DBS Bank to tokenize structured notes on Ethereum, as corporate ETH treasuries reach $17B, signaling growing blockchain adoption.

DBS Bank has declared that it will commence the issuance of structured notes on the Ethereum blockchain. This occurs after the ETH treasury’s total valuation surpasses $17 billion.

DBS Bank Introduces Tokenized Ethereum Structured Notes

In a press release, DBS, the largest bank in Singapore, has recently disclosed its intention to issue structured notes through the Ethereum blockchain. This is a critical phase in the development of tokenized finance. The bank will grant accredited and institutional investors access to sophisticated financial products.

The structured notes will be accessible on digital platforms like HydraX, DigiFT, and ADDX. Structured notes typically necessitate a minimum investment of $100,000. They are non-fungible and difficult to sell because they are customized to satisfy the specific requirements of investors. DBS will issue tokens valued at $1,000 each through tokenization, facilitating the trading of these products.

The initial offering will expose investors to digital assets by tokenizing cryptocurrency-linked participation notes. Investors would not necessitate physical ownership of cryptocurrencies. These notes are intended to provide payments in the event of an increase in cryptocurrency prices and provide downside protection against potential losses.

DBS intends to broaden its digital asset ecosystem by tokenizing notes linked to credit and equity, in addition to cryptocurrency. Li Zhen, the Head of Foreign Exchange and Digital Assets at DBS, underscored the significance of this development.

“Asset tokenisation is the next frontier of financial markets infrastructure. Since 2021, DBS has been scaling this ecosystem by fostering responsible innovation, enabling tokenisation to meet real market demand and make financial markets more efficient and accessible,” he shared.

The decision was made in response to the exclusive introduction of crypto-linked structured notes for its clients by DBS in 2024. Trading in these instruments exceeded $1 billion during the initial half of 2025. This represented a 60% increase from the preceding quarter.

The valuation of Ethereum Treasuries has reached $17 billion

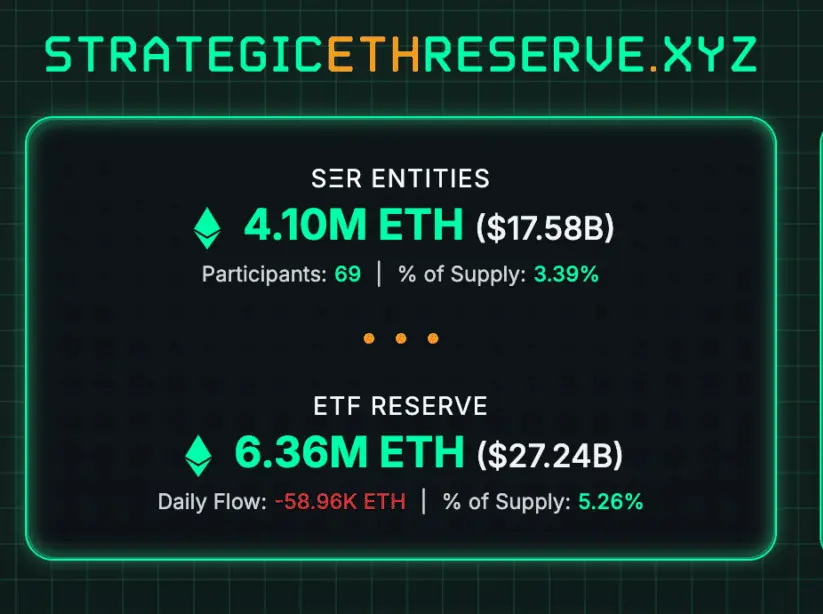

The announcement by DBS Bank is concurrent with an increase in the treasury holdings of ETH. According to data from StrategicETHReserve, entities collectively possess more than 4.1 million ETH. This represents 3.39% of the total supply and is valued at $17 billion.

BitMine Immersion Technologies is the market leader, with an estimated 1.5 million ETH valued at $6.6 billion. The company recently acquired 52,475 ETH for $220 million, bolstering its robust portfolio. The significance of this shift in strategy is that the organization typically concentrates on Bitcoin mining.

SharpLink Gaming ranks second, with 740,760 ETH valued at $3.2 billion, following a significant acquisition earlier this month. After raising $97 million, the Ether Machine currently possesses 345,400 ETH. Additionally, the Ethereum Foundation maintains a treasury of 231,600 ETH.

The DBS Bank’s plan and the increase in ETH held by these businesses indicate Ethereum’s significant status as a top blockchain for financial infrastructure.