Multi-chain lending platforms unlock cross-chain finance—borrow on ETH, repay on SOL, and manage your loans with secure, fast, and cost-efficient blockchain technology

Introduction

Cross-chain messaging protocols like Chainlink CCIP, Axelar, and LayerZero are reshaping how multi-chain lending platforms operate in 2025.

These technologies enable loans originated on one blockchain to be serviced on another without relying on wrapped assets—a breakthrough that removes a long-standing barrier to true interoperability.

By securely transmitting messages and transaction instructions across chains, they allow lenders and borrowers to interact seamlessly across different ecosystems, unlocking new efficiencies in liquidity management and loan servicing.

A key enabler of this interoperability is Circle’s Cross-Chain Transfer Protocol (CCTP), which powers native USDC “teleportation” between chains.

Instead of using risky bridge liquidity pools or wrapped tokens, CCTP burns USDC on the source chain and mints an equivalent amount on the destination chain, ensuring a 1:1 peg at all times.

For multi-chain lending platforms, this capability means instant, frictionless repayments and collateral adjustments—critical features for institutions and DeFi protocols seeking to operate across multiple blockchains without added counterparty risk.

However, the expansion of cross-chain infrastructure brings heightened security challenges. Mid-2025 reports from Chainalysis show that cross-chain bridge exploits have already resulted in over US $2.17 billion in stolen funds—surpassing the total for all of 2024—with projections indicating losses could reach US $4 billion by year’s end.

Meanwhile, Elliptic reports that more than US $21.8 billion has been laundered through cross-chain methods in 2025 alone, nearly triple the figure from two years prior.

Criminal actors are exploiting the same interoperability features that power legitimate lending, making robust risk-monitoring systems essential.

For developers and operators of multi-chain lending platforms, the opportunity is clear, but so is the responsibility.

By integrating secure messaging layers like CCIP with stablecoin rails such as CCTP, platforms can deliver seamless cross-chain experiences while maintaining a strong security posture.

As capital flows increasingly span multiple blockchains, the ability to combine efficiency, composability, and security will define the next generation of decentralized lending infrastructure.

What Are Multi-Chain Lending Platforms?

Multi-chain lending platforms are decentralized finance (DeFi) systems that enable lending markets to operate across multiple Layer 1 and Layer 2 blockchains.

In these platforms, critical components of the loan lifecycle—such as collateral deposits, borrowings, repayments, and liquidations—can occur seamlessly across disparate chains.

This contrasts with traditional single-chain lending protocols; here, users aren’t limited to a single ecosystem—they access liquidity, deploy collateral, and execute loan actions wherever it’s most efficient.

With the inflation of interconnected ecosystems, multi-chain lending platforms grant users broader access to capital and flexibility, offering a powerful, composable infrastructure for modern DeFi.

