The cryptocurrency $CFX experienced a 27% overnight decline. Despite the sharp drop, new Asian partnerships, including pilot programs for a stablecoin pegged to the offshore yuan and integrations for AI-driven payments and decentralized trading, are seen by some as potential catalysts for a price rebound.

The $0.27 breakout collapsed, resulting in a 27.5% decline in Conflux ($CFX) over 24 hours. However, Conflux is secretly establishing partnerships that are concentrated on Asia, which have the potential to reignite the blockchain’s explosive growth.

The Conflux token’s precipitous decline coincides with the commencement of a stablecoin pilot program next week and a token fire that can alter the landscape significantly in the upcoming week.

The Scalable Blockchain Powering Asia’s Next-Gen Payments and AI Economy

Conflux is a layer-1 blockchain constructed on a distinctive Tree-Graph algorithm that enables parallel block processing, providing unparalleled scalability without compromising security or decentralization.

On August 1, 2025, pilot initiatives will commence in Singapore and Malaysia to facilitate Belt & Road cross-border payments through strategic partnerships such as Conflux’s AxCNH stablecoin, which was developed in collaboration with AnchorX and Eastcompeace Technology.

Concurrently, integrations with OrcaMind. Artificial intelligence (AI) for AI-driven payments and Fufuture for decentralized perpetual trading have expanded Conflux’s DeFi arsenal.

Furthermore, a partnership with MetYa is intended to provide AI-powered SocialFi products in Asia, in addition to prominent brands such as China Telecom and McDonald’s China.

To optimize supply dynamics and reduce the PoS APR to approximately 13.38%, the Conflux community authorized a proposal in early May to stake an additional 500 million $CFX and burn 76 million $CFX on the tokenomics front.

In conjunction with experimental projects in real-world asset tokenization and PayFi solutions, these initiatives have enhanced the network’s sustainability and limited the circulating supply.

Additionally, the availability of new listings on platforms such as OrangeX and BigONE has expanded accessibility, thereby increasing exposure and liquidity.

These developments present a compelling depiction of Conflux’s growth trajectory, effectively balancing rapid price appreciation with robust on-chain fundamentals and deeper ecosystem development.

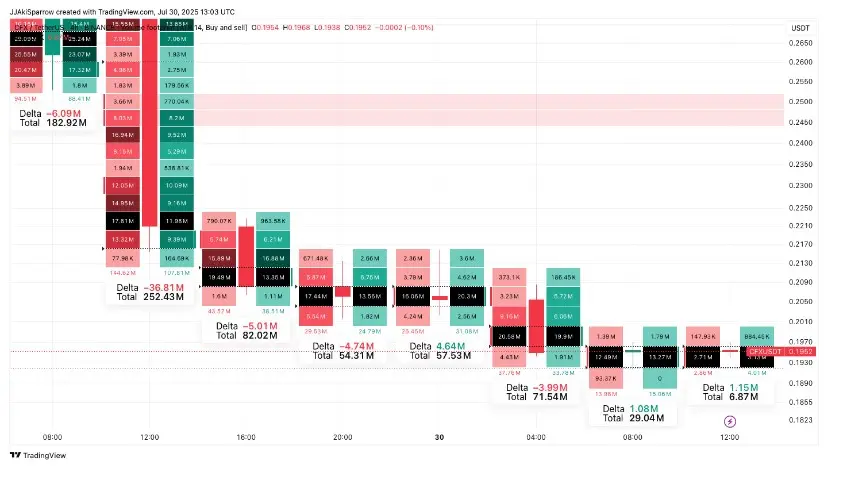

$CFX/USDT Fails to Sustain Breakout as Momentum Fizzles at Resistance

The recent price action on $CFX/USDT starkly contrasts the clear, directional rally observed in July.

The market’s momentum was sufficient to push it decisively above its previous range during the initial leg of that run, which was characterized by an intense impulse from approximately $0.07 to $0.19.

Confirming that the move was not merely speculative but supported by genuine market interest, there was sufficient volume to support the initial impulse. Subsequently, participation increased as $CFX rose.

However, that trend changed as the asset transitioned into a sideways structure below the $0.20 mark.

The consolidation box (as annotated above) experienced a decrease in volume over several sessions, which is a common indication that the market was either preparing to accrue energy for a continuation or to unwind.

The subsequent unsuccessful breakout provided an answer to that inquiry. A secondary impulse was briefly attempted by $CFX, which momentarily exceeded $0.27 before experiencing an almost immediate halt.

Despite a sudden increase in candle height, the dearth of follow-through at the peak of the move suggested exhaustion. The volume of $CFX during the breakout attempt briefly increased but failed to maintain its momentum. This is a classic indication of short-term traders attempting to front-run a breakout without a broader conviction.

The short-term peak is now defined by the rejection wick generated by this failed breakout. The price has since reverted to the previous consolidation area. Momentum indicators substantiate this narrative.

The MACD of the token has also crossed below the signal line, resulting in a downward curvature of both lines. This represents a departure from the bullish alignment observed earlier in the month.

$CFX is at risk of further slipping into the $0.16–$0.18 range, where demand was last obviously established, unless it can maintain the current floor around $0.19 and reclaim $0.22 with volume.