Ethereum rose 5% in 24 hours after ETF approval and has approached the psychological $4,000 price threshold by $70 as of the start of trading on May 27.

In early trading on May 27, the price of Ether ETH, currently denominated at $4,000 and has risen 5% in the preceding twenty-four hours, is approaching $4,000, eliciting optimism that this may mark the start of Ether’s post-ETF approval surge.

The asset reached an intra-day high of $3,930, up nearly 5% on the day, according to data from Cointelegraph; ETH also peaked at a comparable level days before the May 23 approval of spot Ether ETFs.

As a result, ETH gained 27.5% in value over the previous week, surpassing Bitcoin (BTC), which earned a mere 3.8% during the same period.

On May 27, analyst Matthew Hyland informed his 143,000 X followers that an increase in volume further validated the breakout and verified a bullish divergence and a break of the downtrend for ETH.

The significant weekly movement has prompted an onslaught of forecasts from industry analysts and observers.

Arthur Cheong, founder of DeFiance Capital, predicted on X on May 26 that ETH would reach $4,500 before the debut of spot ETFs.

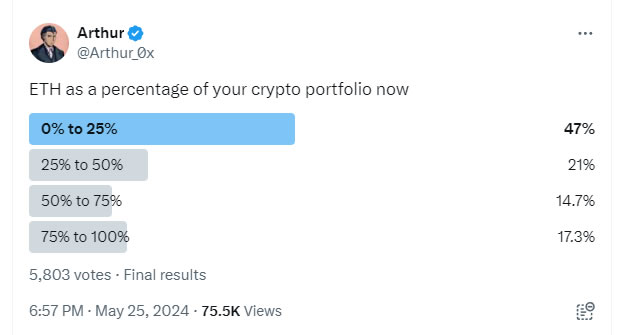

He initiated a survey on X on May 25, inquiring about the allocation of ETH to the portfolios of his followers. Cheong noted that nearly half of the 5,800 respondents had allocations ranging from zero to twenty-five percent, stating, “Just consider how much CT is underallocated to ETH.”

In the interim, Anothny Sassano, an Ethereum educator, predicted that Michael Saylor, the founder of MicroStrategy, would acquire ETH within the following six to twelve months.

Bitcoin prices reached an all-time high in the two months following the approval of spot BTC ETFs in the United States, an increase of over 70%.

By the end of July, if Ether imitates Bitcoin, a comparable movement could propel prices to an all-time high of approximately $6,000.

The significant development of Ether has had repercussions throughout the cryptocurrency ecosystem.

According to DefiLlama, the total value secured in decentralized finance (DeFi) has risen to its highest level in two years, reaching $117 billion, of which 60% is locked on the Ethereum network.

In the interim, Ethereum layer-2 networks are approaching an approximate $47 billion collective all-time high in value, as reported by L2beat.