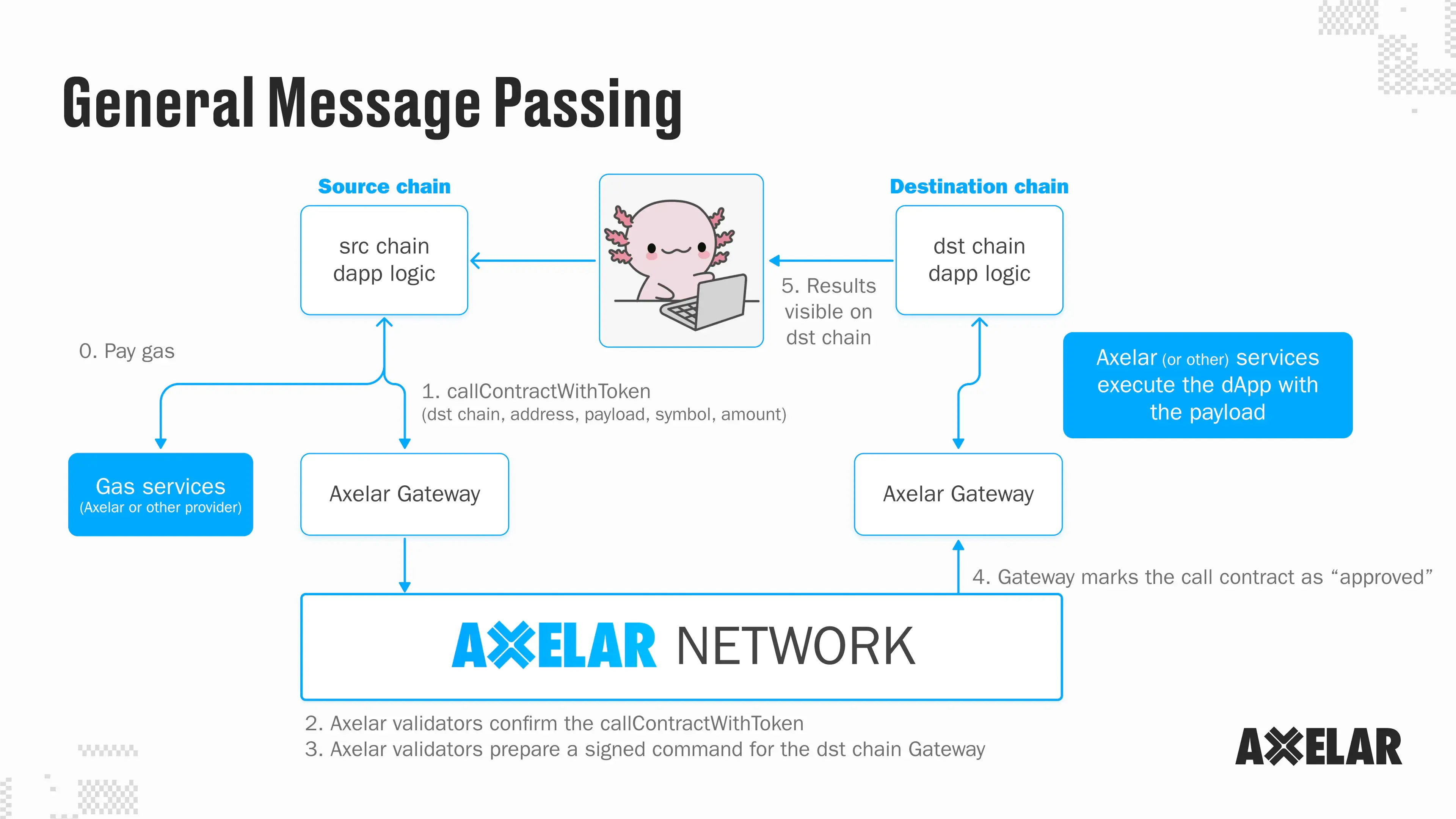

A foundational distinction of these platforms lies in their use of general message-passing infrastructure—for instance, Axelar’s General Message Passing (GMP)—rather than relying solely on cross-chain asset wrapping.

GMP allows developers to transmit arbitrary messages and invoke smart-contract logic across chains, enabling lending protocols to, for instance, lock collateral on Chain A while triggering a loan disbursement on Chain B via a coordinated chain of messages

Prime Protocol on Moonbeam provides a concrete example: users can deposit assets across nine different chains, and via Axelar GMP, the protocol coordinates borrowing on another chain, all while paying gas fees using tokens native to the source chain

Similarly, Chainlink’s Cross-Chain Interoperability Protocol (CCIP) is a key enabler for truly programmable multi-chain lending.

CCIP supports programmable token transfers, which allow tokens and instructions to be sent together in one secure, atomic transaction—and arbitrary messaging, enabling borrowers and lenders to trigger complex cross-chain operations like loan initiation, collateral adjustments, and automated liquidations

For instance, Folks Finance is integrating CCIP to build a “Hub & Spoke” architecture that lets users deposit collateral on one chain and borrow assets on another using seamless cross-chain messaging—and leverages Chainlink’s robust Risk Management Network for added security

Key Distinctions: Multichain Lending vs. “Bridge-and-Borrow” dApps

- Message-Driven vs. Asset-Wrapping: Traditional “bridge-and-borrow” applications typically rely on wrapped tokens—bridging assets via lock-and-mint mechanisms. In contrast, Multi-Chain Lending Platforms, leveraging GMP or CCIP, enable native cross-chain messaging and programmable transfers, allowing loan logic to be executed across chains in a coordinated and secure manner.

