The cryptocurrency Dogwifhat, or WIF, has dropped by 3.6% in price. However, significant investments from large-scale holders and the launch of a new validator are prompting speculation of a potential rebound for the meme coin, with some analysts eyeing a breakout to $2.

The script has been turned on $WIF by a clear neckline break. The memecoin completed a conventional head-and-shoulders pattern on August 15, breaking below $0.94 and aiming for $0.65. This bearish shift has the potential to reverse weeks of bullish momentum.

The asset’s price movement reflects fading bullish strength and growing selling pressure, although whale inflows and new validator developments fueled earlier momentum. $WIF may continue under pressure as sentiment shifts defensively across the meme token landscape without a robust recovery above resistance.

Beyond the Beanie: The Potential for a Bullish Rebound in WIF’s Whale Accumulation and New Utility

The pink knitted hat donned initially by Achi, the Shiba Inu mascot of $WIF, was sold for 6.8 BTC (approximately $800,000) on the Bitcoin Ordinals marketplace, Ord City. Finn, the founder of Bags, submitted the winning proposal, promising to “return it to the community.”

Solana’s memecoin spotlight transferred to rivals like $BONK and newcomers such as Pepeto as $WIF cooled off. The rapid evolution of narratives in the meme sector is demonstrated by the shift in attention, which presents a perpetual challenge to maintaining relevance.

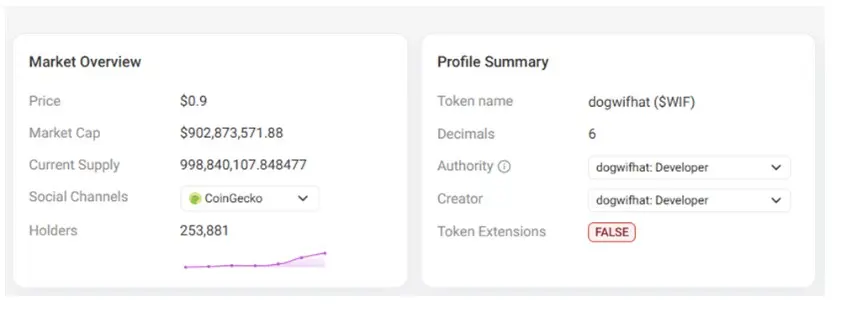

On-chain data demonstrates a compelling narrative of increasing fundamental support for $WIF, despite the recent price decline.

The token was avidly accumulated by whales in July, resulting in a substantial $39 million increase in their holdings of $WIF. This accumulation is particularly significant because the top 100 addresses possess greater than 771 million tokens. Currently, $WIF is the leading source of whale inflows.

The notion that significant holders are transferring tokens from exchanges for long-term storage is further substantiated by a 2% decline in exchange balances over the past 30 days. This is a conventionally bullish indicator that alleviates immediate selling pressure.

The increasing community adoption is underscored by the whale behavior and the fact that $WIF’s holder count has now surpassed 250,000.

The project tries to incorporate a utility layer, even though $WIF’s value is profoundly rooted in its meme status.

DeFi Development Corp has announced the launch of the Official dogWifValidator—DFDV—in a significant development. A powered validator enables holders to receive a portion of the revenue generated by the validator (after operational expenses). This represents a transition to the meme coin’s utility, which Solana’s proof-of-stake mechanics facilitate.

$WIF has maintained robust visibility and trading support throughout the price fluctuations. The token is listed on prominent centralized exchanges, including HTX, OKX, and Bybit.

This multi-platform presence not only promotes a healthy trading volume but also assists in stabilizing market behavior during periods of volatility. The analysts recommend a consolidation in anticipation of an optimistic breakout to $2.

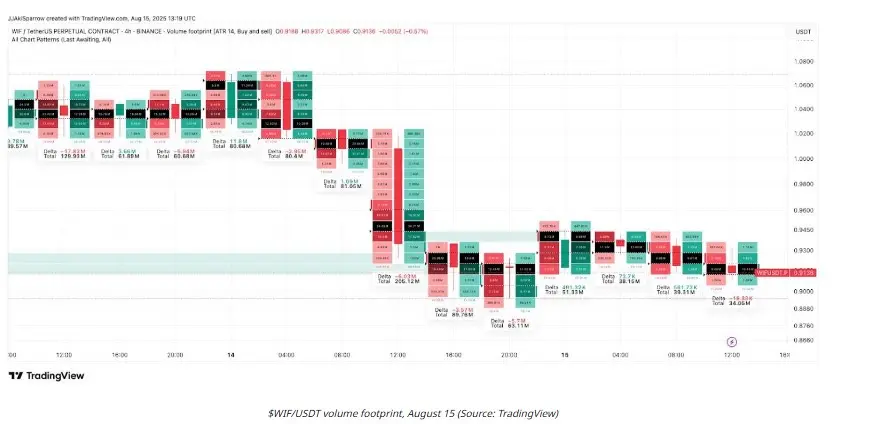

$WIF Faces Breakdown Risk After Topping Formation and Sustained Selling Pressure

A textbook head-and-shoulders pattern has emerged on the 4-hour chart, with $WIF’s recent trend transitioning from bullish to potentially bearish.

This pattern is characterized by a peak shaped like a “head” and connected to two lesser peaks, which are referred to as the “shoulders.” The troughs are connected by a neckline that runs between the peaks. A break below this neckline confirms the reversal.

$WIF’s trend reversal is further validated by a clear neckline break around $0.94, as shown in the chart. This event establishes the foundation for a projected move toward the $0.65–$0.66 area. Price has since retested the underside of that neckline, but he has been unable to reclaim it convincingly.

The volume chart also exhibits aggressive sell deltas, particularly during the breakdown and subsequent recovery attempts.

Cumulative delta remains negative, as evidenced by the numerous 4-hour candles that have produced high sell imbalances, particularly at market lows. This suggests that bears are still active and are consuming bullish attempts.

Furthermore, the RSI remains at a level just above 40, indicating a decline in bullish momentum while avoiding oversold conditions. The MACD histogram continues to decline below the baseline, and the signal line crossover is flattening, further reflecting a loss of upward momentum.

The short-term bias has shifted to bearish as the 20-period SMA trends below the 100-period SMA. The adverse case is further exacerbated by the price being confined below both moving averages.

For bulls to invalidate this breakdown, WIF must reclaim the $0.94–$0.96 range with robust volume and positive delta shifts. The most probable course of action until that time is to continue on the downside.

If the anticipated head and shoulders formation target is achieved, the critical interest levels will be $0.80 for interim support and $0.65 as the measured move concludes. To assess potential absorption or capitulation, traders should observe volume reactions at each support test.

The trade has become increasingly defensive, and unless investors demonstrate a strong level of conviction, WIF may continue to retrace further.