Gemini’s tease of an XRP Mastercard launch on August 25, 2025, with Ripple and WebBank, drives XRP past $3, sparking hope for mainstream adoption.

Gemini has suggested that it may introduce its inaugural XRP-branded Mastercard in the United States. This, in turn, resulted in an increase in conjecture regarding the feasibility of this in the financial systems. This occurs as the price of XRP continues to increase in accordance with its previous highs.

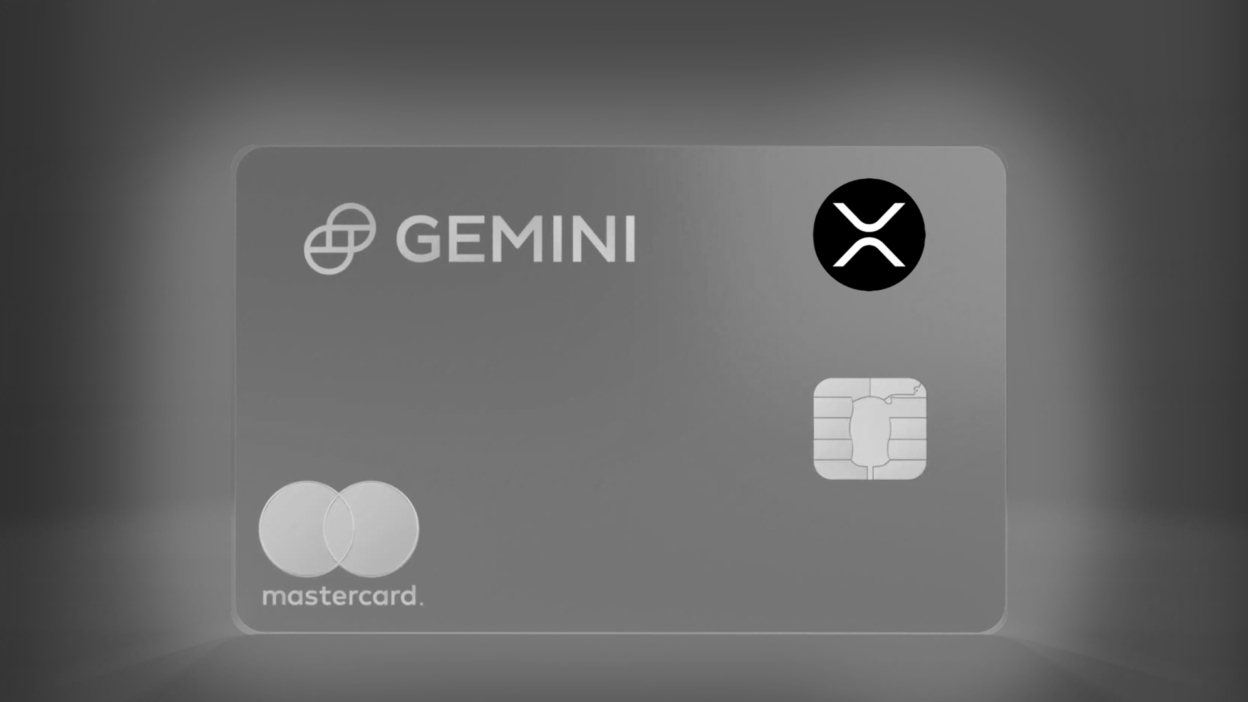

A Hint at the XRP Mastercard Launch from Gemini

The prospective launch of a Gemini XRP Mastercard has continued to generate speculation. This occurred after Gemini shared an image of a billboard in New York City that read, “Prepare your bags.” It also had a potential release date of August 25, 2025. Even though Gemini has not provided an official confirmation, the decision has elicited various responses from the XRP community.

Cameron and Tyler Winklevoss, co-founders of Gemini, were included in the conversation by crypto litigator John Deaton. He made a casual bet that the card could outperform current crypto-linked cards.

Not all individuals are persuaded. The reliability of the rumors was called into doubt by an investor named WrathofKahneman. He observed that Gemini already offers a credit card with cryptocurrency rewards. Kahneman also advocated for the inclusion of additional credible sources to confirm whether the forthcoming product will indeed enable direct payments with XRP.

This debate is reminiscent of a post from March, in which Gemini co-founder Tyler Winklevoss inquired about the XRP community’s willingness to accept a credit card that provided rebate rewards in XRP.

According to reports, Ripple, Gemini, and Mastercard have collaborated to provide the product, which WebBank will distribute to guarantee regulatory compliance in the United States. Reports indicate that the companies contributed $75 million to the venture, which is designed to expedite the token’s integration into the conventional finance sector.

The Mastercard would seamlessly convert token balances into fiat at the point of sale if it were to be launched. This would facilitate the use of digital assets to make routine purchases. This occurs at a time when institutions are increasingly in search of practical applications for cryptocurrencies that extend beyond trading.

Market gains bolster prices of XRP

The price of XRP has continued to increase amid the speculation, as evidenced by CoinMarketCap data. The token has experienced a 6.52% increase to $3.05 in the past 24 hours, surpassing Bitcoin.

This occurs after the Second Circuit Court approves of the joint dismissal of the XRP lawsuit. The approval officially concluded nearly five years of legal problems. With the case behind it, experts contend that the altcoin is now more advantageously situated for institutional acceptability.

Additionally, Canary Capital has recently revised its S-1 filing for an XRP ETF with the SEC. Additionally, the applications of other prominent asset managers, including Greyscale, CoinShares, and WisdomTree, were updated. This action, which was likely precipitated by SEC input, was deemed a positive development.

Analysts have expressed that the approval of spot XRP ETFs is becoming more probable, which is why the SEC has postponed its rulings until October 2025. Bitcoin’s liquidity boom, which was propelled by exchange-traded funds (ETFs), could be replicated by the approval of billions in institutional inflows. The altcoin community is increasingly enthusiastic, even though Gemini has not yet confirmed the rumored launch.