- Programmability & Composability: Rather than simply moving tokens, these platforms embed logic into the cross-chain flow. CCIP’s programmable transfer feature allows a token to be transferred and immediately used in a loan-triggering function on the destination chain—without manual intermediary steps

- Enhanced UX and UX Benefits: Developers and users benefit from smoother experiences. With CCIP or GMP, users no longer need manual bridging or chain hopping—they can interact with lending flows across ecosystems as if they were single-chain transactions.

By incorporating Axelar’s GMP or Chainlink’s CCIP, multi-chain lending platforms transcend the limitations of isolated DeFi systems.

They unlock new levels of interoperability, capital efficiency, and developer flexibility—empowering users to borrow, repay, and manage collateral across the evolving landscape of blockchain networks.

The Core Plumbing: How “Borrow on ETH, Repay on SOL” Actually Works

When a borrower initiates a loan on Ethereum—locking collateral such as ETH or wBTC—the system records this intent on the Ethereum collateral contract. That initial step establishes the borrower’s position and marks the beginning of a cross-chain orchestration.

Once the loan is active, the platform sends a cross-chain instruction via a messaging protocol—such as Chainlink CCIP, Axelar GMP, or LayerZero—to the loan manager deployed on the Solana side (or an intermediary chain).

This instruction bridges the gap between ecosystems, enabling the Solana agent to recognize and track the loan’s state. Chainlink CCIP is especially powerful here due to its support for arbitrary messaging and programmable token transfers, allowing both instructions and tokens to be sent atomically in one transaction

To repay the loan on Solana, the user leverages Circle’s Cross-Chain Transfer Protocol (CCTP): USDC is burned on Ethereum and minted equivalently on Solana, enabling seamless, native stablecoin transfers for repayment or interest servicing without using wrapped assets

Behind the scenes, accounting and state synchronization happen via cross-chain messaging. With Axelar’s GMP, platforms can mirror a loan’s health factor, accrued interest, and repayment amounts across chains—ensuring consistent state across both the Ethereum-originated collateral and the Solana-side loan—that updates the borrower’s position accordingly

Cross-chain finality and security are critical. Each blockchain has different confirmation and reorganizational behaviors. Ethereum, for instance, may require multiple confirmations before a transaction is considered final.

Cross-chain systems often use intent layers, routers, or additional finality assurances to reduce the risk posed by reorgs—ensuring loan actions are not reversed mid-transaction.

Chainlink CCIP’s programmable token transfers enable even richer experiences by embedding instructions with the repayment itself. For example, a repayment transaction could carry encoded logic: “apply funds to Loan #123 and close the position if its health factor exceeds 1.05.”

This allows the entire repayment and state transition to execute atomically in a single cross-chain flow—reducing manual steps and complexity

Summary Flow: Borrow on ETH, Repay on SOL

- Collateral deposit on Ethereum—e.g., ETH or wBTC locked as loan security.

- Cross-chain instruction sent via CCIP/Axelar/LayerZero—loan details forwarded to the Solana loan manager contract.

- USDC moves via CCTP—burned on Ethereum, minted on Solana to handle repayments or interest.

- Accounting & synchronization—loan position updates (balances, health factor, accrued interest) are mirrored via message passing.

- Finality & reorg safety—protocols deploy extra checks (intent routers, confirmations) to mitigate risks of chain reorganizations.

- Programmable token transfers—repayments bundled with execution instructions simplify the process (e.g., “repay and close if healthy”).

By combining message-driven interoperability (CCIP, GMP) with native stablecoin rails (CCTP), multi-chain lending platforms unlock seamless cross-chain operations—enabling users to borrow on one chain and repay.

The Interoperability Stack (2025 Landscape):

The interoperability stack in 2025 has matured into the backbone of multi-chain finance and is now shifting toward standardized messaging layers and native settlement rails.

