Vanguard reduced its MicroStrategy stake by 10% in Q2 2025, as MSTR stock hovered around the $360 support amid tight trading.

In the second quarter of 2025, asset management firm Vanguard reduced its ownership of Michael Sayor’s Strategy (formerly MicroStrategy) by 10%.

The MSTR stock has been moving in a relatively narrow range for the last four months, finding support near $360, and has recently lost its volatility.

The biggest shareholder, Vanguard, recently reduced its holding, which has caused some concern about the stock’s short-term future.

Vanguard Reduces MicroStrategy’s Stake

Vanguard’s largest shareholder is reducing its holding in Michael Saylor’s MicroStrategy, indicating a significant institutional shift.

The MSTR stock has been trading in a narrow range for years, and during the last four months, the $360 support level has been tested numerous times.

Even with the company’s ongoing Bitcoin purchases, this underperformance persists.

Technical levels have become even more critical as hedge funds have seized the lead in trading activity while long-only investors have pulled back.

Although the $360 level has withstood numerous retests, experts at 10x Research noted that a breakdown might indicate a significant change in mood.

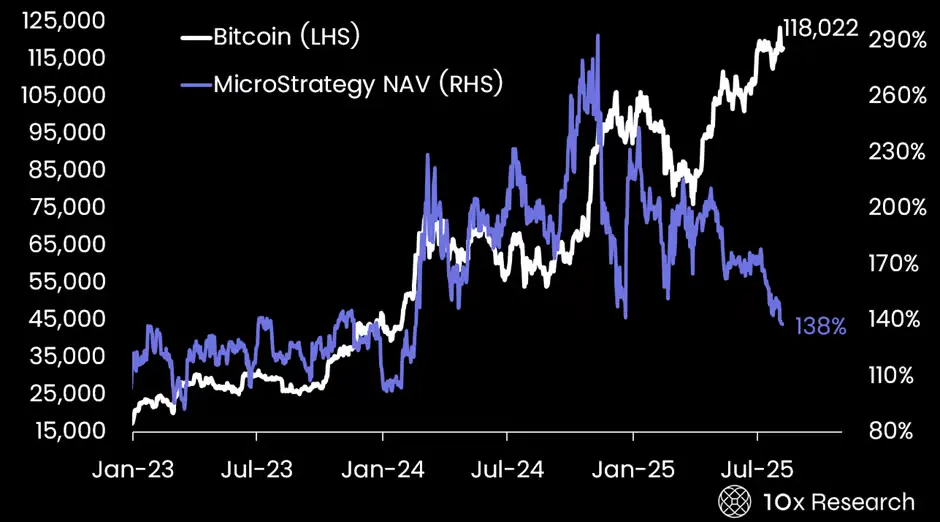

Additionally, the experts noted that the most recent MSTR stock shift coincides with the loss of competitive advantage for Bitcoin treasury-focused businesses.

Attention is beginning to shift away from MicroStrategy to Ethereum treasury and impending cryptocurrency initial public offerings.

Additionally, the analysts cautioned that the stock’s leveraging effect on Bitcoin would be lessened if Bitcoin and MSTR experienced decreasing volatility.

This can make it more difficult for the business to raise money at high prices.

Some analysts think the MSTR stock can rise to $680 after Michael Saylor’s Strategy posted an excellent Q2 with $10 billion in net profits.

According to the researchers at 10x Research, Japan-based Metaplanet has dropped to $1,333, or 37%, while MicroStrategy shares have dropped to $366, or 13%, on the monthly chart.

They stated that both companies no longer have the premium edge that formerly made them desirable stand-ins for exposure to Bitcoin.

Michael Saylor Teases Upcoming Acquisitions

Michael Saylor, the executive chairman of Strategy, alluded to additional Bitcoin transactions in a recent post on the X platform on August 17.

Saylor wrote, “Insufficient Orange,” while presenting the company’s Bitcoin acquisition chart.

Metaplanet and other publicly traded companies have persisted in their Bitcoin acquisition strategy.

Metaplanet reported earlier today that it acquired an extra 775 Bitcoin, bringing its total holdings to 18,888.