Ethena’s ENA surges 15% to $0.61 as USDe stablecoin hits $9.3B market cap, ranking third, driven by 75% growth and DeFi integrations.

In the past 24 hours, there has been a 15% increase in the value of ENA, the native cryptocurrency of the Ethereum-based synthetic dollar protocol Ethena. This is because its USDe stablecoin has become the third-largest in the category, following Tether’s USDT and Circle’s USDC. Over the past month, the on-chain data indicates a significant 75% increase in the supply of USDe on Ethereum, indicating a robust demand in the decentralized finance (DeFi) sector. After today’s gain, Ethena’s price has again traded above $0.61.

Ethena Price Increases Due to USDe Stablecoin Boost

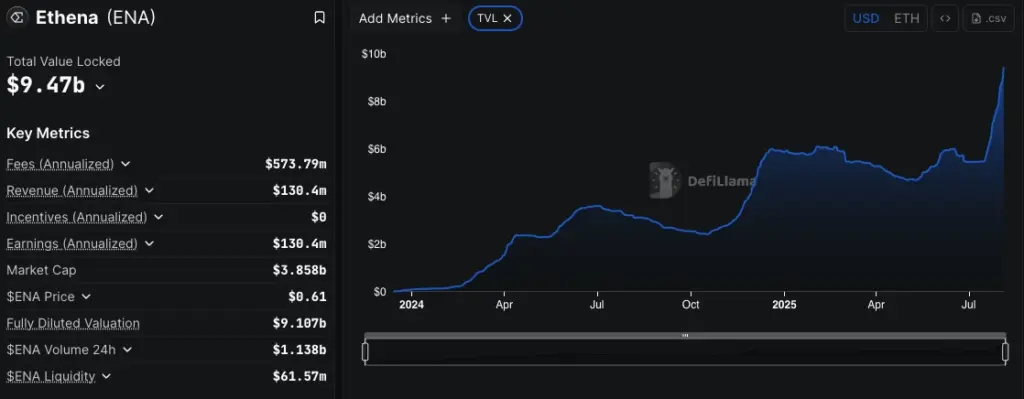

According to DeFiLlama data, Ethena’s USDe stablecoin has experienced a significant increase in adoption, with a 75% increase in supply over the past month, bringing the total to $9.3 billion. The growth has propelled USDe past FDUSD to become the third-largest stablecoin by market capitalization, trailing only Tether (USDT) and USD Coin (USDC).

The USDe market valuation has experienced an astonishing 75% increase in the past month. In addition, the synthetic dollar protocol indicated that it is developing a USD-compliant stablecoin in response to the passage of the GENIUS Act last month.

Additionally, the Ethena DeFi protocol is experiencing a significant increase in popularity, as it has now surpassed $9.47 billion in total value locked (TVL) and has risen to the sixth position. The protocol’s rapid expansion is fueled by recent integrations and high yields, which are attracting diverse stakeholder groups, including more conservative stakeholders and risk-seeking DeFi users.

Amid robust ecosystem expansion, the Ethena price has increased by 140% in the past month. Investors have reason to anticipate a recovery in the wake of the substantial selling pressure last week, as evidenced by the 15% rebound today. The daily trading volume for ENA has increased by 20% to exceed $1.1 billion, indicating that traders are optimistic. The altcoin is expected to continue its upward trajectory to $0.70 within the next month, as noted in the ENA price prediction data from CoinGape.

In July, the Ethena ecosystem experienced substantial USD inflows, totaling $2.96 billion, a significant increase from the $47 million seen in June. At the same time, platform fees increased from $19.96 million in June to $36.5 million in July.

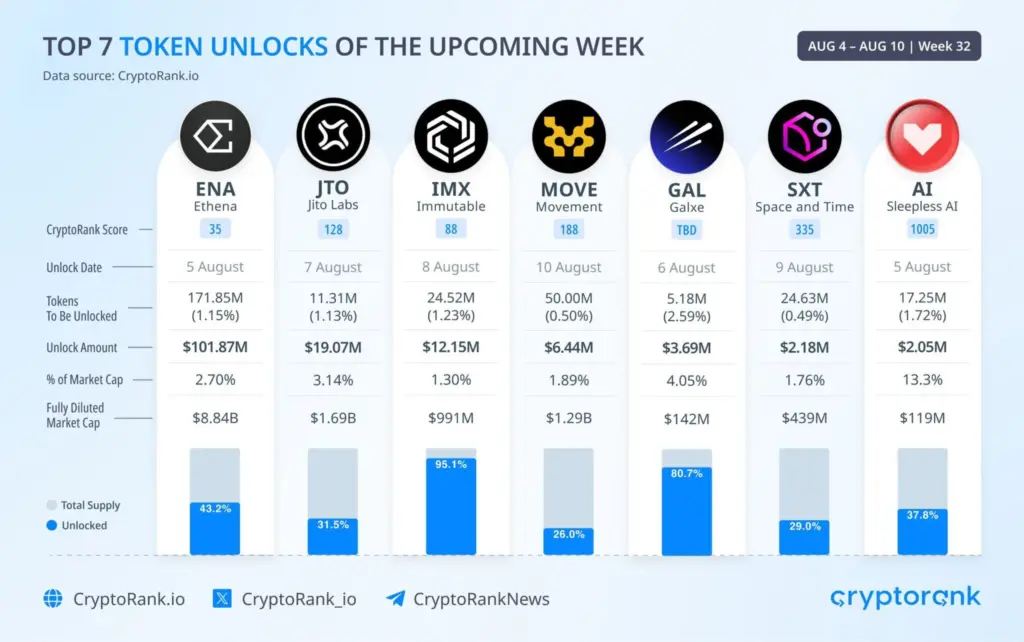

The unlocking of the ENA token has caught the attention of investors

Despite $101.87 million in ENA token releases this week, the Ethena price has rallied today. Consequently, investors should anticipate volatility in the future. Ethena has the most significant token releases this week, according to the data from CryptoRank. This could result in some selling pressure.

In contrast, crypto analyst Ali Martinez stated, “250 million Ethena $ENA have been sent to exchanges in the last two weeks!” This demonstrates that investors anticipate profit-booking following a 140% increase in Ethena’s price in July. Arthur Hayes, a seasoned investor, liquidated 7.76 million ENA coins last week, which were valued at $4.62 million.