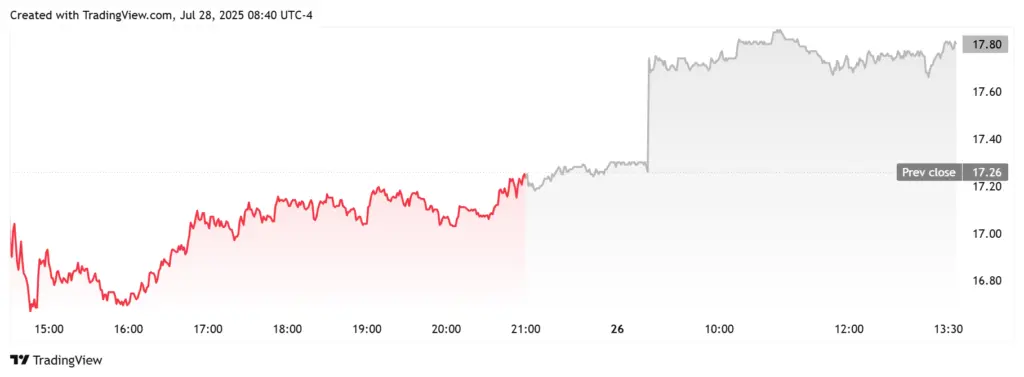

In light of this development, MARA Holdings’ stock is up more than 3%, according to TradingView data.

From last week’s closing price of $17.25, the stock is now trading at about $17.81.

The MARA stock has increased by over 13% over the last month, but it has dropped 10% in the previous five days.

In the meantime, the stock has only lost 1% so far this year.

Even though the price of Bitcoin has risen to multiple new all-time highs (ATHs) this year, the stock has had mixed results.