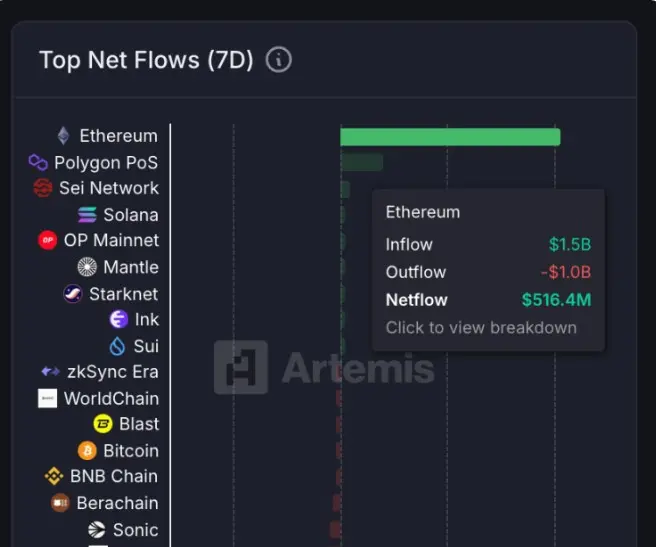

The Ethereum blockchain has recorded a net inflow of $516 million over the past week, far outpacing other networks and reinforcing its position as a dominant force in the crypto market. The surge in funds indicates strong investor confidence and a growing interest in the network’s decentralized applications.

The investors are currently in control of momentum, as Ethereum continues to outperform Bitcoin. BTC is currently consolidating within the same price range as it did a month ago, while ETH has assumed the lead, bolstering the argument for an extended altcoin rally.

The market is transitioning into a phase in which altcoins are beginning to demonstrate strength across the board, with Ethereum leading the charge.

Ted Pillows, a prominent analyst, contributed to the optimism by providing new insights that indicate Ethereum’s ongoing dominance in decentralized finance (DeFi).

He underscored that Ethereum remains the leading chain in DeFi, solidifying its status as the sector’s foundation. Many believe Ethereum is poised for a long-term upswing due to the increasing adoption of institutional investors, the contraction of the exchange supply, and the intensification of derivatives activity.

Ethereum Netflows Surge Amid Fed Speculation

Ethereum’s recent on-chain activity has once again served to solidify its position as the leading cryptocurrency in the market. Ethereum has experienced a netflow of +$516.4 million over the past seven days, surpassing all other networks by a significant margin. To provide context, Polygon, the second-largest company, generated only $102.9 million during the same period. This considerable disparity underscores Ethereum’s status as the undisputed leader in attracting and retaining liquidity.

The timing of this surge is closely associated with macroeconomic developments. After Federal Reserve Chairman Jerome Powell’s remarks at Jackson Hole, stating that “the baseline outlook and the shifting balance of risks may warrant adjusting our policy stance,” markets began to heat up.

This statement has reignited optimism in both conventional and crypto markets, as it has sparked widespread speculation that the Federal Reserve may reduce interest rates in September.

The robust netflows of Ethereum indicate the conviction of both institutional and retail investors. Investors are preparing for additional gains in anticipation of enhanced liquidity conditions.

The inflow surge suggests a trend toward Ethereum as the primary vehicle for DeFi, staking, and treasury strategies, in addition to the buying pressure.

Weekly Price Analysis: Reaching New ATH

The weekly chart indicates that Ethereum (ETH) has achieved new all-time highs, officially breaking into uncharted territory. After months of consolidation and a steep rally recently, the breakout above the 2021 peak near $4,860 confirms a significant bullish structure. ETH concluded this candle strongly, closing at approximately $4,876, representing a nearly 9% increase within the week.

The structure emphasizes the persistence of bullish momentum. ETH is currently trading at a high level, surpassing its 50-week ($2,823), 100-week ($2,794), and 200-week ($2,446) moving averages.

Reinforcing the bullish trend, this alignment is characterized by shorter-term moving averages trending higher than the longer-term ones. Momentum indicators also imply that buyers remain in control, supported by institutional flows and derivatives positioning.

The sole source of significant resistance is price discovery, as ETH has no historical levels that exceed its current price. In these phases, rallies frequently extend rapidly, particularly when accompanied by robust on-chain accumulation trends and increasing open interest.

On the downside, immediate support rests around the $4,300–$4,200 zone, which coincides with the breakout region. The bulls firmly defend this area, despite the potential for deeper corrections if lost.