Strategy launches a $1B U.S.-listed BNB treasury company, leveraging its 628,791 BTC model to tap institutional demand for BNB.

B Strategy has disclosed its intentions to establish a $1 billion U.S.-listed BNB treasury corporation with the assistance of YZi Labs. The transaction transpires amid BNB’s trading near record highs.

Amid robust market demand, an investment firm intends to establish a $1 billion BNB Treasury Fund

According to the official announcement, B Strategy, a prominent investment firm, stated that the new vehicle is designed to raise $1 billion and provide institutional investors with structured exposure to BNB. The company aims to establish itself as the “Berkshire Hathaway” of the BNB ecosystem by maintaining the token as a treasury asset.

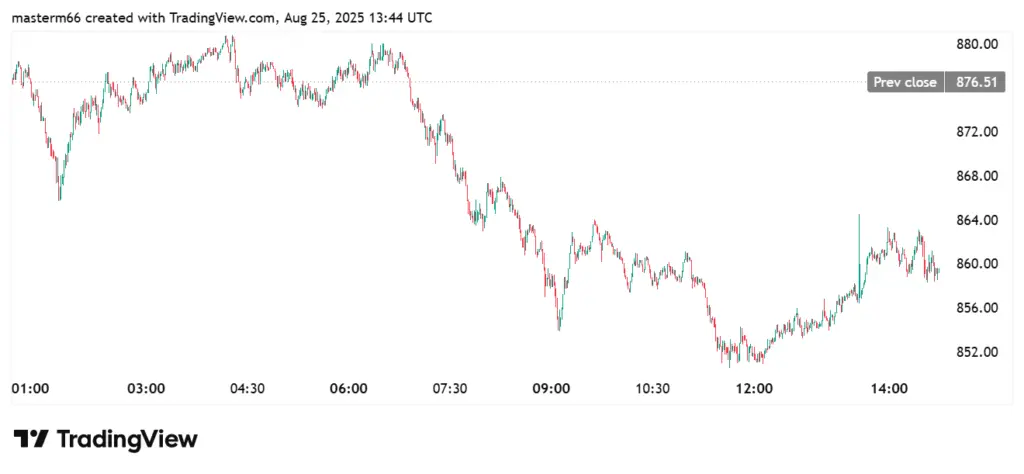

According to TradingView data, the price of BNB has decreased by 1.7% in the past 24 hours, currently standing at $861. However, the token has experienced a nearly 10% increase in the past month and a 38% increase in the latter half of the year.

The token has returned over 48% over twelve months, with YTD returns exceeding 22%. Last week, BNB also achieved a new all-time high, underscoring the robust demand and institutional interest.

The company stated that it has already attracted anchor investors, particularly family offices in Asia. The treasury company is anticipated to secure financing in the coming weeks. B Strategy stated that its objective is to expand BNB’s involvement in financial markets, provide institutional-grade execution, and connect global capital with blockchain opportunities.

Leon Lu, the founder of B Strategy and co-founder of Metalpha, stated that the BNB treasury company will maintain its crypto expertise while adhering to U.S. public market standards. He clarified that the organization aims to optimize BNB per share while providing investors transparency and security. Lu was previously responsible for managing a crypto equities fund seeded by Bitmain and achieved a 276% return within two years.

Max Hua, the former CFO of Bitmain and co-founder of B Strategy, has announced that the new treasury firm will implement rigorous risk management and independent auditing of its holdings. BNB is considered a cornerstone of the new era of financial markets by Ella Zhang, the director of YZi Labs.

She emphasized the token’s ability to facilitate the adoption of real-world assets, Web3, and stablecoins. Zhang said B Strategy is uniquely positioned to amplify the growth of the BNB ecosystem with its $1 billion plan.

Despite the optimism surrounding this plan, a related experience suggests caution. After failing to satisfy the minimal listing requirements, Windtree Therapeutics, an additional U.S.-listed company that implemented BNB as a corporate treasury asset, was delisted from Nasdaq.