Futures-based SOL and XRP ETFs top $1B in inflows months after launch, fueling speculation on possible spot ETF approvals.

Only a few months after their launch, the total inflows into Futures-based SOL and XRP ETFs had surpassed $1 billion.

The possible introduction of spot ETFs is the subject of new discussion due to this spike in investor interest.

Futures-Based SOL, XRP ETFs Make Great Debut

According to new data, since their launches in March and April, respectively, futures-based SOL and XRP exchange-traded funds (ETFs) have attracted more than $1 billion in total.

Contributions to the category’s explosive growth come from the REX-Osprey Solana staking ETF, which has accumulated approximately $150 million in assets under management.

By using futures contracts instead of direct holdings, these products expose investors to changes in the value of their underlying digital assets.

CoinGape has reported that the Teucrium 2X Long Daily XRP ETF (XXRP) has had weekly inflows since its introduction in April 2025.

This illustrates how investors have consistently demanded exposure to leveraged XRP.

AUM of ETF has now topped $160 Million

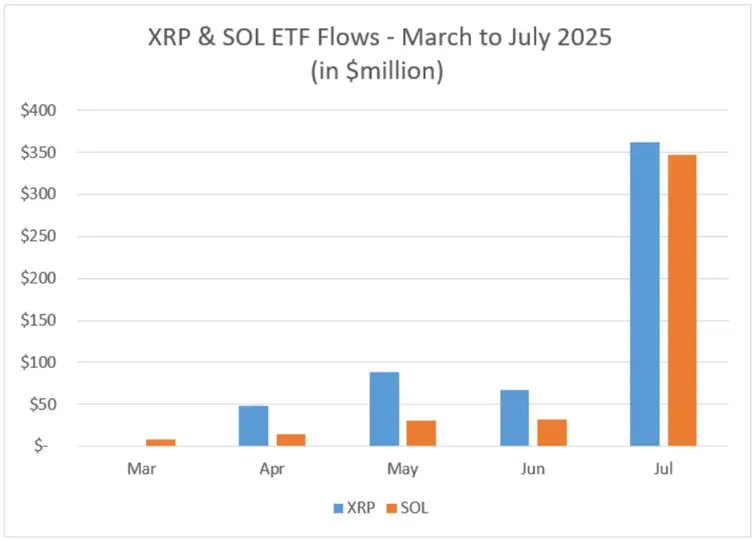

Following comparatively modest inflows in the first few months, Futures-based SOL and XRP ETFs saw a significant spike in July, generating over $350 million.

This implies that regulated products with a crypto link are gaining investor confidence.

In March 2025, Volatility Shares introduced a conventional futures-based fund and a 2x leveraged SOL ETF, making them the first company to provide a Solana-linked ETF.

Spot ETF Expectations Increase

Some experts see the robust success of these futures-based funds as proof of the underlying demand for spot ETFs.

In the past, Geraci maintained that the popularity of the current products would open the door for future BlackRock SOL and XRP ETFs.

Some market analysts point to public statements from BlackRock rejecting immediate plans for such applications, while others maintain that talks are still in progress with a filing date of October.

Analyst MartyParty, however, has rejected online rumors that BlackRock had denied plans for XRP and SOL ETFs.

According to him, discussions with sources verified that the article was untrue and was either made up or misrepresented by a reporter from The Block.

SOL and XRP spot ETF products are still being discussed a lot, according to MartyParty.

He stated that although the exact date cannot be determined, October is still the deadline for any possible applications.

He asked investors in XRP and Solana to unfollow The Block, accusing it of disseminating “biased fake news.”

Notably, the rapid accumulation of capital into XRP and SOL ETFs underscores the need for diverse cryptocurrency investment vehicles in regulated markets.

Investor interest in SOL and XRP is still alive and kicking, as seen by the $1 billion milestone.

The debate around spot ETFs will only get more heated in the coming months.