Instead of simply “moving assets around,” today’s interoperability solutions enable cross-chain logic execution, composable governance, and instant settlement—the building blocks for scalable multi-chain lending, trading, and liquidity systems.

Messaging Layers

Chainlink CCIP (Cross-Chain Interoperability Protocol) empowers multi-chain operations by enabling both token transfers and arbitrary data delivery in a single, secure transaction.

This capability extends beyond asset movement—allowing complex cross-chain governance, programmable actions, and transactional logic execution. It’s a critical tool for multi-chain lending platforms, facilitating streamlined coordination across chains using real-time, atomic messaging.

Axelar General Message Passing (GMP) provides a highly programmable interoperability layer that dominates Axelar’s network activity. In Q2 2024, GMP accounted for roughly 97% of transactions and active addresses, and in Q1 2024, it was 92%, showcasing its dominant role in enabling smart contract calls and data flows across chains.

GMP lets developers invoke any function on any connected chain, unlocking advanced use cases like cross-chain liquidity pooling, universal lending, and seamless DeFi application logic.

LayerZero’s Omnichain Apps (OApps) and Omnichain Fungible Tokens (OFTs) follow the “omnichain app” pattern, used extensively by cross-chain money markets.

These abstractions let developers build interoperable applications with unified front-ends, leveraging LayerZero’s cross-chain messaging for token movement and function invocation across connected networks.

(While no recent quantitative data was available in the search, LayerZero’s network and OApps/OFTs are well recognized as being adopted by numerous cross-chain lending and yield protocols.)

Settlement Rails: USDC CCTP (Cross-Chain Transfer Protocol)

Circle’s Cross-Chain Transfer Protocol V2 (CCTP V2) is central to native USDC movement across chains. Released on March 11, 2025, it adds two powerful features—Fast Transfer and Hooks—while retaining support for the original Standard Transfer mechanism:

- Fast Transfer dramatically reduces cross-chain USDC transfer times from minutes (governed by source chain finality in V1) to seconds, even before source-chain finality is confirmed.

- Hooks allow developers to automatically trigger smart contract actions upon successful transfer—enabling atomic operations like depositing into lending pools or executing repayments.

These enhancements make CCTP V2 not just faster but more composable—crucial for building efficient and seamless multi-chain lending systems.

Recent deployments highlight its growing adoption:

- Hyperliquid is gearing up to integrate native USDC and CCTP V2, replacing bridged assets with Circle-issued stablecoin and supporting high-speed, capital-efficient cross-chain USDC transfers. This comes as Hyperliquid’s total assets under management surged past US $5.5 billion, largely fueled by USDC inflows.

- On the Sei Network, native USDC and CCTP V2 deployments are live, enabling cross-chain access across 13 networks without intermediaries—positioning Sei as a robust hub for cross-chain capital flows.

- World Chain (WLD) has upgraded 27 million users from bridged USDC to native USDC, enabling fast CCTP V2 transfers—especially pivotal for remittance-heavy use cases.

Routers & Intents: Gas and Route Optimization

Atop the messaging and settlement layers, routers and intent abstractions intelligently optimize transaction paths and gas usage.

They abstract away complexity by selecting the most efficient routes—aggregating messaging protocols (like GMP, CCIP, or LayerZero) with swap logic or gas-payment mechanisms.

These layers enable features such as “swap-and-pay” or “send intent,” where users seamlessly combine cross-chain messaging, token conversion, and settlement in a single UX.

While specifics vary by protocol, such abstractions are central to elevating developer and user experience in complex multi-chain flows.

Platform Archetypes & Case Snapshots

Before breaking down the stack’s content, it’s worth noting why these examples matter. Each represents a different architectural response to the challenge of scaling DeFi across multiple chains.

Whether it’s omnichain lending markets, cross-chain brokerage, or blue-chip protocols integrating secure messaging, these case studies highlight both the innovation and the risk exposures shaping multi-chain finance.

They also set the stage for understanding how AI-risk scoring can be applied in varied contexts—from fragile new deployments to well-established platforms adopting cross-chain infrastructure.

