Palantir (PLTR) stock rockets 112% year-to-date, hitting $160.66, driven by a $1B Q2 revenue milestone, 48% YoY growth, and a $10B U.S. Army deal.

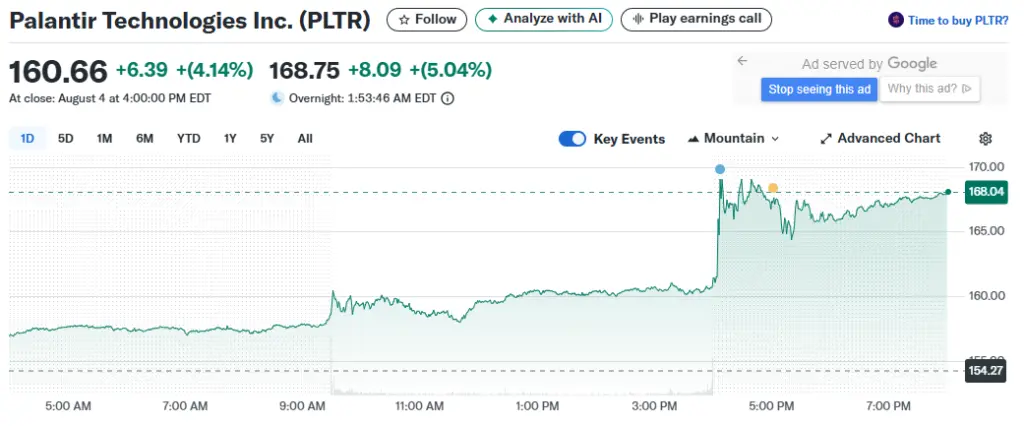

PLTR stock has experienced a 112% year-to-date increase, which was precipitated by Palantir’s exceptionally robust earnings, which significantly increased the stock price. The data analytics company achieved its first quarterly revenue of $1 billion, surpassing analysts’ expectations and providing Palantir stock with a significant increase. The Palantir earnings call demonstrated significant revenue growth in both the commercial and government sectors, resulting in a 4% increase in the stock price immediately following the announcement.

PLTR stock experiences an increase in value as a result of Palantir’s rising stock price and a strong earnings call

The stock of PLTR experiences a surge in value as a result of a record revenue milestone

Palantir’s Q2 2025 results were impressive, demonstrating that the company had achieved the $1 billion quarterly revenue milestone earlier than anticipated. Initially, this milestone was expected to occur in Q4, but it was completed in Q2 instead, and the stock of PLTR responded favorably. Earnings per share were $0.16, surpassing analyst expectations of $0.14. Additionally, total revenue increased by 48% from the previous year.

Alex Karp, the CEO, stated the following:

“The growth rate of our business has accelerated radically.”

This accomplishment has significantly contributed to the recent robust performance of PLTR stock, as investors now recognize the validation of the company’s efforts in the data analytics sector.

The commercial sector at Palantir fuels revenue growth

The most remarkable aspect of these PLTR earnings was the 93% year-over-year growth of the US commercial sector. The US revenue totaled $733 million, a 68% increase that exceeded analysts’ expectations and further bolstered the Palantir stock price.

The company closed agreements worth $2.27 billion during the quarter, a 140% increase from last year. This comprised 42 transactions comprising at least $10 million and 66 transactions valued at a minimum of $5 million. The company’s ability to scale efficiently is demonstrated by the $464 million adjusted income from operations, representing a robust 46% margin.

Stock Outlook for PLTR is Improved by Increased Guidance

Management has elected to increase its full-year revenue guidance to $4.142 billion to $4.150 billion, an increase from the previous guidance of $3.89 billion to $3.90 billion. This substantial upward revision has supported the ongoing strength of the PLTR stock performance.

Analysts anticipate Palantir’s earnings to be between $1.083 billion and $1.087 billion in Q3, significantly higher than their previous estimate of $983 million. The company anticipates that Palantir’s revenue development has genuine momentum, as it anticipates a minimum of 85% year-over-year growth in US commercial revenue.

At the time of this writing, 17 analysts have assigned a consensus Hold rating to PLTR stock, with an average price target of $111.14. Analysts are expected to revise these assessments in response to the robust Palantir earnings call results, particularly in light of the stock’s remarkable 112% year-to-date performance.