Marti, a prominent Turkish ride-hailing company, announced it will allocate 20% of its cash reserves to Bitcoin as part of a new crypto treasury strategy.

Marti Technologies, an Istanbul-based ride-hailing company, has disclosed that 20% of its financial reserves are designated for Bitcoin. The app intends to elevate its crypto holdings to 50% as part of its new crypto treasury strategy.

Marti is also contemplating the acquisition of additional digital assets, such as Solana and Ethereum, the company announced on Tuesday. The company intends to acquire these crypto assets as a hedge against systemic financial risks and as prospective long-term stores of value.

The firm stated that the cryptos will be held by a “regulated, institutional-grade custodian.”

“We have decided to allocate capital to crypto assets because we think that Bitcoin and other digital assets have demonstrated their capacity to store value in conjunction with hard currencies and gold over the past few years,” stated CEO Oguz Alper Oktem.

Marti Accumulating Crypto is the New Talk of The Town

Marti has become a part of the flurry of companies investing their capital in tokens. According to Architect Partners, a crypto advisory firm, 98 companies have declared their intention to raise more than $43 billion to acquire Bitcoin and other cryptocurrencies since June.

These companies, which are motivated by the top BTC corporate holder, Strategy (formerly MicroStrategy), aim to accumulate more BTC per outstanding share over time, rather than merely monitoring the price of BTC.

According to data from Bitcoin Treasuries, Michael Saylor’s strategy currently possesses 628,791 BTC. The BTC juggernaut recently completed the most significant US IPO of 2025, which raised $2.521 billion.

Industry skeptics contend that the sudden surge in companies purchasing cryptocurrency indicates an overheating market. “The increase in corporate treasury allocations to Bitcoin is substantial; however, it should not be driven by the pursuit of trends or the establishment of excessive positions,” stated Seamus Rocca, CEO of Xapo Bank, in an interview with Cryptonews.

It is crucial to remember that organizations such as Strategy and Metaplanet are high-conviction outliers. These headline-grabbing entities implement ambitious strategies consistent with their distinctive business objectives. He stated that a more measured approach will be more appropriate for the majority. “One founded on long-term convictions, rather than short-term reliance on volatility.”

Turkey’s New Crypto Restrictions in the Context of Growing Interest

The news is delivered at a time when the Turkish crypto market has experienced significant development in recent years. According to a KuCoin survey, more than half of the population in the country has invested in cryptocurrency.

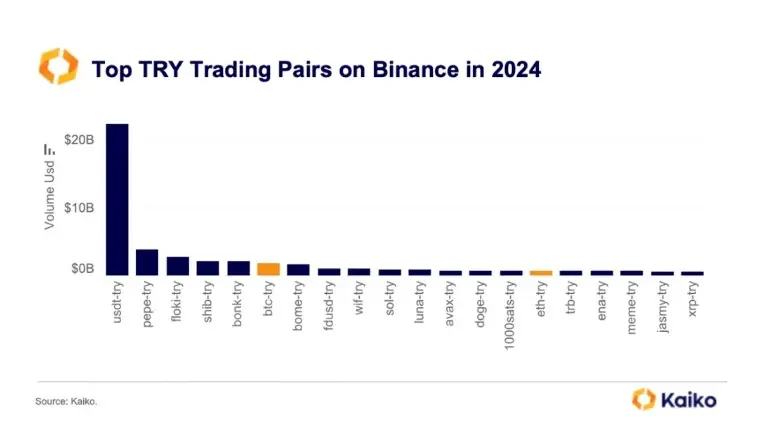

Additionally, the utilization of stablecoins has substantially increased in recent years due to Turkey’s inflationary environment. Kaiko Research reported that the USDT-TRY was the most traded pair on Binance last year, with a volume exceeding $22 billion.

Nevertheless, Turkey has recently implemented more stringent regulations for crypto exchanges and investors. The new comprehensive guidelines encompass measures to secure customers, capital adequacy, operations, and establishment.

Turkey’s Ministry of Treasury and Finance has implemented a stringent crypto supervision policy to combat illicit financial activities. Additionally, the new regulation mandates a postponement in the withdrawal of crypto assets. A 48-hour waiting period will be imposed on any cryptocurrency purchased, exchanged, or deposited before it can be withdrawn.