Omnichain Money Markets: Radiant Capital

Radiant Capital positions itself as a pioneering omnichain money market, powered by LayerZero’s message-passing infrastructure.

The platform allows users to deposit major assets like ETH, wBTC, and USDC on one chain and borrow various supported assets across multiple chains without siloing liquidity

Radiant’s design includes dynamic liquidity providers (“dLPs”), who lock tokens—particularly its native $RDNT—to earn yield, governance rights, and protocol fees, while borrowers use collateral across chains with flexible rTokens (e.g., rUSDC, rETH) representing their positions

The platform, however, faced significant challenges: in late 2024, Radiant suffered a high-profile exploit, wiping out nearly 98% of its total value locked (TVL), illustrating the fragility of early omnichain deployments despite the promise of cross-chain capital efficiency

Cross-Chain Credit Brokers: Prime Protocol Case Study

Prime Protocol exemplifies the cross-chain prime brokerage model, enabling users to deposit collateral on any chain and borrow funds on another—an approach that unlocks “cross-margin” capabilities in DeFi

Built using Axelar GMP and following a hub-and-spoke architecture anchored on Moonbeam, Prime avoids traditional bridge models. Instead, collateral remains on native chains, with a central hub syncing state via secure messaging.

Deposit contracts on connected chains relay user-deposit data to the hub, which caches the information and facilitates immediate borrowing actions on any supported chain via outward messaging

This architecture not only improves user experience—providing seamless liquidity access across chains—but also demonstrates Axelar GMP’s potency in delivering secure, multi-chain coordination without moving assets off-chain.

Blue-Chip Integrations: Aave + CCIP

Aave has taken strategic steps toward integrating Chainlink’s CCIP into its operations, especially regarding cross-chain deployment of its stablecoin GHO and multi-chain governance mechanisms.

Early integration plans, documented in governance proposals and strategy discussions, outline CCIP’s role in enabling secure, atomic token transfers of GHO across chains like Arbitrum and Base, aiming to improve accessibility and liquidity while retaining protocol control and risk oversight

Aave’s GHO rollout on Base, facilitated by CCIP and Chainlink’s Cross-Chain Token (CCT) standard, includes carefully enforced supply/borrow caps, programmable transfers, and embedded risk controls supported by a dedicated risk management oracle network

Beyond stablecoin flows, Aave has integrated CCIP into its cross-chain governance infrastructure, migrating from multiple native bridges to a unified messaging layer—reducing complexity and enhancing security

Conclusion

Multi-chain lending is evolving into program-and-prove infrastructure. The ability to lock collateral on Ethereum, service debt on Solana, and prove every step on-chain with verifiable messaging and native stablecoin rails is more than a technical feat. It’s a UX transformation that blends speed, security, and transparency into a single, seamless experience.

The winners in this space will be those who treat interoperability as core protocol logic, not an afterthought—leveraging programmable token transfers, low-latency settlement rails, and intent-based routing to make complex cross-chain flows feel like local transactions.

When platforms achieve that, they don’t just deliver convenience; they create defensible, measurable reliability that turns early adopters into loyal users and liquidity providers.

FAQ

Can I repay a loan on Solana if my collateral is on Ethereum?

Yes. Multi-Chain Lending Platforms can use secure message-passing protocols like Axelar GMP or Chainlink CCIP, combined with Circle’s CCTP, to mint native USDC on Solana for repayment. This removes the need for manual bridging or off-chain coordination.

Do I still need wrapped assets for repayments?

Not for USDC if you’re using CCTP’s native burn-and-mint mechanism. However, for non-CCTP-supported assets, wrapped tokens or synthetic versions may still be required depending on the lending platform’s design.

What is the biggest risk in multi-chain lending?

The most significant risks are in bridge and messaging integrity, as well as liquidation latency. A failure in these layers can result in missed liquidations or loss of funds, making robust security audits essential.

How fast can repayment reach finality?

Repayment speed varies by chain and settlement rail. Well-optimized systems aim for P95 finality targets and provide on-chain proofs to confirm repayment status in near real-time.